Table of Contents :

The expense ratio of a mutual fund scheme refers to the annual fee charged by a mutual fund house to the investors for the management of the scheme. It is calculated by dividing a mutual fund scheme’s total expenses by the value of assets under its management (AUM).

While managing a scheme, a fund house incurs expenses such as administrative cost, marketing cost, promotion cost, distribution cost, compliance costs, shareholder service cost, etc., which get reflected in the scheme’s expense ratio.

Get Your Free Credit Report with Monthly Updates Check Now

SEBI Regulations on Expense Ratio

As per the capital market regulator, SEBI (Securities and Exchange Board of India), fund houses can charge Total Expense Ratio (TER), subject to the following maximum limits:

| Asset Under Management (crores) | TER for equity-oriented schemes (%) | TER for other schemes excluding Index Funds, ETFs and Fund of Funds (%) |

| Rs. 0-500 | 2.25 | 2.00 |

| Rs. 500-750 | 2.00 | 1.75 |

| Rs. 750-2,000 | 1.75 | 1.50 |

| Rs. 2,000-5,000 | 1.60 | 1.35 |

| Rs. 5,000-10,000 | 1.50 | 1.25 |

| Rs. 10,000-50,000 | For every increase of 5,000 crores in AUM TER reduces by 0.05% | For every increase of 5,000 crores in AUM TER reduces by 0.05% |

| > Rs. 50,000 | 1.05 | 0.80 |

Expense Ratio is inversely related to the AUM of the fund. When the value of a funds’ assets is small, the expense ratio is higher such that the management meets the fund expenses from a smaller asset base. Whereas, when the asset value of a fund is huge, the expense ratio is comparatively lower as the expenses get distributed across a wider asset base.

However, SEBI allows fund houses an extra of 30 basis points (0.30%) in expense ratio over and above the mentioned maximum limits for selling in beyond top 30 cities, only if 30% or more of new inflows come from beyond the top 30 cities. This is done to widen the penetration of the mutual funds in tier 2 and tier 3 cities.

Fund houses are also allowed to charge 5 basis points (0.05%) of AUM over and above the maximum expense ratio limits instead of an exit fee, wherein exit load is levied or is applicable. However, AMCs are not allowed to charge the expense ratio instead of exit load for close-ended schemes.

Expense Ratio of Index Funds, ETFs, and Fund of Funds (FoFs)

Index Fund: An Index Fund is a mutual fund which invests in a market index such as the Nifty 50 or the Sensex. The fund invests in index stocks, in the weights in which they are present in the index. It thus seeks to replicate the performance of an index. This does not require a high level of active management of the fund and hence, the expense ratio of index funds tends to below.

Exchange-Traded Funds (ETFs): ETF is a type of fund which passively invests in stocks, bonds or commodities, usually tracking an Index like the Nifty 50 or the Nasdaq 100 (for instance, Motilal Oswal Nasdaq 100). An ETF is traded on stock exchanges just like stocks. One must have a Demat and trading account to invest in it. In case of an ordinary mutual fund, you can directly buy units from the fund house, without going to a stock exchange. An ETF is a passive instrument (not actively managed) and hence, tends to feature a significantly lower expense ratio as compared to mutual funds.

Get Free Credit Report with Complete Analysis of Credit Score Check Now

Fund of Funds (FoFs): A Fund-of-funds (FoF) is a mutual fund which invests in other mutual funds. In India, FoFs are typically mutual funds investing in overseas mutual funds, which in turn invest in foreign stocks (for instance, Franklin India Feeder Franklin US Opportunities Fund) or FoFs investing in gold ETFs (for instance Reliance Gold Savings Fund). The expense ratio of FoFs is relatively higher than what an investor would incur by directly investing in the underlying mutual fund.

Expense Ratio of Direct vs Regular Mutual Fund Schemes

Mutual fund schemes come in two plans- direct plan and regular plan. The only difference between the two is that in case of a regular plan, your asset management company (AMC) or mutual fund house does pay a commission to a broker or agent as distribution expenses or transaction fee out of your investment, whereas in case of a direct plan, no such commission is paid.

Thus, direct mutual fund plans have a lower expense ratio than that of the regular mutual fund schemes.

Why is Mutual Fund’s Expense Ratio Important to Investors

Mutual fund’s expense ratio is important for investors because even a slight difference in its percentage can have a significant impact on the net profitability of the investor. Expense Ratio is the operating cost and commission of an AMC for its fund managers and brokers that gets deducted from the final payout (principal & returns) of the investor.

