As the saying goes, ‘Time is Money’ and hence the earlier you start investing, the more time for the significant growth of the principal amount and returns earned on it. Often you would have heard that investing and saving as soon as you get a job should be the goal. However, students can start investing in mutual funds as well. As most of the students are dependent on parents and can’t invest large amounts of money, one can start investment through Systematic Investment Plans (SIPs) in MF with minimal amount and reap its benefit in the long run. Some parents may also make the investment themselves for their children who are studying.

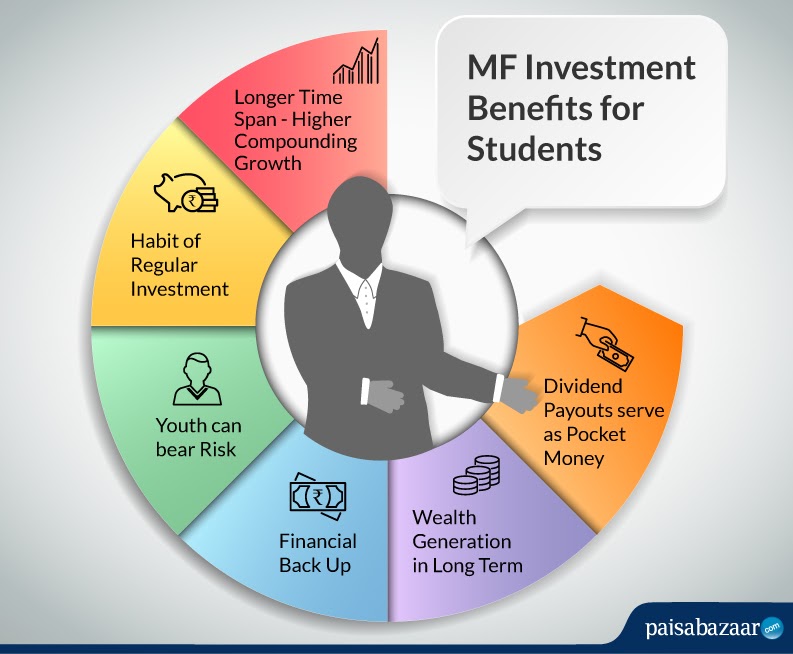

Why Students Must Invest in Mutual Funds – Benefits

1. More Years for the Compounding Growth

Investments through SIPs have the power of compounding. More years of investing and frequent investing will lead to exponential growth. Let’s understand this with an example. A & B are two persons (of same age) who invest ₹500 every month. A began investing as a student right at the age of 18 and B started later at the age of 24. Let’s calculate their SIP returns by the time both of them are 30, i.e. A has invested for 12 years (from 18 to 30) and B has invested for 6 years (from 24 to 30). We assume that they invested a fixed amount of ₹500 all these years at an average 12% rate of return. If we calculate the wealth created, A will earn ₹1.6 Lakh while he invested Rs 72,000. On the other hand, B will earn around ₹52,000 for an investment of Rs 36,000. In a matter of only 6 years, A has earned about 3 times more of B.

One can increase the amount of SIP subsequently each year, called Top-up SIP. As a student, you can start investing with a low amount as of ₹500 or ₹1,000. Some mutual funds also come with a SIP as low as ₹100 monthly payment. You can opt for Flexible SIP in which every month the amount may differ. It becomes more pocket friendly for students.

Also Know: How to Calculate your SIP Returns Here

2. Disciplined Habit of Saving/Investment

Investments, especially through SIPs develop a habit of managing finances and regular savings. When young, there is a tendency to spend more as students usually do not think much along the line of investment. However, If this disciplined approach evolves at a young age, you will learn to curtail unnecessary expenses and rather invest them. It will also prove beneficial in later stages of life when not only income but also responsibilities and expenditures rise

Also Read: How to start SIP

3. Capacity to Bear Risks

There are a number of MF schemes; the financial target, investment horizon and risk appetite of the investors will determine which plan is suitable to them. Students can generally opt for Large Cap Equity Funds if they seek stable returns as well as lower risk. However, as a student you usually have higher risk potential. With plenty of time on your hands, you can bear some risk and stay invested for a long duration in Mid Cap Funds or Small Cap Funds. Students may experiment with Contra Funds that invest on unnoticed & beaten down stocks with a view that its value realisation and price hike will happen when it gets recognized in the market. It can yield high returns in the long term.

The reason for high risk potential is you have lesser responsibilities (no worry of children’s education, running a family) and hence you can aim for wealth creation by aiming to grow your money instead of protecting it. Also, you have a longer time horizon to stay invested when you start early. Mutual Funds are always recommended for long term investment as money has time to grow and then only an investor can experience the fruits of high returns.

One can go for Multi Cap Funds or Hybrid Funds if seeking a diversified portfolio or a balance of risk return ratio. If parents seek to park some extra cash for their children and are looking for safer options then they can invest in Debt Funds as well.

4. Financial Back Up against Bad Times

In case, you go through rough patches in life such as unemployment, delayed salary, recession, loss in business, etc. then the money invested through years can act as your lifeboat. If you start early, you have more financial back up to safeguard you against hard times. If you have invested via SIP those can also be discontinued temporarily during hard economic times. Although it is not advisable to do so unless an extreme financial exigency.

5. Higher Accumulated Fund Corpus

Mutual Funds help in building corpuses to fund children’s higher education, weddings, property purchase and even retirement plans. The earlier you start to invest, the higher capital appreciation you generate. Starting early sets you up for a better future and the dreams and aspirations you have.

6. Earn Pocket Money through Dividend Payout

Dividend is the profit distribution among the shareholders of a company or the unit holders of a mutual fund. You can opt for a dividend option for any MF scheme and the profit earnings made by the fund will be shared from time to time. It can be a good source of income and serve as pocket money for students.

Best Mutual Funds for Students

Apart from financial objectives and risk tolerance, one must review the track record of consistency of returns a particular fund scheme has given as well as the AMC of the MF plan. It is also important to develop a little understanding of different categories of funds as defined by SEBI so as to invest wisely. Below are the suitable fund categories:

- Students should opt for long term investments Equity Funds as they earn high returns and can bear risk. Large Cap Funds are the safest among Equity Funds as they are considerably stable in bearish markets. Due to its brand reputation in the market, Large Cap equities yield returns in unfavourable times. Thus, if you want to earn good returns and have low risk in equity asset class, then go for Large Cap

Click Here for Best Large Cap Funds

- As mentioned earlier, students can go for high risk return funds such as Mid Cap or Small Cap schemes. With plenty of time, you can invest longer and the share prices of medium sized and small capitalization firms can grow. Thus, you may end up getting high value of the units purchased in the long term. It is advisable to stay invested for a minimum of 5 years or better 10 years if are classified as an aggressive investor, you opt for these two types of funds

Click Here for Best Mid Cap Funds

Click Here for Best Small Cap Funds

If you are seeking a diverse and better risk return managed portfolio, you can invest in Balanced Advantage/Dynamic Asset Allocation. This scheme dynamically allocates the fund based on market trends. Contra Funds are advisable for students to invest for long term. They can purchase more units of equities at lesser price and later when markets stabilise, these stocks can yield high returns due to its high growth potential