Table of Contents :

A Hedge Fund pools resources from investors and invests them in domestic as well as international markets to generate quality and long-term returns. “Hedge” essentially means to protect oneself from any potential financial loss or any other adverse circumstances. They are often set up as private investment limited partnerships where only accredited and institutional investors can invest their money.

Securities and Exchange Board of India (SEBI) has categorized hedge funds under Category III as Alternative Investment Funds. It defines hedge funds as “ funds which employ diverse or complex trading strategies and invests and trades in securities having diverse risks or complex products including listed and unlisted derivatives.”

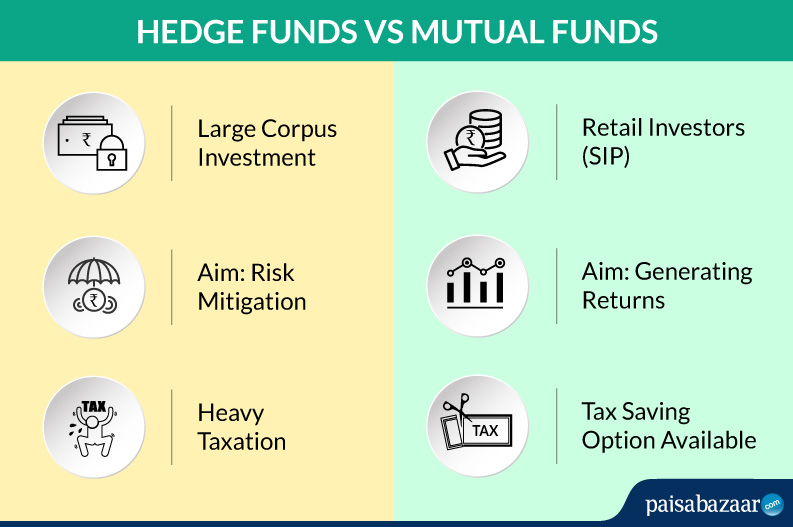

As the name suggests, hedge funds are supposed to “hedge” against market risk. Their investment style and fund management are directed at achieving the aim of generating returns at reduced risks. Although, with changing times, the strategies involved changed and currently, hedge funds tend to be more risky, relative to mutual funds and other saving instruments.

Key Characteristics of Hedge Funds

- One of the primary objectives of hedge funds is that returns are market neutral. Diversification of investment portfolio and trading strategies are such that one can expect returns in both the market trends (up and down).

- They employ leveraging and borrowing techniques for profit maximisation and amplifying returns. However, in India, consent from investors of a hedge fund need to be taken before borrowing money for investment purposes.

- In India, hedge funds are relatively less regulated as compared to its counterparts such as mutual funds and other financial instruments.

- There are no restrictions on investment avenues and thus hedge funds invest in almost every kind of financial instrument. They invest in a gamut of investment vehicles such as land, real estate, equities, debt securities which effectively helps in risk mitigation to a great extent. This wider investment latitude is what differentiates hedge funds from conventional investment vehicles.

- Hedge funds charge both an asset management fee as well as performance fee. Internationally, they take 2% of the total assets as expense fee and another 20% of the total returns as a performance fee. This makes hedge funds a little more expensive option for investment purposes. In India, there is no specific fee. Expense ratio can be 2% or below that as well and performance fee varies from 10% to 15% of the returns generated.

- The minimum amount required for investment in hedge funds in India is ₹1 crore. This is too huge a sum for retail investors, who would rather invest in mutual funds through Systematic Investment Plan (SIP).

Who Should Invest in Hedge Funds?

Institutional investors, high net worth individuals (HNIs), accredited investors, insurance firms, banks are some of the major entities that invest in hedge funds. These investors have large corpus of money for their investment expansion.

Individuals with high risk appetite should invest in these funds as a hedge fund manager buys and sells securities at par with the market fluctuations. Since the portfolio management style is quite aggressive, individuals with low risk tolerance should stay away from hedge fund investment.

Unlike mutual funds, hedge funds have a concept of lock-in period. The money invested should be locked-in for at least one year before it can be redeemed. Thus, investors who want to invest in funds with high liquidity should look for other investment avenues like mutual funds or equities.

Hedge Funds in India

Hedge funds in India are at a nascent stage right now and this is because of lack of capital sourcing, regulations, etc. They have recently started mushrooming in India and have a lot of hurdles ahead of them before they become a popular investment option among investors.

An average investor in India has a low risk tolerance as compared to her western counterpart. This poses a difficulty for a hedge fund in pooling resources for further investment.

Also, it is difficult for financial market regulations to accommodate the complex functioning of hedge funds. This is why, hedge funds in India are not required to get registered with a market regulator.

In India, there are no separate taxation laws for hedge funds. They are taxed as any other Alternative Investment Vehicle. Heavy taxation on returns from hedge funds has been criticised for a long time. This is one of the reasons for slow growth of hedge fund industry in India.

We can only hope for better governance and regulations on hedge funds in India which will provide a good ecosystem for the growth of the hedge fund industry.