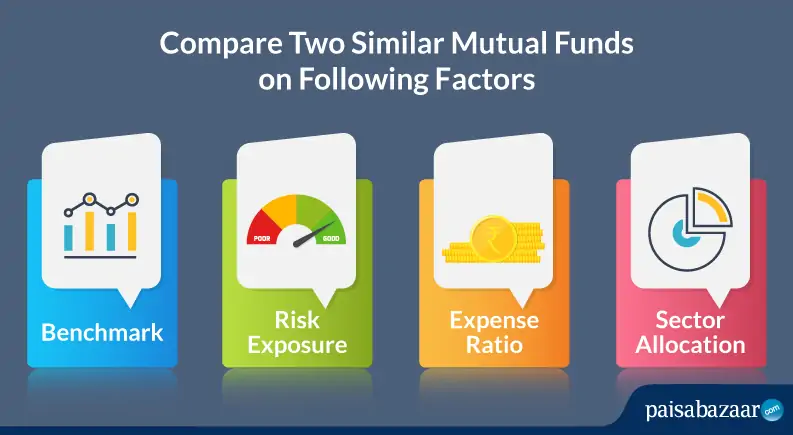

The Mutual Fund universe offers a myriad of schemes, including equity funds, debt and hybrid, with further sub categorization. The plethora of mutual funds available make it a really arduous task for investors to pick the perfect fund to invest in. Also, if two schemes belong to the same subcategory, it becomes quite difficult to compare the schemes. Through this article, we will try to understand how investors can compare two mutual fund schemes based on certain parameters.

How to Compare Two Mutual Funds Schemes?

- Benchmark

Each mutual fund has a corresponding benchmark index, which acts as a standard to compare the scheme’s returns and performance. The Securities and Exchange Board of India makes it mandatory for every mutual fund scheme to declare a benchmark, and then evaluate its performance against that of the benchmark.

Let’s understand the concept of benchmark with the help of an example. Let’s assume a particular fund ‘Scheme A’ has delivered returns of about 15% in a 5 – year time period, whereas the corresponding benchmark has delivered returns of 12%, then it is said that ‘Scheme A’ has outperformed its benchmark in the aforementioned time period. Now, for comparison with different schemes, you need to consider whether other schemes have outperformed the benchmark to this level or not. If not, then this scheme should be marked as preferred on this parameter.

- Risk Exposure

The risk exposure of a particular scheme depends on how the market volatility affects the underlying invested securities. Each fund has a corresponding riskometre which classifies the schemes into five different levels of risks, viz., Low Risk, Moderately Low, Moderate, Moderately High and High Risk. Choose a fund which is consistent with your risk appetite.

To check how mutual fund schemes have performed over the various market cycles, rolling returns of the two schemes should be compared. It gives us an idea about the volatility of the returns delivered by the two schemes over a particular time period.

Related Article: Can Investing in High Risk Mutual Funds bring Higher returns?

Also, there are certain financial ratios like Alpha and Beta which can be used to compare the risk-adjusted returns of two mutual fund schemes. Alpha tells us about how much extra return the fund is expected to deliver over and above the benchmark index.

Beta signifies the risk involved in investing in a particular fund. For comparison, if the beta of two schemes is equal, we compare their alphas. If the alpha of one scheme is 1.5 while that of the other is 2.5, it is obvious that the risk-adjusted returns of the latter are better than that of the former. This is how investors can compare the risk exposure of two similar portfolios, and make an informed investment decision.

- Expense Ratio

Expense Ratio is a fee charged by a mutual fund house to manage your assets. It factors in administrative fee, fee for professional management of assets and other related expenses. This fee is charged as a percentage of your investment and has a direct impact on your mutual fund returns. While comparing two mutual fund schemes, it is advisable to choose a fund with lower expense ratio, as it will have less impact on your final capital gains.

It should be noted that regular plans have a higher expense ratio when compared to direct plans of a mutual fund. So, while comparing two funds, make sure you’re comparing either their regular plans or their direct plans. Don’t compare a regular plan of one scheme with the direct plan of another.

- Sector Allocation

Even though two mutual fund schemes invest in firms belonging to one market capitalization, the sector allocation may vary. For instance, two large cap funds are supposed to invest in equity instruments of large cap companies, they might have different preferential sectors for allocation. The investment style may also vary, depending on the fund manager’s choice of stocks. These include, value investing, growth investing, top down or bottom up approach, etc. While comparing two schemes, this aspect should also be looked into, so as to decide which one suits your preference, and risk appetite.

For instance, both ‘Scheme A’ and ‘Scheme B’ invest in large cap funds, although ‘Scheme A’ can invest the majority of its assets in the Financial Services sector whereas ‘Scheme B’ can invest in the Manufacturing or FMCG sectors. While comparing, you should check what all sectors are going to perform well in the near future, and then accordingly choose the fund that caters to these sectors.

Also Read: What are Value investing Mutual Funds?

The Do’s and Don’ts of Mutual Funds Comparison

- While comparing two schemes, it is recommended that one compares the annualized returns for the same time period. For instance, if you look at 3 -year returns of a particular fund, then you need to compare it with the 3 – year returns of another fund, and not the 5 – year returns.

- Don’t compare apples with oranges. A large cap should be compared to a large cap fund. It is similar across other market capitalizations. Often, the returns from one category vary drastically from those of other categories, which is why it is advisable to compare funds from the same subcategory as well.

- Actively managed funds should not be compared with passively managed funds, as the expense ratio of the former is relatively higher than that of the latter. For instance, index funds or exchange-traded funds should not be compared with other actively managed equity funds such as large cap funds, or multi cap funds.