What are the Components of Expense Ratio

The components of the Expense ratio are different kinds of costs incurred by the fund house. It includes various charges as following:

Checking Credit Report Monthly has no impact on Credit Score Get Report

- Management Fee

Fund managers invest a lot of time and energy in managing the fund corpus, stocks and other assets along with the portfolio of the investors. They research the market trends and invest in different asset classes making calculated predictions that can generate optimum returns for the investors

- Maintenance Fee

A mutual fund portfolio requires maintenance other than just management by the fund managers. It includes keeping all track records of the transaction, offering customer support, etc. All these operational and administrative tasks are charged as maintenance fee

- Brokerage

Regular Plans of mutual funds come with a higher expense ratio than that of a Direct Fund because, in Regular Plans, the AMCs hire financial brokers or agents that do the sale and purchase of stocks unlike the Direct Plans where they do it themselves. Thus, the commission paid out to the brokers is included in expense ratio in case of a regular scheme

- 12B-1 Fee

This is charged usually in case of new funds when they are launched and are lesser-known in the market. It needs to be spread among the masses to create its asset base and hence these promotional charges are added up in the expense ratio

How does the Expense Ratio impact Fund Returns

As mentioned earlier, it is the amount that will get deducted from the final payout of the investor’s funds and hence it is an important parameter to be considered before investing in any mutual fund scheme. Higher Expense Ratio means less profit and vice-versa. If someone earns 10% returns over the principal amount in a fund plan and Expense Ratio is 2%, then the investor gets only 8%.

Expense Ratio Calculator

You do not need a calculator to know the expense ratio of a mutual fund scheme. Every fund house publishes the expense ratios for all its mutual fund schemes in its factsheets. These factsheets are updated every month and are available on the websites of AMCs.

Your Credit Score and Report is Now Absolutely Free Check Now

How to Calculate Mutual Funds Expense Ratio?

There are many ratios that you can use to evaluate a mutual fund. However, not all of them are equally useful. According to experts, the below mentioned 5 basic ratios may be used to analyze any mutual fund. However, If there are still any doubts about your fund selection, you always check with the additional ratios.

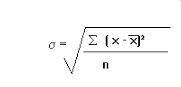

Standard Deviation

Standard Deviation is the most widely used measure of calculating the risk involved in a mutual fund. Standard Deviation is basically the square root of variance.

Standard Deviation is given by the following formula:

In this case, x is each value (say, monthly return). X (bar) is the average of the values (such as the monthly return average). N would be the number of months (60, for example, if we are looking at a 5 year period).

Interpretation

A high standard deviation indicates the involvement of higher risk in the fund and vice versa. For instance, the standard deviation of HDFC Equity Fund is 18.49% while the standard deviation of HDFC Hybrid Equity Fund is 11.41%. The standard deviation of HDFC Liquid Fund is just 0.21%. In a normal statistical distribution, approximately 95% of observations fall within 2 standard deviations. This means that you would expect returns of HDFC Liquid Fund to give returns within 0.42% of its average value of 6.89%, with a 95% probability. However, this only holds if the mutual fund returns follow a standard deviation.

Turnover Ratio

This ratio refers to the percentage of a mutual fund’s assets which have been bought/sold in the previous year. For example, a turnover ratio of 50% means that a Mutual Fund has bought/sold stocks equal to 50% of its average assets.

Interpretation

A high turnover ratio can mean that the fund manager is frequently changing his strategies and incurring high transaction costs (buying and selling transactions involve brokerage and other costs). Thus, a high turnover ratio is usually viewed as a negative factor.

Alpha

Alpha or Jensen’s Alpha is the degree with which a mutual fund is outperforming its benchmark adjusted to its risk level. For example, if the fund is benchmarked to the Nifty 50 which has given 10% returns and the fund delivers a return of 12%, it would have an alpha of 2%.

A Better Credit Score can get your Loan Approved Quickly Check Now

Interpretation

A high alpha implies that the fund is outperforming. On the other hand, a low or negative alpha indicates the poor performance of a fund.

Beta

This ratio gives the sensitivity of the mutual fund to the market. The higher the beta, the more sensitive the fund is. For example, a beta of 2 indicates that for every 1% move in the market, the fund’s NAV will move by 2% on average.

Interpretation

A high beta fund can imply both higher risk and higher return (and vice versa for a low beta fund).

