Table of Contents :

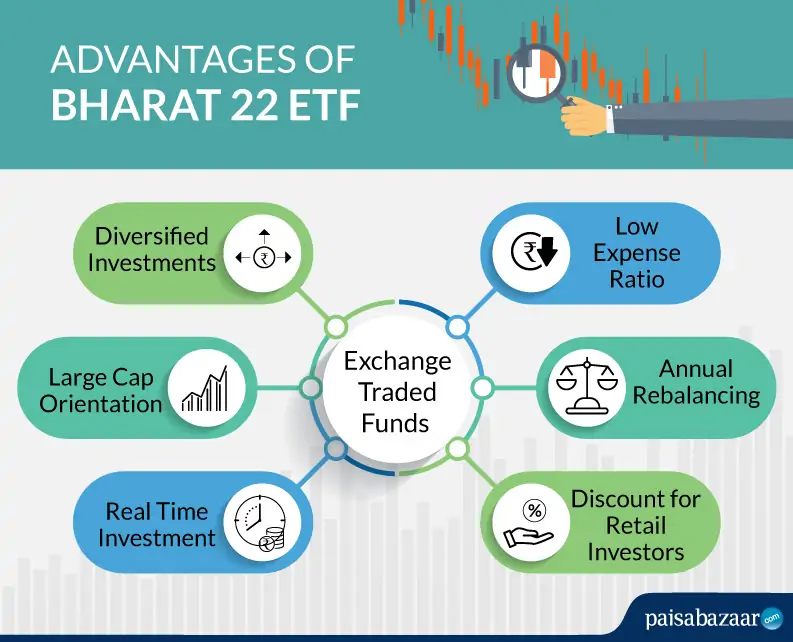

Launched in November 2017, Bharat 22 ETF tracks performance of the Bharat 22 Index, which comprises of 19 public sector units and 3 privately owned companies. This foundation was laid by the government in the Union Budget of 2017 as a medium to achieve its targets of disinvestment. Bharat 22 Index remains the top choice of the government’s current disinvestment plans.

The Indian government plans to raise Rs. 3500 crore through this additional offering managed by ICICI Prudential Asset Management Co. Ltd. Investors who subscribe to Bharat 22 ETF will be offered an additional discount of 5% on the reference price. This amount can be calculated as the volume weighted average price of its constituents on the offer date.

- Inception: November 24, 2017

- Assets under Management: Rs. 8422 crore (as on June 30, 2019)

- Category: Equity: Large Cap

- Fund Manager: Kayzad Eghlim

- Benchmark: S&P BSE Bharat 22 TRI

- Expense Ratio: 0.01% (as on June 30, 2019)