Mutual funds refer to a pool of resources collected from investors, which is later invested in equity and debt securities to generate returns. Returns from investment in these securities is quite sensitive to market fluctuations. Therefore, it is advisable to measure one’s risk appetite and financial objectives before investing in mutual funds.

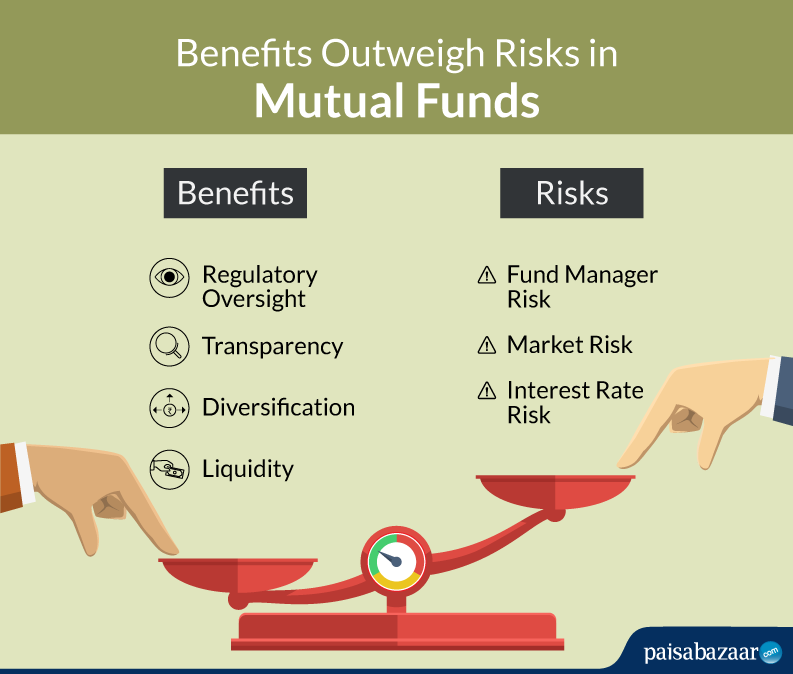

To talk about the safety of investing in mutual funds, one should be aware of their subjectivity to market risks. However, they are tightly regulated, transparent, liquid and highly diversified in nature.

How are Mutual Funds safe?

1. Regulatory Oversight

The Securities and Exchange Board of India (SEBI) exercises close oversight over mutual funds.

- Mutual Funds are governed by a Scheme Information Document (SID) which is filed with SEBI and must be approved by the regulator.

- SEBI lays down a maximum exposure limit to ownership of individual stocks.

- SEBI category rules set minimum and maximum limits for exposures to individual assets (such as equity or debt) within a fund.

2.Transparency

While investing in a Mutual Fund, it is important for the investor to go through all the scheme related documents carefully. To ensure safety, SEBI has laid down certain rules for AMCs to comply to:

- The valuation of a mutual fund, termed as NAV or the Net Asset Value is declared on each business day.

- Mutual Fund investors have been enabled to know the performance of their investment at any given point of time.

- Mutual Funds also publish their investment portfolios at the end of each month. Investors can thus observe the allocations made by individual funds at various intervals.

3. Diversification

Diversification is one of the most critical factors while making investments. It makes mutual funds a lot safe compared to direct equity investment in few stocks or putting all the savings in a single piece of land.

- Mutual Funds hold diversified portfolios, wherein a typical equity fund (excluding sector funds) will hold 20-40 stocks.

- A Mutual Fund cannot invest more than 10% of its assets in a single stock.

- Hybrid Funds, a type of Mutual Funds invest in both equity and debt, thereby further diversifying your risk.

4. Liquidity

One of the major benefits of investing in Mutual Funds is their liquidity. Most Mutual Funds are open-ended in nature, implying that one may redeem his/her investment on any business day.

- In some cases, you may have to pay a small fee called an Exit Load if you pull out your money too early.

- Your ability to access your own money in the form of Mutual Fund investments is not hampered directly.

- The liquidity conditions, however, are quite different while investing in land or insurance, where pulling your money out is extremely difficult.