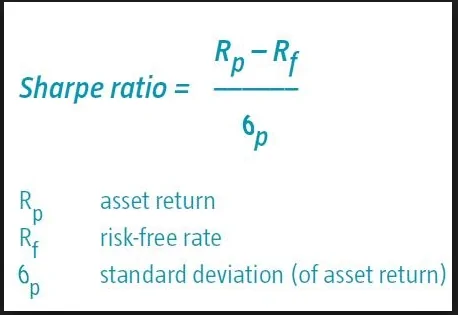

Sharpe Ratio

This ratio incorporates both risks and returns. It gives you an idea of the return delivered by a fund compared to the risk it is dealing with. For example, some funds may deliver higher returns only by taking a higher risk. Such returns should be viewed with more scepticism than the funds which give high returns while taking a low level of risk. Mathematically, the Sharpe ratio divides the outperformance generated by a fund compared to the risk-free rate with the volatility of the fund.

Interpretation

A high Sharpe ratio indicates a high return for a given risk level. This is a highly desirable quality in a fund and hence, mutual fund schemes with higher Sharpe ratios should be preferred.

A Good Credit Score ensures you manage Your Finances Well Check Now

Frequently Asked Questions (FAQs)

Q. What is a good expense ratio for a mutual fund?

A. 0.5% to 0.75% Expense Ratio for an actively managed portfolio is considered to be a good one and beneficial for the investors. Expense Ratio of more than 1.5% is considered to be very high from an investor’s point of view. ETFs usually have a lower expense ratio than pure mutual funds.

Q. How does the expense ratio affect mutual funds?

A. As mentioned above, a lesser expense ratio means lesser deductions from the net profit of the investor.

Q. What is the expense ratio in a mutual fund with example?

A. For example, you have invested ₹10,000 in a plan that has an expense ratio of 1% annually. It means you have to pay ₹100 for the portfolio and fund management. If you earned 5% interest on your money, i.e. ₹500 then you get only ₹400. The total payout to the investor will be like this:

Total Payment = (Principal Amount + Interest Earned) – Expense Ratio

= (₹10,000 + 5% of ₹10,000) – 1% of ₹10,000

= (₹10,000 + ₹500) – ₹100

= ₹10,500 – ₹100

= ₹10,400

Q. Is the expense ratio charged every year?

A. Yes, it is an annual fee charged from the investor inclusive of all management, transactional and operating costs.

Here is a list of Mutual Funds you can Invest in 2020:

| Fund Name | NAV | Fund Assets (Cr) | 1 Year Return | 3 Year Return | 5 Year Return |

| SBI Small Cap Fund | 53.24 | 2,704 | 8.33% | 11.28% | 17.04% |

| Mirae Asset Emerging Bluechip Fund | 59.72 | 8,219 | 18.27% | 14.40% | 17.53% |

| Canara Robeco Emerging Equities Fund | 100.84 | 5,235 | 10.38% | 11.25% | 13.89% |

| Nippon India Small Cap Fund (earlier Reliance Small Cap Fund) | 40.74 | 8,425 | -2.60% | 8.14% | 11.82% |

| Kotak Emerging Equity Scheme | 42.23 | 4,960 | 11.35% | 8.38% | 12.89% |

| ICICI Prudential All Seasons Bond Fund | 25.38 | 2,816 | 11.28% | 8.24% | 9.91% |

| Franklin India Dynamic Accrual Fund | 72.79 | 4,012 | 9.51% | 9% | 9.98% |

| SBI Magnum Medium Duration Fund | 36.19 | 1,942 | 11.77% | 9.31% | 9.80% |

| Axis Strategic Bond Fund | 19.83 | 1,188 | 8.32% | 7.68% | 9.11% |

| PGIM India Dynamic Bond Fund | 2019.77 | 42 | 13.69% | 9.32% | 10.08% |

| HDFC Hybrid Equity Fund | 56.73 | 21,087 | 9.44% | 9.50% | 10.22% |

| Aditya Birla Sun Life Balanced Advantage Fund | 58.49 | 2,689 | 9.99% | 8.20% | 9.46% |

| ICICI Prudential Equity & Debt Fund | 146.65 | 23,487 | 8.11% | 10.41% | 10.65% |

| Kotak Asset Allocator Fund | 88.43 | 42 | 11.09% | 9.29% | 9.12% |

| ICICI Prudential Balanced Advantage Fund | 40.35 | 27,956 | 12.79% | 10.40% | 10.37% |

4 Comments

Is expense ratio taken into consideration for calculation of NAV? Means is expense ratio deducted from profit and then NAV is calculated? If so then one can calculate his returns by multiplying units held and NAV. Is it correct?

Yes, expense ratio is considered while calculating a fund’s NAV.

I am unable to understand the benefit of direct investment in Mutual funds.

Can you explain by giving one fund like HDFC balance advantage fund

[…] the case of direct plans the commission is added to your investment balance, thereby reducing the expense ratio of your mutual fund scheme and increasing your return over the long […]