Table of Contents :

Just as the name suggests, Dynamic Bond Funds are dynamic in nature, with regard to the composition and maturity of the investment portfolio. Under these funds, the fund managers are allowed to make changes to the trade instruments with different maturity periods as per the presumed changes in their interest rates. However, there could also be situations when no actions are taken by the fund managers in between the interest rate changes. This makes Dynamic Bond Funds ideal for those who wish to experiment with the interest rate cycles.

The ultimate objective of a Dynamic Bond Fund is to deliver quality returns, irrespective of the fluctuations in the market. For instance, a fund manager might increase the holding in long term instruments in a bullish market, or may decrease the short-term instruments in his portfolio during a bearish market. All the changes depend on the fund manager’s understanding of the market. Since he is allowed to make changes to the composition of funds, these funds are called Dynamic Bond Funds.

Why Invest in Dynamic Bond Funds?

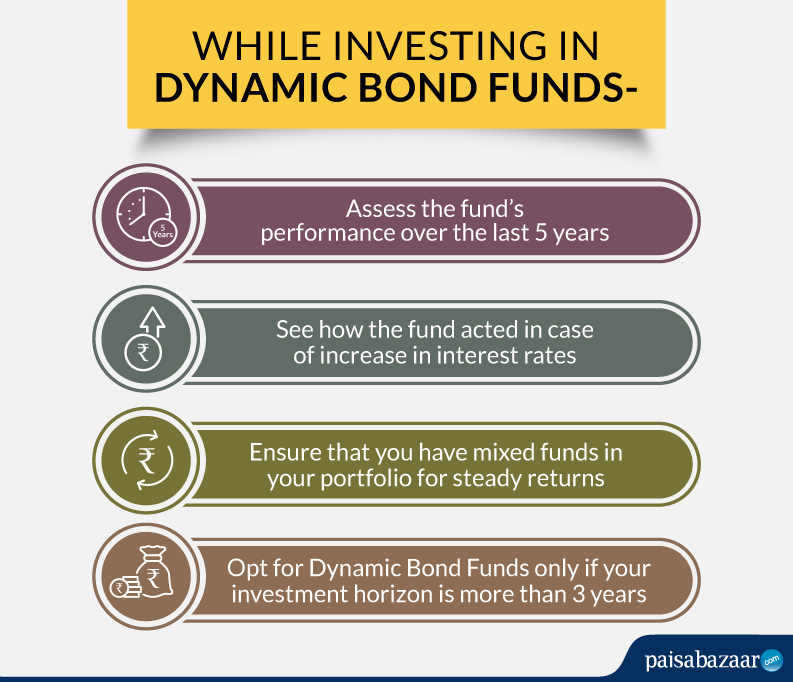

Dynamic Bond Funds are considered ideal for investors who are willing to accept a moderate amount of risk and willing to invest for a time period of around 3 to 5 years. However, while investing it must be taken into consideration that dynamic bond funds and interest rates go hand in hand.

Unlike all other debt funds, dynamic funds do not need to adhere to any investment mandates. These funds can invest from long-term securities to securities as short as one-month duration, depending upon the fluctuations in the interest rates.

Dynamic bond funds can shift from long-term to mid-term and/or short-term securities on a very short notice. This offers the investors of these funds a chance to safeguard their portfolio from the fluctuations in interest rates.

For instance, if the fund manager anticipates that the interest rates are about to fall, it can increase its portfolio tenure. Or if s/he thinks that the interest rates are touching the lower grounds, it can reduce the portfolio’s average maturity instantly.

Dynamic Bond Funds might be Risky

Similar to all the other financial instruments, dynamic bond funds carry risks of their own. In case the fund manager fails to reduce the portfolio as and when required, the profits earned could be heavily affected.

The profits earned from dynamic bond funds are majorly dependent on the fund manager. His view and understanding of the interest rate is extremely crucial. For instance, if the RBI takes a step that does not incline with the manager’s expectation of the returns, then the profits could be severely impacted.

Fluctuations in the macroeconomic factors like oil prices, fiscal deficit, government policies, etc. affect the returns from these funds.

