Table of Contents :

A Consolidated Account Statement (CAS) is a statement showing details regarding all the mutual fund holdings across fund houses of an investor. It lists all the mutual fund transactions made by an investor in a given period along with all the necessary details such as NAV (Net Asset Value) date, NAV value, market value, etc.

You can get this statement emailed to your inbox by providing your PAN (Permanent Account Number) to any of the mutual fund registrars – CAMS, Karvy, Franklin Templeton or Sundaram BNP Paribas Financial Services (SBFS). However, please note that your email address must be registered with your mutual fund scheme in order to avail of this service. All the funds in which your email address is registered will be included in this statement.

Get Your Free Credit Report with Monthly Updates Check Now

How to Generate a Consolidated Account Statement Online?

Step 1: Visit Camsonline.com

Step 2: In the new window (https://www.camsonline.com/COL_InvestorServices.aspx) Click on “INVESTOR SERVICES”

Step 3: Click on CAS – CAMS, KARVY, FT (Request a consolidated statement across three RTAs via email without

T-PIN.) Click here

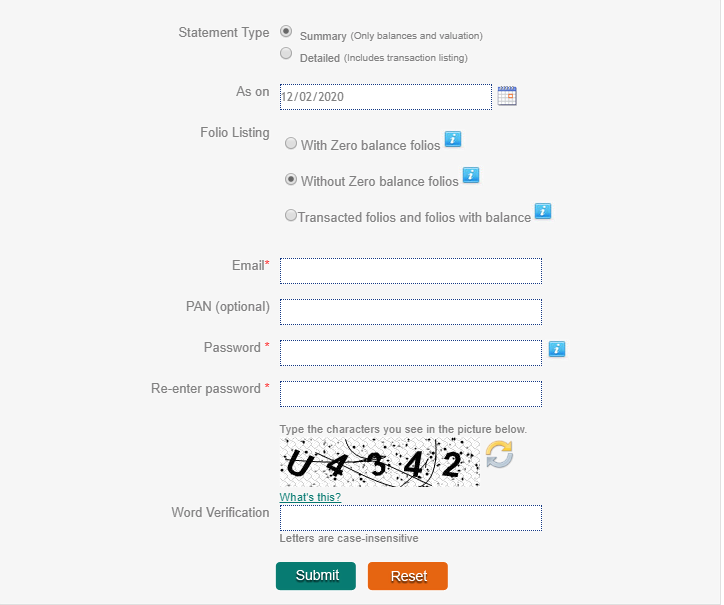

Step 4: Select “Statement Type, Date, Folio Listing, Email ID, PAN (Optional)”

Step 5: Now enter password, verification code and click on submit button

Step 6: You will get a mail from Camsonline.com in PDF format.

Benefits of CAS

- Performance Evaluation: You can use a CAS to evaluate the performance of your funds and to know when these funds become a long-term investment (for capital gains tax purposes). Equity funds become long term after a 1-year holding period and debt funds become long term after a 3 year-holding period.

- Tax Liability: CAS also gives you a record of all your transactions and hence you can use it to calculate your tax liability. You can also submit the CAS and a tax-saving investment proof to your employer to enable adequate TDS deduction.

- Checking Details: A CAS also enables you to check that your name, PAN and bank account details are correctly mapped to your mutual fund investments and know whether you have been recorded as FATCA compliant or not. FATCA compliance is a procedure required to ascertain your tax residency (Indian or NRI).

- Redemptions and Dividends: You can also use the CAS to track all the redemptions you have made from mutual funds and all the dividends you have obtained from them.

Get Free Credit Report with Complete Analysis of Credit Score Check Score

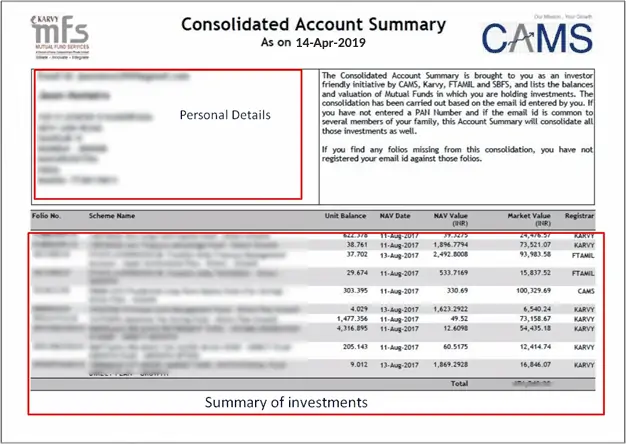

Sample CAS

Does CAS include Mutual Fund Charges?

Consolidated Account Statement (CAS) as the name suggests is a statement that keeps all the transactions of mutual fund investment of an investor consolidated at one place. It shows details of sale, purchase and all other details such as NAV, NAV date, etc. of all the mutual fund holdings in an orderly manner.

