The beginning of the year is often seen as the tax-saving season for consumers. Salaried individuals are rushing to furnish proofs indicating their investments. Come February, another important aspect every Indian is watching with hopes is the Union Budget. There were several investor expectations from the financial year 2020-21 budget. One of them was doing away with the long-term capital gains tax on equity and equity-related instruments, which could increase the inflows in markets. The LTCG tax was reintroduced in the 2016-17 budget.

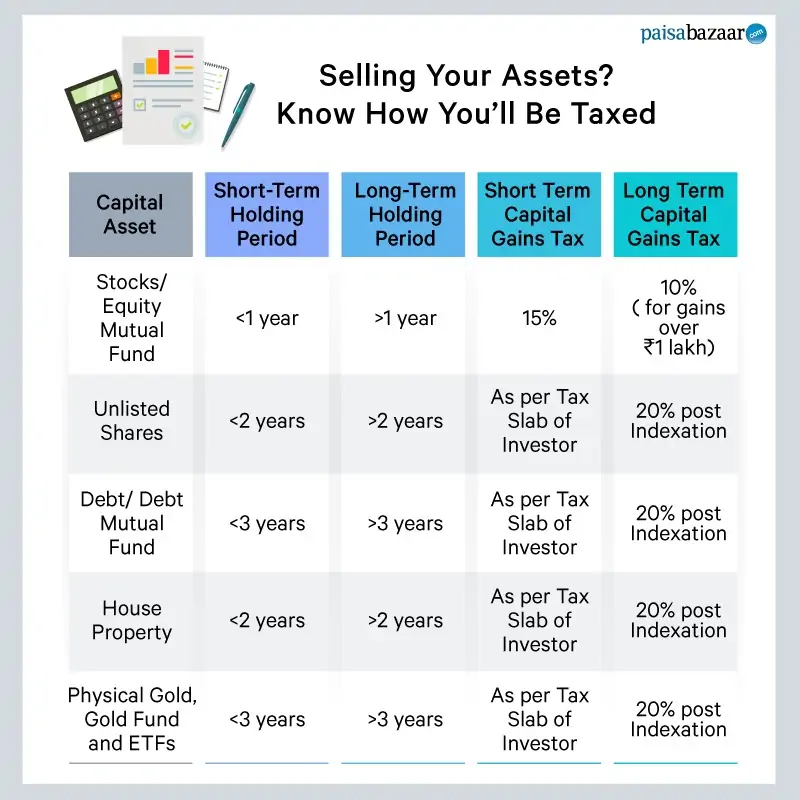

Nonetheless, investors have several options to save taxes or park their cash in for emergency situations or other long-term financial goals, or simply invest. However, when you sell your assets (redeem funds) there are taxes that you pay in the short term and long term. Understanding these can be a challenging task.

What is long term capital gains tax

Firstly, let’s understand what capital gains are. Any profit made from the sale of capital assets is known as capital gain. Capital gains from distinct financial instruments and tangible assets like gold and property are taxed differently; the holding period of the investment at the time of sale/redemption is also considered.

Some of the investment avenues take into account the effect of inflation on your actual purchase price, known as indexation, which effectively increases your cost of acquisition of the asset by factoring in inflation. This in turn lowers the value of capital gains thus reducing the overall tax liability on them. The value of capital gains is calculated by subtracting the cost of the acquisition of the assets from its final sale price.

Let’s look at how the gains from 5 of the most popular investment instruments are taxed:

Stocks/ Equity Mutual Funds

If you’ve invested in direct equity (through stocks) or equity-oriented mutual funds, capital gains from them are taxed based on the holding period of the security. If you choose to withdraw before 1 year of investment, Short Term Capital Gains (STCG) Tax of 15% would be levied.

Whereas, LTCG tax of 10% plus cess would be levied over and above ₹1 lakh of capital gains if you redeem the fund units or sell your stocks post 1 year of their purchase. However, there is a slight catch here. The grandfathering clause.

According to the clause, LTCG made upto 31st January 2018 are exempted from tax (effective April 2018). Now, capital gains will be calculated by subtracting the market value of your investment on the aforementioned date from the final value of the investment at the time of sale. Let’s understand this with an example:

Suppose, Mr. X invests ₹3 lakh in an equity mutual fund on June 1, 2016. He sells the fund units on June 1, 2018 at ₹5.5 lakh. At the face value, his capital gains stand at ₹2.5 lakh. However, due to the grandfathering provision, this value changes. If the market value of the fund units is ₹4 lakh on January 31, 2018, this value would be considered as the cost of purchase. So now, the capital gains become ₹1.5 lakh. Out of this, ₹1 lakh is exempted from any taxation. Mr. X now has to pay 10% on the remaining ₹50,000, i.e. 5000 as tax on his equity investment.

Unlisted Shares

Unlisted shares are just like equity investments, however, they are not traded on the stock exchanges across the country. The holding period for this instrument to be eligible for LTCG tax is 2 years.

If an investor withdraws his/her investment before 2 years of purchase, the capital gains would be added to the taxable income of the investor and taxed as per the prevailing tax slab. After 2 years, LTCG tax of 20% is levied on gains on redemption, with the benefit of indexation.

In the new budget, however, ESOPs taken up by employees of start-ups have received some relief. The value of the ESOP was taken as part of an individual and then taxed. Technically one would pay tax whether or not you had realised the monetary value of the ESOPs. You will have to pay tax on the earliest of the following dates:

- At the end of 5 fiscal years from the year in which you exercised the ESOP

- The date on which you sold the shares

- The date on which you ceased being an employee of the company

However, the start-up needs to qualify under Section 80-IAC of the Income Tax Act in order to have this relief exercised.

Debt or Debt Mutual Funds

Investment in debt securities such as government bonds, etc or debt-oriented mutual funds is also gaining popularity amongst investors who wish to earn stable returns. The minimum holding period for this investment to qualify for LTCG tax is 3 years.

If an investor withdraws his/her investment before 3 years of acquisition, the capital gains would be added to the taxable income of the investor and taxed accordingly. LTCG tax of 20% is levied on gains on redemption post 3 years of purchase, with the benefit of indexation.

Land or House Property

Taxation on proceeds from the sale of land or any house property is quite complicated, as there are certain tax exemptions applicable on sale of real-estate properties.

If you sell the purchased property within 2 years of acquisition, the proceeds are treated as STCG. The gains are added to the taxable income of the investor and taxed as per the tax slab. If you sell the property post 2 years of purchase, LTCG of 20% would be levied on the profit, with the benefit on indexation.

However, there’s a way through which you don’t need to pay taxes on proceeds from sale of house property: if you choose to reinvest the whole amount from the sale of up to 2 other properties. Earlier this was limited to one property, but reinvestment in 2 properties was permitted in the Union Budget 2019. If the entire amount is reinvested, an investor doesn’t have to pay any taxes.

Physical Gold, Gold Funds and ETFs

Investment in gold has long been one of the most popular emergency fund choices for Indians. Capitals Gains from sale of Physical Gold, Gold funds and ETFs are taxed just like debt instruments. If sold before the completion of 3 years of investment, STCG will be taxed as per the income tax slab of the investor. After 3 years, LTCG tax of 20% would be levied, with the benefit of indexation.