Difference Between Gilt Funds and Dynamic Bond Funds

The fund manager handling gilt funds can only change the maturity of the funds while the managers of a dynamic bond fund can make changes in the entire portfolio, making shifts from long-term to mid-term or small-term funds, depending upon their returns.

Best 5 Dynamic Bond Funds to Invest in 2020

| Scheme Name | AUM(CR) | 1Y Return | 2Y Return | 3Y Return |

| ICICI Prudential All Seasons Bond Fund | 2707 | 11.59% | 7.19% | 9.93% |

| IDFC Dynamic Bond Fund | 1962 | 13.61% | 6.98% | 9.47% |

| Franklin India Accrual Dynamic Fund | 3910 | 9.49% | 8.79% | 9.91% |

| ICICI Prudential Balanced Advantage Fund | 29104 | 12.59% | 11.54% | 10.29% |

| Aditya Birla Sun Life Balanced Advantage Fund | 2802 | 9.40% | 9.31% | 9.33% |

1. ICICI Prudential All Seasons Bond Fund

| 1-year | 3-year | 5-year | |

| Return | 10.92% | 8.69% | 10.75% |

| Benchmark | 10.86% | 6.79% | 7.92% |

(Data as on August 29, 2019; Source: Value Research)

Net Asset Value: Rs. 2,791 Crore (as on July 31, 2019)

Launch Date: January 20, 2010

Fund Manager: Manisha Banthia (at the helm since January 2013), Anuj Tagra (at the helm since January 2015)

2. IDFC Dynamic Bond Fund

| 1-year | 3-year | 5-year | |

| Return | 15.47% | 8.99% | 10.44% |

| Benchmark | 10.86% | 6.79% | 7.92% |

(Data as on August 29, 2019; Source: Value Research)

Net Asset Value: Rs. 2,068 Crore (as on July 31, 2019)

Launch Date: December 3, 2008

Fund Manager: Suyash Choudhary (at the helm since January 2013)

3. Franklin India Accrual Dynamic Fund

| 1-year | 3-year | 5-year | |

| Return | 9.32% | 9.32% | 10.40% |

| Benchmark | 10.86% | 6.79% | 7.92% |

(Data as on August 29, 2019; Source: Value Research)

Net Asset Value: Rs. 3,960 Crore (as on July 31, 2019)

Launch Date: March 5, 1997

Fund Manager: Umesh Sharma (at the helm since January 2013), Sachin-Padwal Desai (at the helm since January 2013), Santosh Kamath ((at the helm since February 2015)

3. ICICI Prudential Balanced Advantage Fund

| 1-year | 3-year | 5-year | |

| Return | 3.55% | 8.58% | 10.04% |

| Benchmark | -2.33% | 9.65% | 8.11% |

(Data as on August 29, 2019; Source: Value Research)

Net Asset Value: Rs. 27,798 Crore (as on July 31, 2019)

Launch Date: December 30, 2006

Fund Manager: Dharmesh Kakkad (at the helm since September 2018), Ihab Dalwai (at the helm since January 2018), Manish Banthia (at the helm since January 2013), Rajat Chandak (at the helm since September 2015), Sankaran Naren (at the helm since July 2017)

4. Aditya Birla Sun Life Balanced Advantage Fund

| 1-year | 3-year | 5-year | |

| Return | 1.54% | 7.48% | 9.10% |

| Benchmark | -2.33% | 9.65% | 8.11% |

(Data as on August 29, 2019; Source: Value Research)

Net Asset Value: Rs. 2,697 Crore (as on July 31, 2019)

Launch Date: April 25, 2000

Fund Manager: Vineet Maloo (at the helm since August 2015), Mohit Sharma (at the helm since April 2017)

FAQs on Dynamic Bond Fund

Ques: What is the difference between a dynamic bond fund and an income fund?

