Table of Content:

What are Index Funds?

Index Funds are passively managed mutual fund schemes that track an underlying index like Nifty, Sensex, etc. The idea is to invest in the same stocks as that of the index in the same proportion, to mimic the performance of the benchmark index. Since these are passively managed, they’ve low operating expenses and low portfolio turnover.

What are Exchange Traded Funds?

Just like Index Funds, Exchange Traded Funds (ETFs) are also passively managed schemes that track an underlying index. The index consists of various securities including stocks, debt, commodities, gold, etc. Units of ETFs are traded on bourses just like equity shares, with a face value and a trading value. Being a market-traded security, ETFs don’t have a Net Asset Value (NAV), which is an intrinsic part of actively managed mutual fund schemes.

The risk associated with ETFs depends on the type of index under consideration. If the index is a mid-cap index, then it carries moderate risk and if there’s a small cap index as benchmark, then the fund possesses high risk on investment.

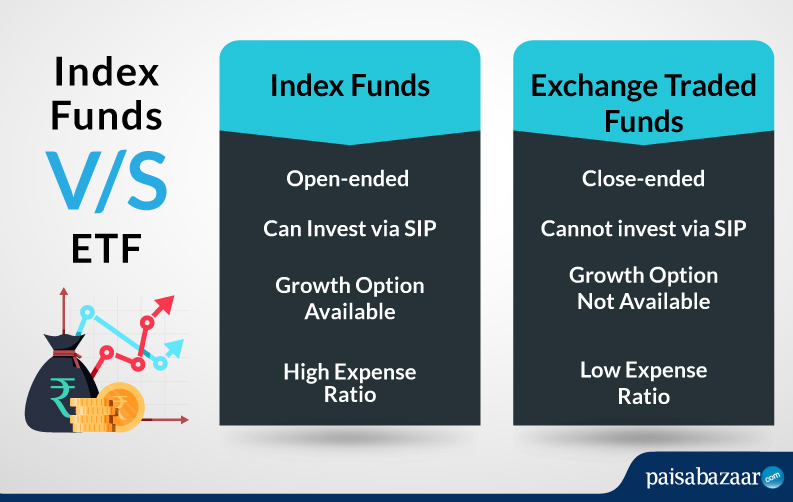

Index Funds v/s Exchange Traded Funds

-

Nature of Funds:

If you invest in an Index Fund, the investment gets added to the total Assets Under Management (AUM) of that specific Index Fund, since they’re open – ended funds. However, ETFs are close-ended funds, where fresh subscription is issued and later the fund units are up for purchase/sale on the stock exchanges. Any transaction in the secondary market would not change the net value of AUM, it will remain the same as before. AUM of ETFs change only when there is any change in the stock prices of the underlying firms.

-

Tracking Error Risk:

Even though index funds or ETFs invest in a similar fashion as that of an underlying index, sometimes they fail to deliver the same returns as that by the index. This happens because of tracking error. It refers to the difference in the market performance of an index and that of a fund, which usually happens when the fund manager is not able to shuffle the portfolio in accordance with that of the index frequently. The main motive of a fund manager of an index fund or an ETF is to keep the tracking error as low as possible, so as to imitate the performance of the underlying index to perfection.

-

Liquidity:

Investors can sell their index fund units as per their wishes, since they are open-ended in nature. On the other hand, ETF units are closed-ended and cannot be liquidated as per one’s convenience. There needs to be a counterparty ready to purchase the fund units in the secondary market, to liquidate the investment in ETF. Also, investors need a demat account to purchase/sell the ETF units on the stock exchanges across India.

-

Systematic Investment Plan (SIP):

One of the primary advantages of investing in index funds over ETFs is that one can invest in the former via Systematic Investment Plan (SIP). This facility is not available in ETFs as they’re close-ended in nature. SIP allows investors to invest a small amount of money at predetermined intervals. This mode of investment has gained popularity amongst the mutual fund investors over the past few years owing to its benefit of rupee-cost averaging and the power of compounding.

-

Transaction Cost:

In India, the expense ratio applicable on Index Funds is much higher than that on ETFs. The expense ratio for index funds typically hovers around 1.25%, whereas that of ETF is as low as 0.35%. However, it should be noted that whenever an investor sells the units of the ETF on the bourses, s/he needs to incur the additional costs such as brokerage, GST, etc.

-

Dividends:

If an investor receives dividends from investment in ETFs, it is deposited in the registered bank account. However, when one earns dividends from investment in index funds, s/he has the option to either claim it separately or reinvest in the fund and purchase appropriate units.

Also Read: ETF VS Mutual Funds: Know the Difference

What to Choose: Actively Managed Funds or Passively managed Funds?

It is a common myth that it is better to invest in actively managed funds as they seek to deliver better returns than the benchmark indices. Although, many funds fail to achieve the goal in the long run because of a multitude of reasons such as wrong market timing, inaccurate market prediction, fund manager’s lack of insight on the future valuation of a stock, etc. Whereas, it has been noticed over the years that passively managed funds such as index funds or exchange traded funds have outperformed numerous active funds in the long term investment horizon. One can leverage the low-cost model of index funds or ETFs, and earn high returns simultaneously.

Top 5 Index Funds to Invest in 2020

| Fund Name | 1 – Year Returns | 3- Year Returns | 5 – Year Returns |

| UTI Nifty Index | 4.84% | 9.20% | 5.93% |

| SBI Nifty Index | 4.53% | 8.99% | 5.73% |

| ICICI Prudential Nifty Index Fund | 4.83% | 8.86% | 5.70% |

| Nippon India Index | 4.70% | 9.06% | 5.60% |

| Franklin India Index | 3.82% | 8.00% | 4.97% |

{Data as on March 02, 2020; Source – Value Research}

Top 5 ETFs to Invest in 2020

| Fund Name | 1 – Year Returns | 3- Year Returns | 5 – Year Returns |

| Motilal Oswal NASDAQ 100 | 19.49% | 18.61% | 16.49% |

| Nippon India ETF Bank BeES | 9.09% | 12.62% | 9.25% |

| HDFC Gold ETF | 25.82% | 11.46% | 8.73% |

| ICICI Prudential Nifty | 4.96% | 9.34% | 6.14% |

| Nippon India ETF Long Term Gilt | 14.15% | 7.93% | — |

{Data as on March 02, 2020; Source – Value Research}