Table of Contents :

What are Mutual Funds?

Mutual funds are a type of investment schemes that pools together investors’ money and invest it in different types of financial instruments such as stocks, bonds, government securities, gold, etc.

Mutual funds are managed by professional investment managers called fund managers. These experts buy and sell securities on behalf of investors. The performance of the fund depends on the performance of the investment portfolio. For this, the fund managers spend a considerable amount of time on market analysis and for choosing the right stock to buy.

Get Your Free Credit Report with Monthly Updates Check Now

How do Mutual Funds work?

Mutual funds are essentially a basket of many financial instruments that generate returns over a period of time. If an investor invests in a mutual fund scheme, s/he buys units of that scheme based on the Net Asset Value(NAV) of that fund on the day of the transaction.

The fund manager invests the collected funds in various financial instruments, such as equity stocks, debt instruments, derivatives, arbitrage, etc to generate returns for the portfolio holders. The total capital gains from these allocations get added to the assets under management of the fund, on which the NAV of the fund depends.

The investors can redeem the fund units as per their convenience. The units are redeemed on the current NAV of the fund, which would have probably be substantially higher when compared to the NAV at which the units were bought. This increase highlights your total gains on the investment. If the NAV at the time of redemption is not much higher than at the time of investment, it is suggested to remain invested in the fund, and wait for the market sentiment to move in your favour.

How do Mutual Funds Generate Returns for Investors?

Investors generate returns through mutual funds in the following ways:

- Capital Appreciation:

Mutual funds invest in securities with high growth potential or in companies available at attractive market valuations. The NAV of a mutual fund varies following the stocks held by it. So when there is a net increase in stock prices held by a mutual fund, the NAV of that mutual fund also increases accordingly giving the benefit of capital appreciation on the units held by its investors. Investors can redeem their mutual fund units at higher NAV and realize capital appreciation.

- Dividend Payout: Depending on the fund type an investor buys, they benefit from dividends declared by portfolio companies, interest earned from portfolio bonds and other earned income. Investors can choose to receive distributions or simply reinvest the amount in the fund. As an investor, you have to ask the fund house to receive distributions in cash since they usually reinvest the money in the fund.

How does the Systematic Investment Plan (SIP) of Mutual Funds work?

While investing in Mutual Funds, investors have two modes of investment to choose from. First is, Lumpsum investment and the second is the Systematic Investment Plan. The former is typically preferred by investors with high-risk appetite, as it involves one-time payment.

On the other hand, SIP involves a regular investment of small amounts of money at predefined intervals. This instils disciplined investment habits amongst investors who find it difficult to save. When you invest in a mutual fund scheme via SIP, you essentially buy the fund units at the NAV applicable on the day of the transaction. For instance, if you’ve chosen 5th of every month for SIP instalment of ₹500, you would get fund units as per the NAV of that day. This ensures that you buy more units when the market is down and fewer units during a bullish market. This is known as rupee cost averaging. It is one of the key benefits of investing in mutual funds via SIP.

Get Free Credit Report with Complete Analysis of Credit Score Check Now

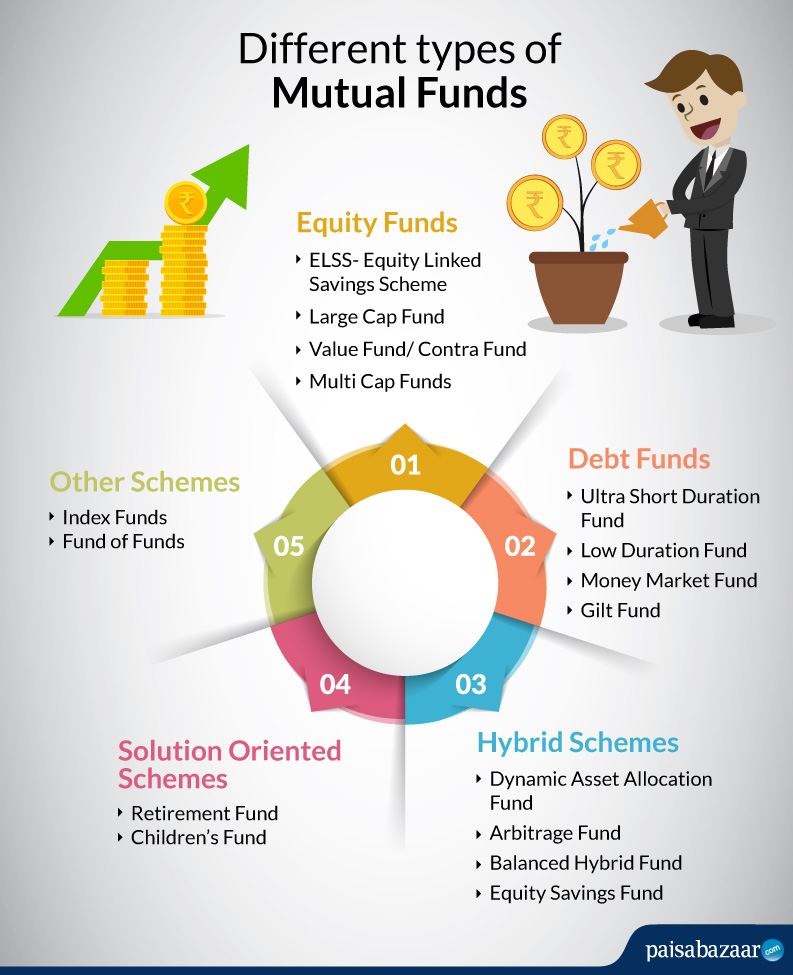

Different Types of Mutual Funds

Fund houses and financial institutions offer a variety of mutual funds. These can be classified into several categories based on the type of scheme, fund objectives, assets invested, etc. Here is a look at different types of mutual funds:

Read More: Types of Mutual Funds in India

How Are Mutual Funds Taxed?