Ans: Income funds are the ones that focus on generating a fixed monthly income for their investors, while Dynamic Bond Funds are the ones that invest their assets across all classes of fixed income securities. Income funds tend to generate returns by following fixed income strategies and capital gains from interest rate movements, whereas Dynamic Bond Funds follow planned strategies between bonds of different maturities to generate returns.

Ques: When should I invest in dynamic bond funds?

Ans: The price of dynamic bonds is believed to be inversely proportional to the interest rates. Hence, if the interest rates are falling in the market, the bond prices are likely to increase. This is when the investors can make most profits.

Ques: What happens to bond funds when interest rates go up?

Ans: If the interest rates rise, the value of dynamic bond funds will fall, resulting in delivering negative returns. However, the fund will still receive interest payments from its bonds, which will be passed on to the investors; thereby maintaining the current yield.

Ques: What is debt Dynamic Bond?

Ans: Debt Dynamic Bond Funds are the ones that invest their assets only in debts, money market funds and related securities.

Here is a List of Dynamic Bond Funds in India

| Fund Name | AUM (Cr) | Returns over 1-Year | Returns over 3-Year | Returns over 5-Year |

| Franklin India Dynamic Accrual Fund – Direct | 3,960.08 | 9% | 9% | 10% |

| Aditya Birla Sun Life Dynamic Bond Fund – Direct Plan | 3,249.38 | 10% | 6% | 9% |

| ICICI Prudential All Seasons Bond Fund – Direct Plan | 2,791.26 | 11% | 9% | 11% |

| IDFC Dynamic Bond Fund – Direct Plan | 2,068.34 | 16% | 9% | 10% |

| SBI Dynamic Bond Fund – Direct Plan | 1,083.34 | 15% | 9% | 10% |

| Reliance Dynamic Bond Fund – Direct Plan | 972.02 | 13% | 7% | 9% |

| DSP Strategic Bond Fund – Direct Plan | 881.13 | 12% | 6% | 9% |

| Kotak Dynamic Bond Fund – Direct Plan | 736.57 | 14% | 9% | 10% |

| HDFC Dynamic Debt Fund – Direct Plan | 661.72 | 4% | 4% | 8% |

| UTI-Dynamic Bond Fund – Direct Plan | 632.72 | -1% | 4% | 7% |

| Tata Dynamic Bond Fund – Direct Plan | 367.40 | 10% | 7% | 9% |

| IIFL Dynamic Bond Fund – Direct Plan | 328.61 | 8% | 7% | 9% |

| JM Dynamic Debt Fund – (Direct) | 276.28 | 8% | 8% | 9% |

| BNP Paribas Flexi Debt Fund – Direct Plan | 151.00 | 11% | 7% | 9% |

| Union Dynamic Bond Fund – Direct Plan | 146.49 | 12% | 6% | 8% |

| Axis Dynamic Bond Fund – Direct Plan | 141.20 | 13% | 8% | 10% |

| HSBC Flexi Debt Fund – Direct Plan | 121.10 | 14% | 7% | 9% |

| Canara Robeco Dynamic Bond Fund – Direct Plan | 113.14 | 12% | 7% | 9% |

| Quantum Dynamic Bond Fund – Direct Plan | 59.25 | 12% | – | – |

| L&T Flexi Bond Fund – Direct Plan | 57.05 | 13% | 8% | 10% |

| Edelweiss Dynamic Bond Fund – Direct Plan | 51.52 | 17% | 8% | 9% |

| PGIM India Dynamic Bond Fund – Direct Plan | 40.87 | 14% | 10% | 11% |

| IDBI Dynamic Bond Fund – Direct Plan | 37.07 | 9% | 5% | 7% |

| Principal Dynamic Bond Fund – Direct Plan | 34.64 | 1% | 4% | 7% |

| Mirae Asset Dynamic Bond Fund – Direct Plan | 34.45 | 15% | – | – |

| Indiabulls Dynamic Bond Fund – Direct Plan | 26.39 | – | – | – |

| Baroda Dynamic Bond Fund – Plan B (Direct) | 22.18 | 0% | 4% | 8% |

| Quant Dynamic Bond – Direct Plan | 21.64 | 8% | 5% | 7% |