Table of Content :

While investors in India have a wide variety of investment instruments to choose from, mutual funds provide an array of schemes by themselves. The types of mutual funds can be broadly classified into-

Get your Free Credit Report with Monthly Updates Check Now

Before you invest in any of these funds, it is ideal to have a specific objective and a capacity for risk, along with a short-term or long-term perspective depending on your upcoming financial needs. Mutual funds are convenient, well-regulated investment instruments and have the potential to provide high returns when compared with other investment options. Mutual funds may provide high liquidity as well as easy entry/exit options depending on the chosen fund type. Thus, in case of emergencies, you always have the option to liquidate your mutual fund investments.

Redemption of Mutual Fund Units

Mutual fund redemption is the process where an investor sells his/her investments in a particular fund. This could either be due to multiple reasons such as personal financial needs of the investor or if an investor speculates a peak in the fund’s performance and does not believe in keeping funds locked in beyond the current time.

Even though the redemption of mutual fund units is not encouraged by professionals, fund houses still offer the option of redemption of your fund units if the need arises. It is equally easier to redeem your mutual fund investments as it is to begin them. If you are facing any financial difficulties for a certain period, you may choose to discontinue your SIP instead of entirely opting out of it. You can read more about how to discontinue your SIP temporarily here.

Ways to Redeem Mutual Fund Units

Get Free Credit Report with Complete Analysis of Credit Score Check Now

Investors can redeem their mutual fund units through multiple ways that are stated as below-

- Redemption through AMC

- Redemption Through Online Portals

- Redemption Through Agent

- Redemption Through Demat Account

- Redemption through CAMS

Let’s understand the process of redemption using each of these ways.

Direct Redemption through AMC

- If you purchased your mutual fund units directly through the mutual fund house then you first need to sign in to the portal using the ID and password that you were allotted at the time of purchase of these funds. After logging in, you can easily perform various transactions like buying units and also redeeming any existing fund units.

- You can either redeem all the units held in your scheme (if they are not locked-in) or choose to partially withdraw. If you redeem all the units then your account gets closed, but if partial redemption is made, then the balance units will remain and perform accordingly.

- Alternatively, you can also visit the AMC and submit the duly filled form for redemption. Once the request is processed, the redemption amount reaches the customer via NEFT or through a cheque sent to the registered address.

- However, the online mode of redemption is faster than the latter. Also, you are advised to keep in mind that redemption forms are liable to get rejected due to inaccurate data filled in or signature mismatch. This may lead to unnecessary delays in the redemption procedure.

Redemption via Online Portal

Apart from buying mutual funds directly through an AMC or agent, you may also buy mutual funds through online fund house partner portals such as Paisabazaar. These partner portals also offer the facility of redemption of fund units, wherein you can place your redemption request by creating a login ID and password. You may redeem your mutual fund units in the same way as you bought them. The redemption request is processed after confirmation of the same and the money will be directly transferred to your linked bank account.

Redemption through Agent

If you had invested in the fund through an agent, you are bound to redeem your funds through the agent. The procedure will involve the filling of the mutual fund redemption form that specifies the plan and scheme name, folio number along with the number of units or the amount to be withdrawn. Subsequently, the agent will submit the form at the office. Once the redemption process is initiated, the redemption proceeds will get credited to the beneficiary account via NEFT or a cheque will be dispatched to the registered mailing address of the investor.

Checking Credit Report Monthly has no impact on Credit Score Check Now

Redemption via Trading or Demat Account

If the mutual funds have been bought through one’s own Demat or trading account then redemption will take place in the similar manner. As the whole trading process is completed online, an e-payout is made against the redemption request into the same bank account that is registered with the Demat account.

Redemption through Agencies like CAMS and Karvy

Computer Age Management Services or CAMS gives individuals the option to redeem mutual funds of several AMCs through their office. A redemption form may be downloaded and submitted at any CAMS office after duly filling and signing it. Other agencies like Karvy Computershare also provide these services. The investor stands to benefit by choosing these agencies as a lot of services for different AMCs can be availed through a single point of contact.

After receiving the redemption request, the details are verified and the payout is usually made within 2-4 business days into the registered bank account of the investor. In case of cheque dispatch, it may take a couple of more days to complete the process.

Reasons to Redeem Mutual Fund Units

Though an investor has an option to redeem his/her mutual fund units at his/her own will after the lock-in period(if any) is completed, it is essential to think over this decision wisely before placing the redemption request. This will keep an investor away from making premature withdrawals that affect the final payout costs. Investors are therefore advised to redeem their fund units only in case of certain specific reasons which could be-

- Achievement of investment goals– Say you had started investing to buy a car in 5 years. If after the given time period, you realize that you have gathered an equivalent corpus, you gain redeem your funds. However, in such cases, partial redemption is advised or a Systematic Withdrawal Plan would be beneficial.

