Mutual funds as an investment avenue offer a multitude of benefits to investors who are actively looking for long term capital appreciation. They have been broadly categorised into three types, namely, Equity Funds, Debt Funds and Hybrid Funds. Each category caters to a different investor segment, depending on the risk appetite and financial goals of the investor. This article focuses on two of these categories, i.e., Debt Funds and Hybrid Funds.

Difference between Debt Funds and Hybrid Funds

What are Debt Funds?

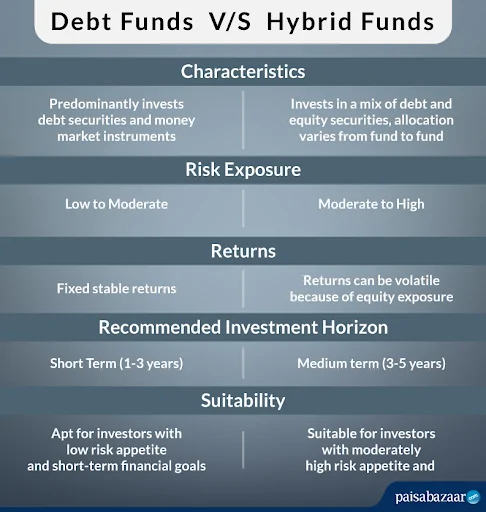

Open-ended mutual fund schemes that predominantly invest in fixed-income debt securities are known as debt funds. The underlying assets comprises treasury bills, government bonds, certificate of deposits, debentures, corporate bonds and various other money-market instruments.

Debt funds are one of the safest investment instruments available to investors, who wish to earn optimal returns on their investment, without betting on risky avenues. Also, the returns are quite stable, as opposed to returns from equity funds which are highly volatile.

To compare Equity and Hybrid Funds, visit: Equity Funds v/s Hybrid Funds

What are Hybrid Funds?

Mutual Fund Schemes that invest in a mix of equity and debt securities are known as Hybrid Funds. These funds balance out the risk and returns of both Equity and Debt Funds through diversification in different asset classes. The risk exposure of a Hybrid Fund depends on its investment stance and asset allocation amongst equity and debt.

Hybrid Funds leverage the benefits of both equity and debt instruments, the former delivers high returns while the latter gives stability to the overall investment portfolio.

Comparative Analysis of Debt and Hybrid Funds

- Returns

The most crucial parameter to consider before investing in mutual funds is the returns delivered by them. Debt funds have delivered stable, fixed returns over the years owing to their investment in fixed-income instruments. Although, compared to equity and hybrid funds, the returns delivered by debt funds are little low.

Hybrid funds have significant allocation to equity securities, which give a substantial jump to the overall returns. However, this allocation to equities also exposes the portfolio to market volatility, and makes the returns from hybrid funds a little volatile.

- Risk

Debt funds are not entirely risk-free. Credit risk and interest rate risk are quite prevalent in these funds. Credit risk arises when the portfolio consists of securities with low credit rating. Whereas interest rate risk arises when any change in interest rate negatively affects the prices of the bonds. It is advisable to carefully analyse the fund’s historical performance and portfolio allocation, to get an idea of risk exposure of the fund.

The risk exposure of hybrid funds depends on its asset allocation. If it is a conservative hybrid fund with majority of asset allocation to debt securities and money market instruments, then the intrinsic risk is quite low. However, in case of aggressive hybrid funds that have substantial asset allocation in equity instruments, the risk exposure is significantly high.

- Liquidity

Overnight Funds or Liquid Funds are categorised under debt funds which have delivered optimal returns in the short run over the years. These funds are highly liquid and are a perfect safe haven for idle money in hand. One can redeem the units as per his/her convenience.

On the other hand, hybrid funds are not that liquid because of substantial equity allocation. Even though you can redeem the fund units as per your wish, there is a possibility that you might incur loss in the short run. That is why, debt funds are preferred over hybrid funds when it comes to short term investment.

- Taxation

Different tax rules are applicable on debt and hybrid mutual funds. Taxation on debt funds depends on the holding period of investment. If you withdraw before 3 years of investment, Short Term Capital Gains are added to the taxable income of the investor, and taxed as per the income tax slab of the investor. Long Term Capital Gains tax of 20% is levied on redemptions after 3 years of investment, with the benefit of indexation.

On the other hand, the taxation rules for hybrid funds depend on their portfolio. The Income Tax Act only recognizes equity and debt instruments for taxation purposes. If the asset allocation in equities is more than 65%, the fund will be taxed as per equity mutual funds. For instance, the investment portfolio of an aggressive hybrid fund majorly consists of equity and equity related instruments, which subsequently makes it eligible for taxation as per the equity tax rules. Short term capital gains tax of 15% would be levied if you withdraw before 1 year of investment, whereas long term capital gains over and above ₹1 lakh would be taxed at 10%. If the debt allocation of a hybrid fund is more than 65%, then the fund is treated as debt fund while calculating taxation on capital gains.

Also Check: Debt vs Equity Financing