While looking for fixed income investment avenues, we come across numerous options such as bonds, certificates of deposit, treasury bills, debt funds, bank fixed deposits, etc. Out of these, certificates of deposits and fixed deposits are usually compared as both are time deposits that offer fixed interest rates. Let’s look at the two financial vehicles in detail to get a holistic view of the two instruments and choose which one to invest in.

Table of Contents :

What are Bank Fixed Deposits (FDs)?

Bank fixed deposits are one of the most popular investment options available in India. A fixed deposit account essentially offers a fixed interest rate on your principal investment. This fixed-income security is offered by almost every scheduled bank in India. Numerous investors in India have availed the benefits of Bank FD.

Get Your Free Credit Report with Monthly Updates Check Now

An investor makes a lump-sum principal investment that earns interest during the deposit period. At maturity, the investor gets the principal and the accrued interest.

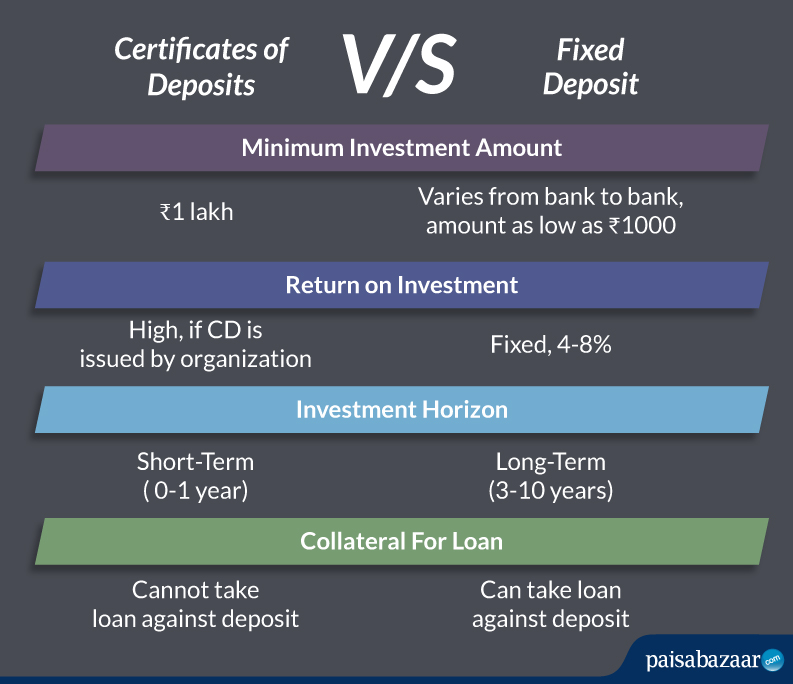

Different Banks/NBFCs provide fixed deposit accounts with different maturities ranging from 7 days to 10 years.

What are Certificates of Deposit?

CDs are financial assets that are issued by banks and financial institutions. They offer fixed interest rates on the invested amount. The primary difference between a CD and a Fixed Deposit is that of the value of the principal amount that can be invested. The former are issued for large sums of money (1 lakh or in multiples of 1 lakh thereafter).

The maturity period of Certificates of Deposit ranges from 7 days to 1 year if issued by banks. Other financial institutions can issue a CD with maturity ranging from 1 year to 3 years.

To know more about CDs, visit: Certificates of Deposits

Comparative Analysis of Certificates of Deposits (CDs) and Fixed Deposits (FDs)