Earnings from Mutual Funds are either in the form of capital gains or dividends. Investors are liable to pay tax on capital gains, while the tax on dividends is paid by the fund house before distribution. Dividend income of the mutual fund is tax-free at the hands of the investor.

The capital gains tax on the mutual funds depends on the holding period as well type of mutual fund. Investors are liable to pay either short term capital gains tax (STCG) or long term capital gains tax (LTCG) depending on the holding period of mutual fund units. However, the taxation rate of STCG and LTCG varies depending on the type of mutual fund.

Checking Credit Report Monthly has no impact on Credit Score Check Now

Also Read: Mutual Fund Taxation: How Mutual Funds are Taxed in India?

Benefits of Investing in Mutual Funds

Mutual funds are designed to help investors achieve their long-term and short-term financial objectives. Here are some of the benefits:

- Diversification: In mutual funds, the money is invested in multiple securities. For example, any typical equity fund would hold stocks of about 35-60 companies. Investing in these companies individually would require great investment amount while in mutual funds you can hold each one of them with an investment amount as low as Rs. 500. This is the key benefit of investing in mutual funds as it helps in mitigating risk when the market goes down. Not every asset type moves in tandem. While some go up, other falls. By investing in mutual funds, any losses from one type of asset can be potentially balanced out by gains from others.

- Power of Compounding: Mutual funds come with the power of compounding which refers to the interest an investor earns on the interest accrued on principal. This way, the value of the investment keeps growing. Besides, the value of the investment also increases over time as the companies grow (in case of equity funds) or asset prices increase (gold, etc.)

- Capital Gain Distributions: The profits generated by selling securities at a higher price are called capital gains, which are distributed amongst the investors. This additional income through capital gain distribution can be used to buy more units of the portfolio or can be simply redeemed.

- Automatic Reinvestment: Mutual funds give returns in two different ways – dividends and an increase in the value of the units held. An increase in value can only be utilised if you sell the units. Dividends, on the other hand, are available as soon as they are declared or distributed. These can be used to buy more mutual fund units through automatic reinvestment. For investors, mutual fund dividends are tax-free at the hands of investors. However, the dividend distribution tax is paid by the mutual fund house itself before distributing dividends.

- Fund Exchange or Exchange Privilege: Exchange privilege is a feature offered by mutual funds through which an investor can switch from one scheme to another within the fund family without paying any extra charges. So, if your mutual fund scheme is not performing well, you can switch to some other scheme of the same fund house without any charges under the fund exchange facility.

- Variety: Mutual funds provide a variety of options to invest in. Based on the risk appetite, return expectations and investment time horizon, an investor can choose among various asset classes. The mutual fund scheme may focus on technology stocks (Sectoral Funds), blue-chip stocks (Large Cap Funds) or even a mix of bonds and stocks (Hybrid Funds). This reduces the market risk associated with mutual fund investment.

- Transparency: The mutual fund industry is regulated by the Security and Exchange Board of India (SEBI) and very much transparent in terms of its investment decisions and holdings. This helps investors to keep track of their mutual fund investment. Asset Management Companies (AMCs) are required to provide regular updates on how the funds are performing to the investors.

Also Read: Top Mutual Funds to Invest in 2020

Your Credit Score and Report Is Now Absolutely Free Check Now

Things to Consider Before Investing in Mutual Funds

The Mutual Fund industry offers a plethora of opportunities to investors for significant long term capital appreciation and wealth creation. However, before diving into the world of mutual funds, it is imperative that one analysis the below-mentioned factors and accordingly take decisions.

- Financial goals: Investment in Mutual Funds is done keeping in mind one’s financial objectives. If you’re investing to create a huge corpus of wealth for retirement, children’s education, and any other expenses that require large amounts of money, you can consider small-cap or mid-cap equity mutual funds for investment. They’re risky in the short run, but deliver high returns in the long run. If you’re looking for investment options to park your money for a short term, you can opt for debt funds, which are relatively less risky and offer more liquidity.

- Historic performance of the fund: After contemplating on your financial goals and choosing the best mutual fund category that is in line with your goals, you need to select the top-performing mutual fund in that specific category. Historic returns of mutual funds are one of the parameters to estimate future returns. If the fund’s 5 year annualized returns are better than its peers and the benchmark returns, it is considered a good choice for investment.

- Assets Under Management (AUM): The higher the value of total assets under management for a fund, higher are the chances of that fund to deliver substantial returns in the long run. The large size of AUM indicates investors’ trust in the fund and allows fund managers to make rational decisions without fearing large outflow of assets from the fund.

- Risk Tolerance of the investor: Picking up the right mutual fund category for investment is also based on investor’s risk appetite. If you’re a conservative investor, it is better to opt for large-cap equity funds, debt funds or conservative hybrid funds. However, if you have a substantial risk appetite, you can opt for small-cap equity funds, or aggressive hybrid funds, to earn quality returns.

1 Comment Comments

it is very important & good & interesting Informative for clients