- Financial emergencies- As time passes, our priorities, goals and objectives change. If there is a need for liquidity in an emergency situation such as health problems,etc., then selling units could meet this requirement.

- Changes in the scheme– If there are changes in the scheme, which is henceforth not suitable to your investment objectives, you may consider redeeming your funds from the current scheme and investing them to another. However, it is advisable to observe the performance of the fund for a year and then take a call.

- Underperformance of the fund– There might be situations when you would feel that your scheme is underperforming while its benchmark and peer funds are doing better. This would imply that you have parked your money in a loss making fund or a fund that is only providing minimal returns. A temporary poor performance, however, does not necessarily mean that in the long run the same would continue. But if a fund is consistently performing poorly, it is a good idea to exit by liquidating the available units.

- Market Volatility: This should be least of the reasons for an investor to exit from a fund. In fact, market experts and analysts advise to buy high value yet low priced stocks in the opportunity of any market fall. Buy low and sell high- that’s the old wisdom of the market. But most of us do the reverse.

A Good Credit Score ensures you manage Your Finances Well Check Score

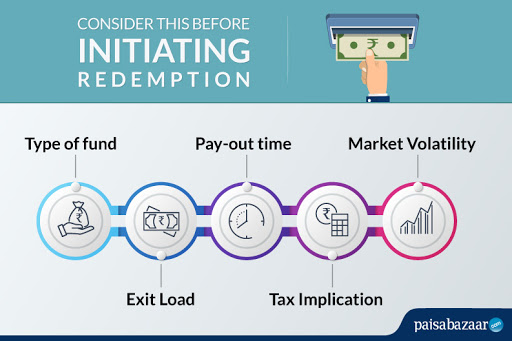

Things to be Considered before Redeeming Mutual Fund Units

Redemption of mutual fund units is a big call and must be taken only after proper research and thought. Given below are a few checkpoints for you to go through before you make the decision of redemption-

- Type of fund: The type of fund that you have invested in takes a huge call on whether you can redeem your funds at a given point in time or not. For instance, if you have invested in close-ended funds such as ELSS or fixed maturity funds, you are allowed to redeem these funds only after their lock-in period ends.

- Exit Load: Open ended funds do not come with a lock-in period. But if the funds are redeemed within a specified period then they will attract an exit load. For example- if a fund is redeemed within 1 year from the date of its purchase, then an exit load of 1% (variable) may be applicable. The amount of exit load varies as it is not a statutory charge, the period and percentage of load is scheme-specific.

- Pay-out time: Usually, it takes 2-4 business days for the pay-out to get credited in the beneficiary account. Hence, it is sensible to plan ahead if the funds are required for a specific purpose.

- Tax Implication: If equity-based mutual funds are held for more than a year then they are not taxable for the investor. But if it is redeemed after 1 year, then the gains would attract a long term capital gains tax of 10% along with surcharge and education cess if the capital gains exceed Rs.1 lakh. And if the same fund is invested in non-equity based mutual funds, then it would be taxable at the rate of 20% with indexation if it is held for less than 3 years.

It must be noted that exiting a fund during a bear market would only imply low returns or capital erosion. Though these investments are susceptible to short term fluctuations, in the long term, equity investments have always appreciated. So, instead of getting panicky and being just another sheep following the crowd, you must use a market slowdown to plan your investments cheaply and find ways to stick to your investments rather than exiting from your funds.

While mutual fund investments are quite flexible, as far as the investment amount, period of investment and redemption is concerned, one should have a long-term horizon when choosing these funds. Long-term perspective makes room for ample wealth creation, capital protection and appreciation. However, such investments demand a high level of commitment, discipline, effort and time, but the result is worth the wait.

FAQs

Ques. How does an investor redeem mutual fund units?

Ans. An investor can redeem his/her mutual fund units directly through the AMC, through an agent, though online portals, agencies such as CAMS or Karvy or through his/her Trading or Demat account.

Ques. How do I know what is the amount that will be credited?

Ans. You should check the NAV of your fund at the date when you apply for redemption of your funds. The value of your funds will be calculated depending upon the fund’s NAV on the same day.

A Better Credit Score can get your Loan Approved Quickly Check Score

Ques. How long does it take for the redemption proceeds to be credited?

Ans. When the redemption request of your funds gets a confirmation, it will take 1-5 days for your funds to be credited to your registered bank account.

Ques. What load or charges will the investor have to pay on redemption?

Ans. Investors will have to pay an Exit Load upon redemption of their fund units. Exit Load is charged in order to discourage the investors to withdraw their funds, thereby reducing the number of withdrawals from the scheme.