Table of Content:

What is Information Ratio?

Information ratio (IR) or Appraisal Ratio is defined as a mathematical measure used to determine the consistency of a fund manager to provide investors with risk-adjusted returns over the long term. A higher ratio typically represents the ability of a fund manager (mutual fund scheme) to outperform other fund managers or the benchmark, over a specific period of time. In most cases, the IR value is annualized similar to longer-term returns data to facilitate an easier understanding. It should be noted that using the Information Ratio is most effective when the funds or portfolio of similar type are compared to each other.

Uses of Information Ratio

- To measure risk-adjusted returns related to a benchmark

- Measure to determine the performance and consistency of the fund manager

- To compare and analyse the expertise, skills and abilities of the management according to the investment strategies employed. By practicing this, it becomes easy to balance the excessive or abnormally high returns

- To calculate the fee charges by mutual funds from their investors

Key Features of Information Ratio

- Information Ratio helps in the determination of how much and how often a portfolio trades in excess of its benchmark. The IR calculation helps provide a quantitative result of the performance of your fund management.

- Comparison to benchmark i.e. tracking error data used to calculate the ratio takes into account the ability of the fund/fund manager to provide returns that exceed benchmark returns. Changing benchmark will lead to a change in the ratio of the scheme.

- The ratio data is based on the historical performance of the scheme and there is no guarantee that similar levels of performance will be maintained at a later date.

Benefits of Information Ratio

The following are some key pointers to keep in mind when selecting a mutual fund to invest in, based on this ratio:

- A consistently high Information Ratio over the longer-term represents a fund’s and the fund manager’s ability to outperform the chosen benchmark. Such consistency allows the investors to invest in/redeem their investments without the need to time markets, thereby attracting them towards the specific funds

- Appraisal Ratio not only measures and compares returns but also adjusts results according to the market volatility

- For investors of Small-cap and Mid-cap funds, it is very important to measure the related risks and past performance. Information Ratio is a good indicator of the historical performances

- IR helps in judging whether a fund is dependable and will perform better or not

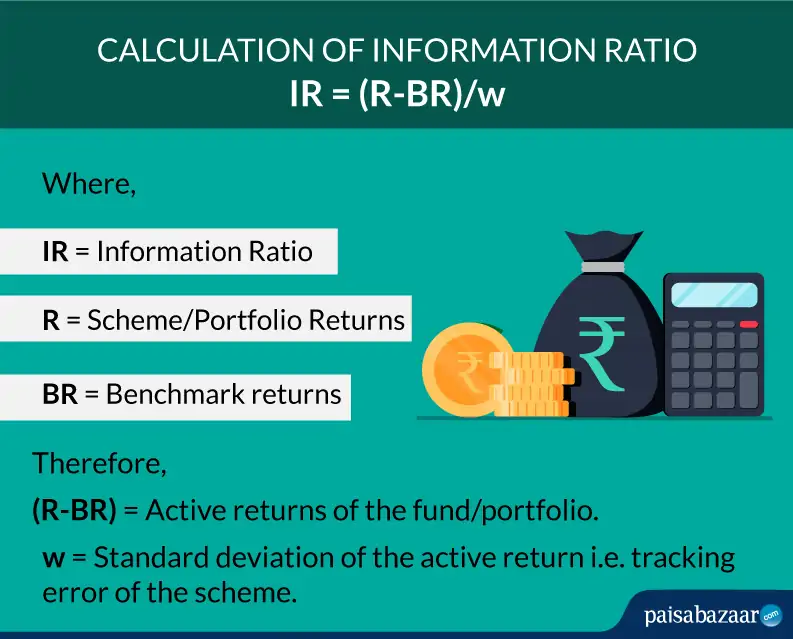

Formula of Calculating the Information Ratio

- Higher the Information Ratio, Better the fund performance and vice versa

- When the average returns of the fund (Total returns minus benchmark returns) is more than the standard deviation, it means that the fund is performing excellently

- Likewise, if standard deviation is more than the average returns, the fund is performing negatively. Standard deviation helps measure the level of risk associated with the investment. Higher the Standard deviation, lesser the consistency or predictability

- One may calculate the Tracking error by taking the standard deviation of the difference between the portfolio returns and index returns

- One may calculate the Tracking error by taking the standard deviation of the difference between the portfolio returns and index returns

Example of Information Ratio

For instance, you want to invest in a good fund and you are confused between two funds say Fund A and Fund B. Now, you want to compare the information ratio of these two funds to select the better option. Let us take S & P 500 index as the benchmark.

Fund A has given 11% returns where the benchmark has given 8% returns and the standard deviation of the fund and benchmark returns is 6%. And, Fund B has given 12% Returns where the benchmark has given 8% returns and the standard deviation is 9%

Using the formula of Information ratio:

- Fund A-

IR= (11% – 8%)/6% = 50%

- Fund B-

IR= (12% – 8%)/9% = 44%

The Information ratio of Fund A is more than that of Fund B. This implies that Fund A is more consistent with the returns and has the potential to give better returns than Fund B.

Limitations of Information Ratio

- While the Appraisal Ratio considers the consistency of returns that a mutual fund or investment portfolio has provided to its investors as a mathematical function, the calculation does not take scheme leverage into account. As a result, the Appraisal Ratio may provide negative returns when the fund generates a high alpha in comparison to the benchmark and vice versa. This is the key reason as to why you should not base your investment decision on a single criteria or performance metric in case of any scheme

- There are different parameters such as the age, financial situation, income etc, according to which the risk tolerance differs in case of different investors. In this case, IR is interpreted can vary depending upon the investors

- Every Mutual Fund has different securities, asset allocation and portfolio which makes it difficult to compare multiple funds against a benchmark

Information Ratio vs. Sharpe Ratio

- The Information Ratio provides details of the active returns of a scheme i.e. the scheme’s performance with respect to its chosen benchmark divided by the standard deviation. On the other hand, the Sharpe ratio represents the “excess” returns or outperformance provided by a scheme when compared to the returns provided by a risk-free investment divided by the standard deviation of returns

- The Sharpe Ratio can be calculated as the difference between the asset’s return and the risk-free rate of return divided by the standard deviation of the asset’s returns. As a result of the use of benchmark comparison criteria, Information Ratio can often provide a better representation of a scheme’s past performance as compared to Sharpe Ratio. One should, however, utilize multiple comparison criteria rather than depending on a single one when comparing or choosing investments

Frequently Asked Questions

Q.1: Why IR is a reliable tool to help investors choose the best fund?

Ans: Information ratio is a reliable tool to choose the best fund because it is more practical and accurate as compared to other available tools such as Sharpe Ratio. It doesn’t just compare returns but also analyses the reliability and expertise of a fund manager and his investment strategy.

Q.2: Do you want a high or low information ratio?

Ans: Higher information is always better than low information ratio as it shows that a fund has performed greatly under expert management. High IR also depicts the efficiency of the fund manager in minimizing the the risk and delivering better results than the benchmark.

Q.3: Which is a better tool sharpe ratio or information ratio?

Ans: Information is a better tool to judge the reliability and potential of a fund as it measures the returns, fund manager’s expertise and portfolio construction as a whole. Whereas, Sharp ratio will only help you measure the difference between returns of the portfolio and the returns given by the benchmark.