SEBI has directed all the AMCs to declare all kinds of charges and fees given to the distributors in absolute terms against the investors’ total investments in half yearly CAS. Average Total Expense Ratio (in percentage) for applicable plan of each scheme (Regular or Direct), gross commission figures including the costs incurred by distributors such as service tax, operating expenses and any other payments made in form of sponsorships/events, trips, gifts or rewards are to be mentioned in the CAS.

How do AMCs compute Consolidated Account Statements?

National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL), that work for National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) respectively have details of all kinds of transactions done through an investor’s demat account or in mutual funds. These details are shared by the AMC on the basis of which CAS is computed. Other platforms like CAMS, SBFS also give access to the investors to have a consolidated view of their holdings in an email statement through the PAN option.

A Good Credit Score ensures you manage Your Finances Well Check Score

Here is a List of Mutual Fund Schemes you can Invest in FY 2020:

| Scheme Name | AUM (CR) | 1Y Return | 3Y Return | 5Y Return |

| Mirae Asset Emerging Bluechip Fund – Direct Plan | 8868 | 17% | 18% | 17% |

| Mirae Asset Emerging Bluechip Fund – Growth | 8868 | 16% | 17% | 16% |

| Axis Small Cap Fund – Direct Plan | 1200 | 23% | 16% | 13% |

| Axis Long Term Equity Fund – Direct Plan | 21492 | 18% | 18% | 12% |

| IIFL Focused Equity Fund – Direct Plan | 446 | 29% | 16% | 12% |

| Invesco India Growth Opportunities Fund – Direct Plan | 1991 | 14% | 18% | 12% |

| Axis Midcap Fund – Direct Plan | 3551 | 18% | 19% | 12% |

| Axis Small Cap Fund – Growth | 1200 | 21% | 14% | 12% |

| Sundaram Rural and Consumption Fund – Direct Plan | 2155 | 7% | 11% | 12% |

| JM Multicap Fund – Direct Plan | 143 | 19% | 16% | 11% |

| DSP Natural Resources and New Energy Fund – Direct Plan | 380 | 0% | 9% | 11% |

| Axis Bluechip Fund – Direct Plan | 8749 | 22% | 21% | 11% |

| Axis Long Term Equity Fund – Growth | 21492 | 17% | 16% | 11% |

| JM Tax Gain Fund – Direct Plan | 35 | 16% | 16% | 11% |

| Sundaram Rural and Consumption Fund – Growth | 2155 | 6% | 10% | 11% |

| Invesco India Mid Cap Fund – Direct Plan | 621 | 6% | 13% | 11% |

| Kotak India EQ Contra Fund – Direct Plan | 874 | 14% | 17% | 11% |

| IIFL Focused Equity Fund – Growth | 446 | 27% | 14% | 11% |

| DSP Natural Resources and New Energy Fund – Regular Plan | 380 | -1% | 8% | 11% |

| Axis Midcap Fund – Growth | 3551 | 16% | 18% | 10% |

| Invesco India Growth Opportunities Fund – Growth | 1991 | 13% | 16% | 10% |

| Canara Robeco Bluechip Equity Fund – Direct Plan | 257 | 18% | 17% | 10% |

| JM Multicap Fund – Growth | 143 | 18% | 15% | 10% |

| Axis Bluechip Fund – Growth | 8749 | 21% | 19% | 10% |

| DSP Equity Fund – Direct Plan | 2888 | 20% | 15% | 10% |

| JM Tax Gain Fund – Growth | 35 | 16% | 15% | 10% |

| Kotak India EQ Contra Fund – Growth | 874 | 12% | 15% | 9% |

| DSP Equity Fund – Regular Plan | 2888 | 19% | 14% | 9% |

| Canara Robeco Bluechip Equity Fund – Regular Plan | 257 | 16% | 16% | 9% |

| Canara Robeco Equity Diversified – Direct Plan | 1581 | 14% | 16% | 9% |

| Tata Mid Cap Growth Fund – Regular Plan | 747 | 10% | 11% | 9% |

| Canara Robeco Equity Diversified – Regular Plan | 1581 | 13% | 16% | 8% |

| Invesco India Infrastructure Fund – Direct Plan | 41 | 12% | 13% | 7% |

| Invesco India Infrastructure Fund – Growth | 41 | 10% | 11% | 6% |

| LIC MF Infrastructure Fund – Direct Plan | 55 | 15% | 11% | 5% |

| LIC MF Infrastructure Fund – Growth | 55 | 13% | 10% | 4% |

| Mirae Asset Tax Saver Fund – Direct Plan | 2671 | 18% | 20% | – |

| Mirae Asset Tax Saver Fund – Regular Plan | 2671 | 16% | 18% | – |

5 Comments

Hi, we have started investing in SIPs since 2000. That time we did by agent and not given personal email or mobile no. How can we update the same and get the statement of investment? Please let us know if any app does the same.

Hi Chiranjit,

You can contact the branch offices of the concerned fund house(s) or the offices of their Registrar & Transfer Agents (RTAs) to update your contact details and KYC.

Hello – How can I see my investments at its cost as well as at its market value in all M funds at one go. Thanks

It is easily available through CAS or on the mobile apps you use to invest money.

Thanks, it’s quite informative