What is the Risk Involved?

Although the above mentioned reasons clearly state that Mutual Funds are relatively safe, they are still subject to market risks.To know more about the nature and extent of risk involved and how you may avoid it, read below.

- Fund Manager Risk

The fund manager may not be able to outperform the market. As a result your fund may give you low or even negative returns. To avoid this, you may choose to invest your funds with an organization that has an impressive investment portfolio.

- Market Risk

The market as a whole may go down sharply. If this happens, your Equity Mutual Funds or Hybrid Mutual Funds will also go down in value. There may also be times when the entire market may get overvalued, such as in the late 1990s during the dot com boom and in 2007-08 before the financial crisis.

- Credit Risk

Debt Mutual Funds invest in the bonds and debentures of different companies. These companies may default on these borrowings. To mitigate this risk, mutual funds usually buy highly rated bonds.

- Interest Rate Risk

The value of bonds usually falls when the interest rates rise. In such a scenario (as happened in 2018), your mutual funds, which hold bonds, can also lose value.

How to Mitigate the Risk in Mutual Funds?

As they say, “Prevention is better than cure”, it is advised that the risks involved in Mutual Fund investments are mitigated well in time. Below are a few thumb rules to be followed-

- If your investing horizon is less than 3 years, stick to debt funds only. Within the debt category you can go for liquid funds or corporate bond funds (the latter can only hold AAA rated debt). This will keep your credit risk and interest rate risk contained.

- If you are investing for more than 3 years, pick a fund category that best suits your risk appetite. Hybrid Funds which mix equity and debt carry a moderate level of risk, large cap equity funds carry a moderate-to-high level of risk and sectoral funds carry an extremely high level of risk.

- SIPs or Systematic Investment Plans allow investments of a fixed sum in a mutual fund scheme at predetermined intervals. These investments reduce the potential financial risk associated with the lump sum investment, enabling the investor to make adjustments in his investments, moving in line with the current financial situation of the investor.

Here is the list of some of the recommended mutual fund schemes you can consider In:

