While looking for fixed income investment avenues, we come across numerous options such as bonds, certificates of deposit, treasury bills, debt funds, bank fixed deposits, etc. Investors often compare debt funds and fixed deposits as both are highly popular amongst the investors and have their own share of advantages and disadvantages. Let’s look at the two financial instruments in detail to get a better understanding of them both.

Table of Contents :

What are Bank Fixed Deposits (FDs)?

Bank fixed deposits are one of the most popular investment options available in India. A fixed deposit essentially offers fixed interest rate on your principal investment. This fixed-income security is offered by almost every scheduled bank in India. Numerous investors in India have availed the benefits of Bank FD.

An investor makes a lump-sum principal investment that earns interest during the deposit period. At maturity, the investor gets the principal and the accrued interest.

Different banks provide fixed deposit accounts with different maturities and rates. Investors can opt for FD accounts with maturity period ranging from 7 days to 10 years.

What are Debt Mutual Funds?

Open-ended mutual fund schemes that predominantly invest in fixed-income debt securities are known as debt funds. The underlying assets comprises treasury bills, government bonds, certificate of deposits, debentures, corporate bonds and various other money-market instruments.

Debt funds are one of the safest investment instruments available to investors, who wish to earn optimal returns on their investment, without betting on risky avenues. Also, the returns are quite stable, as opposed to returns from equity funds which are highly volatile.

Comparative Analysis of Fixed Deposits and Debt Funds

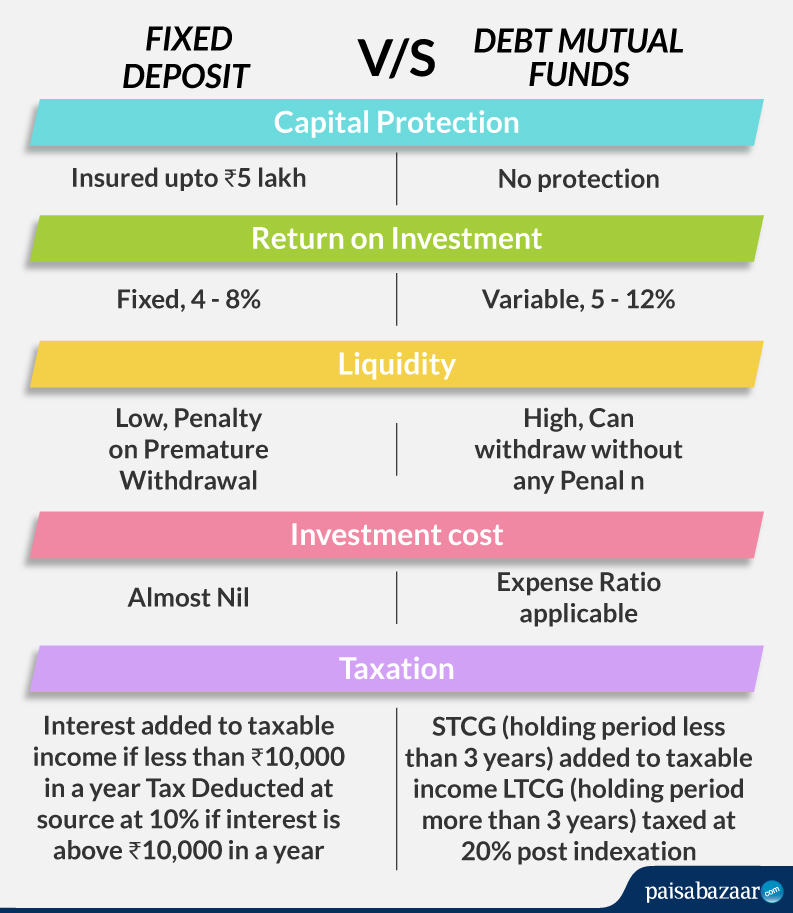

Here we’ve compared the aforementioned investment instruments based on the following parameters, so a holistic perspective will help you choose the right investment option for you

- Capital Protection

Your investment in Bank Fixed Deposits upto ₹5 lakh in each bank is insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC) in case the bank defaults or fails to meet its obligations. This implies that capital beyond ₹5 lakh in FDs is as unsecured as in any other financial vehicle.

On the other hand, investment in debt funds is not backed by any governmental institution. However, the safety of the invested capital can be deduced by the credit rating of the underlying instruments. If the credit rating of the instruments is high, it means that the possibility of the issuer of the security may default on payment of the principal and interest is minuscule.

- Return on Investment

The interest rate offered by banks on Fixed Deposits is fixed, irrespective of the changes in the interest rate during the maturity period of the security. This means that if you’ve locked your money in a fixed deposit account for 3 years at 6% interest rate, you will receive the same interest rate for the entire maturity period, irrespective of the changes in the interest rates in the overall market. The interest income is thereby, guaranteed in case of FDs. Whereas returns from debt funds are not guaranteed, they depend on the interest rate of the underlying securities which may depend on various factors including interest rate fluctuations, monetary policy changes and the fund manager’s investment decision. The positive side to this is that most of the time returns from debt funds are higher than that from FDs.

- Liquidity

Debt funds fare better than FDs on this parameter as they are highly liquid, especially if you consider liquid funds, which offer instant redemption facility. Investment in other debt funds is also liquid as you can redeem the fund units as per your convenience without paying any extra charges. On the other hand, premature withdrawal from FDs (except tax-savings FDs) is allowed after you pay up surrender charges or penalties.

- Investment Costs

Typically, banks do not charge anything for investing in bank FDs. However in case of debt funds, investors need to pay various annual recurring charges such as fund management fee, marketing & selling expense including agent commission, brokerage etc. As per SEBI regulations, the total annual recurring charges have been capped at 2.25% p.a. of the daily net assets.

- Tax Treatment

Interest earned investment in FDs is added to the investors’ annual income and taxed accordingly, as per their tax slab. So, if the annual income falls in the 30% tax bracket, the interest earned from FD will attract 30% income tax. The banks deduct TDS if the interest earned on your fixed deposits crosses Rs 10,000 in a financial year.

In case of debt funds, short-term capital gains (gains made from investment of less than 3 years) are added to your annual income and taxed at applicable slabs. However, the returns on investment of over 3 years is classified as long term capital gains, which are taxed at 20% with indexation benefits. The indexation benefit allows you to factor in inflation while calculating your capital gains.

Conclusively, even if the rate of returns from debt funds and fixed deposits are the same, one still stands to gain more from debt funds provided s/he comes under 20% or 30% tax bracket and stays invested for more than 3 years.

Which one to choose?

Debt funds score above fixed deposits on two factors:

- Return on investment

- Liquidity

However, one can choose to invest in fixed deposits if s/he wishes to earn steady interest on the invested capital and do not need the money any time prior to the maturity date.

Since the returns from debt funds vary as per the changes in interest rates, there is a possibility of earning higher returns than FDs. Also, if one needs to park his/her funds for a short term with the facility of instant redemption, he/she can choose liquid funds, instead of keeping the money in savings accounts.