| Fund Name | 1 Year Return | 3 Year Return | 5 Year Return |

| Axis Bluechip Fund – Direct Plan | 22% | 21% | 11% |

| Mirae Asset Tax Saver Fund – Direct Plan | 18% | 20% | – |

| Axis Midcap Fund – Direct Plan | 18% | 19% | 12% |

| Axis Bluechip Fund – Growth | 21% | 19% | 10% |

| Axis Long Term Equity Fund – Direct Plan | 18% | 18% | 12% |

| Invesco India Growth Opportunities Fund – Direct Plan | 14% | 18% | 12% |

| Axis Midcap Fund – Growth | 16% | 18% | 10% |

| Mirae Asset Tax Saver Fund – Regular Plan | 16% | 18% | – |

| Mirae Asset Emerging Bluechip Fund – Growth | 16% | 17% | 16% |

| Kotak India EQ Contra Fund – Direct Plan | 14% | 17% | 11% |

| Canara Robeco Bluechip Equity Fund – Direct Plan | 18% | 17% | 10% |

| HDFC Index Sensex – Direct Plan Growth | 18% | 17% | 9% |

| Nippon India Index Fund Sensex Plan – Direct Growth | 18% | 17% | 8% |

| Mirae Asset Large Cap Fund – Direct Growth | 16% | 17% | 13% |

| Tata Index Sensex Direct Plan | 18% | 17% | 9% |

| Axis Small Cap Fund – Direct Plan | 23% | 16% | 13% |

| IIFL Focused Equity Fund – Direct Plan | 29% | 16% | 12% |

| JM Multicap Fund – Direct Plan | 19% | 16% | 11% |

| Axis Long Term Equity Fund – Growth | 17% | 16% | 11% |

| JM Tax Gain Fund – Direct Plan | 16% | 16% | 11% |

| Invesco India Growth Opportunities Fund – Growth | 13% | 16% | 10% |

| Canara Robeco Bluechip Equity Fund – Regular Plan | 16% | 16% | 9% |

| Canara Robeco Equity Diversified – Direct Plan | 14% | 16% | 9% |

| Canara Robeco Equity Diversified – Regular Plan | 13% | 16% | 8% |

| DSP Equity Fund – Direct Plan | 20% | 15% | 10% |

| JM Tax Gain Fund – Growth | 16% | 15% | 10% |

| Kotak India EQ Contra Fund – Growth | 12% | 15% | 9% |

| Mirae Asset Hybrid Equity Fund – Direct Growth | 15% | 15% | NA |

| Tata Retirement Savings Fund Moderate Plan – Direct Growth | 13% | 15% | 13% |

| Mirae Asset Emerging Bluechip Fund | 18.27% | 14.40% | 17.53% |

| Axis Small Cap Fund – Growth | 21% | 14% | 12% |

| IIFL Focused Equity Fund – Growth | 27% | 14% | 11% |

| DSP Equity Fund – Regular Plan | 19% | 14% | 9% |

| Aditya Birla Sun Life Tax Relief 96 – Direct Growth | 9% | 14% | 12% |

| Invesco India Mid Cap Fund – Direct Plan | 6% | 13% | 11% |

| Invesco India Infrastructure Fund – Direct Plan | 12% | 13% | 7% |

| L&T India Large Cap Fund – Direct Growth | 16% | 13% | 8% |

| DSP Equity & Bond Fund – Direct Growth | 17% | 12% | 11% |

| SBI Small Cap Fund | 8.33% | 11.28% | 17.04% |

| Canara Robeco Emerging Equities Fund | 10.38% | 11.25% | 13.89% |

| Tata Mid Cap Growth Fund – Regular Plan | 10% | 11% | 9% |

| Invesco India Infrastructure Fund – Growth | 10% | 11% | 6% |

| LIC MF Infrastructure Fund – Direct Plan | 15% | 11% | 5% |

| HDFC Index Sensex Fund – Growth | -2% | 11% | 8% |

| ICICI Prudential Equity & Debt Fund | 8.11% | 10.41% | 10.65% |

| ICICI Prudential Balanced Advantage Fund | 12.79% | 10.40% | 10.37% |

| LIC MF Infrastructure Fund – Growth | 13% | 10% | 4% |

| HDFC Hybrid Equity Fund | 9.44% | 9.50% | 10.22% |

| PGIM India Dynamic Bond Fund | 13.69% | 9.32% | 10.08% |

| SBI Magnum Medium Duration Fund | 11.77% | 9.31% | 9.80% |

| Kotak Asset Allocator Fund | 11.09% | 9.29% | 9.12% |

| Franklin India Dynamic Accrual Fund | 9.51% | 9% | 9.98% |

| DSP Natural Resources and New Energy Fund – Direct Plan | 0% | 9% | 11% |

| Kotak Emerging Equity Scheme | 11.35% | 8.38% | 12.89% |

| ICICI Prudential All Seasons Bond Fund | 11.28% | 8.24% | 9.91% |

| Aditya Birla Sun Life Balanced Advantage Fund | 9.99% | 8.20% | 9.46% |

| Nippon India Small Cap Fund (earlier Reliance Small Cap Fund) | -2.60% | 8.14% | 11.82% |

| DSP Natural Resources and New Energy Fund – Regular Plan | -1% | 8% | 11% |

| Motilal Oswal Multicap 35 Fund – Regular Growth | -10% | 8% | 15% |

| ICICI Prudential Bluechip Fund – Growth | -6% | 8% | 9% |

| Tata Retirement Savings Fund Moderate Plan – Regular Growth | -8% | 8% | 12% |

| Axis Strategic Bond Fund | 8.32% | 7.68% | 9.11% |

| SBI Magnum MultiCap Fund – Growth | -5% | 7% | 12% |

| L&T Tax Advantage Fund – Growth | -13% | 7% | 9% |

| Aditya Birla Sun Life Tax Relief 96 – Growth | -13% | 7% | 11% |

| L&T India Value Fund – Growth | -13% | 6% | 11% |

| DSP Equity Opportunities Fund – Growth | -8% | 6% | 10% |

| SBI Bluechip Fund – Growth | -6% | 5% | 10% |