Mutual fund investment is on the rise with more and more retail investors entering into the segment. This increased interest has sparked quite a bit of talk regarding the market ups and downs in various circles of novice as well as seasoned investors alike. If one already has mutual fund investment online, it will be easy understand what all this talk is about and one can start conversing with them. But those who don’t have this knowledge as of yet don’t have to worry because mutual funds aren’t that tough actually.

What is a Mutual Fund?

A Mutual Fund is a fund comprising of money collected from a pool of investors for further investment. The fund house then invests the money in various financial vehicles such as equities, debt, and other money market securities.

The returns generated from the mutual fund investment are distributed proportionally among the investors. A professional and competent manager who has a sound knowledge of the financial market manages the fund, thus bridging the gap of layman’s knowledge of the financial world and that of an expert.

Investors who have little to no knowledge of the financial market can take advantage of the expertise of the fund manager and earn higher returns on their investment. For an investor, an MF offers an opportunity to invest in a diversified portfolio of stocks, bonds and various other market securities.

Also Know: What is a Fixed Deposit? What are the Latest FD interest rates provided by Banks/NBFCs?

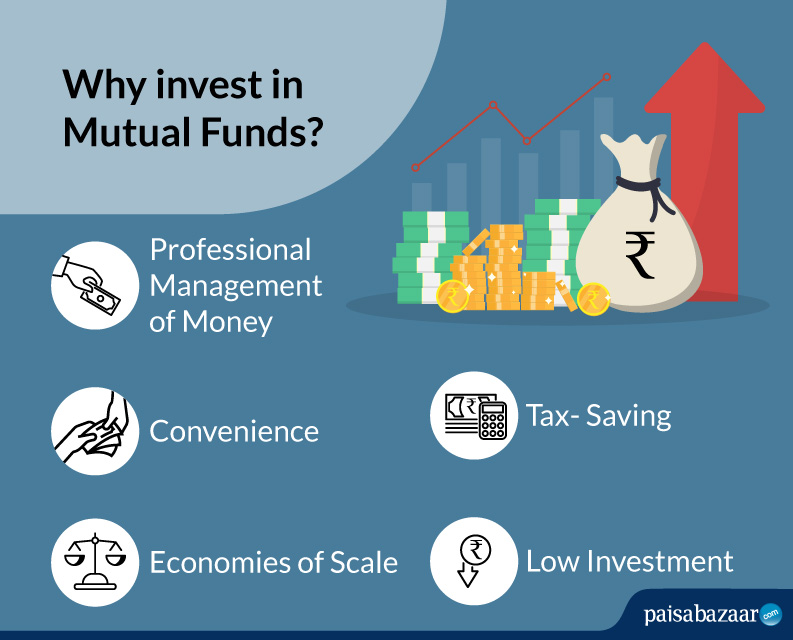

Why Invest in a Mutual Fund?

1. Professional Management of Money

Getting higher returns on your investments by leveraging the knowledge and expertise of a professional manager is the most important reason for investing in Mutual Funds. For a beginner, MF offers one of the best opportunities to invest their funds as they are managed by professionals and a team of proficient researchers.

2. Convenience

It is quite convenient to invest in MF since there is no direct involvement of the investor with the market. S/he just needs to register with the fund and start investing. There is no need to monitor the financial market and you can just invest and forget about it for a while. However, it is crucial to regularly check the performance of MF, if it is not at par with your expectations, you can withdraw from that particular fund and invest in some other fund-the key is to be patient, however.

3. Economies of Scale

MFs have economies of scale. When an investor opts for MF instead of individually buying stocks in the market, s/he saves on the transaction costs incurred. Also, if an individual has a low investment budget, it becomes impossible to buy a high price stock. MF bridges that gap as it accumulates money from lots of small investors and invests in well-performing stocks and other market securities which might be difficult for an investor to buy individually. Aggregate investing leads to a reduction in transaction costs thereby benefiting the individual investor.

4. Tax- Saving

Equity Linked Savings Scheme(ELSS) is one such MF which offers higher returns with the shortest lock in period of 3 years.

5. Low Investment

An investor with low investment budget can also invest in MF. You can start with an amount as low as ₹500 is to invest in a mutual fund through the SIP route.

Suggested Read: Is it Safe to Invest in Mutual Funds?

How to Invest in a Mutual Fund?

To invest in a Mutual Fund, a potential investor needs to complete their Know Your Client (KYC) details. This is to make sure that one understands the possible risks and rewards before registering in a Mutual Fund. After the KYC is complete, one can simply start investing in a fund either through a broker, or directly visit the fund’s office. Nowadays, investors can also invest in MF online.

When you visit the fund’s office, and apply directly for investing in the MF, or avail online services, you save on the Total Expense Ratio, thereby increasing your Net Asset Value (NAV). Expense Ratio is the total percentage of the MF used for administrative, management, advertising and other expense ratios.

If you go through a broker, you need to pay an additional fee which brings a reduction in your NAV. Therefore, it is advisable to invest in MF directly through the fund’s office provided you have the confidence in your financial decisions and expertise to handle your investments on your own.

Types of Mutual Fund

Securities and Exchange Board of India (SEBI) has classified Mutual Funds in four broad categories.

1. Equity Mutual Funds

These funds primarily invest in stocks. High returns with high risk are the characteristics of these funds. If you have a good appetite for risk and can keep your investment for a long time, then equity MFs are the perfect fit for you. Since, the returns in these funds are dependent on the performance of stocks in the financial markets, which is quite volatile, equity funds tend to be risky in the short run.

2. Debt Mutual Funds

These funds primarily invest in bonds and fixed income securities (debt securities). These investments earn from the fixed interest earned on these securities. An investor who is risk averse should invest in debt funds to get good returns on his/her investment.

3. Hybrid Mutual Funds

As the name suggests, these funds are a mix of equity and debt funds. These funds allocate their investment in stocks and debt securities, thus having a moderate risk on investment.

4. Solution – Oriented Mutual Funds

These funds are designed for specific solutions or goals such as retirement, child’s education, etc. If you want to plan for your future and have a good retirement income, you can invest in these funds, which have a compulsory lock in period of 5 years.

Also Read: What are Advantages & Disadvantages of Mutual Funds?

Taxation Rules for Mutual Fund Investments

Correct and complete knowledge of taxation on mutual fund investment is pivotal to optimize profits on your investments. So let’s understand taxation rules which you should know before investing in mutual funds.

Equity Mutual funds

Taxation rules of equity mutual funds or equity related instruments are quite simple to understand. Mutual fund portfolio must consist of 65% or more of its holdings in equity shares to fall within the equity mutual fund bracket. An investor holding a unit for more than 12 months is considered as long term capital gain. There is currently no tax on long term capital gains in case of equity investments.

A unit held for less than 12 months is a short term holding which has a flat tax rate of 15% on short term capital gain i.e. profits. Dividend or any other income from equity mutual funds are tax free. This must be considered, since long term capital gains are exempted, long term capital loss from mutual fund investments can only be set off against long term capital gains of other mutual funds.

Similarly, short term capital loss arising from the redemption/switch of equity mutual funds is allowed to be set off against any short term or long term capital gain from mutual funds. For purposes of taxation, arbitrage funds and equity-oriented hybrid funds are considered to be equity investments.

Non-equity Mutual funds

Mutual fund investments in debt funds, gold funds, international equity funds and debt-oriented hybrid funds are considered as debt oriented funds. These investments are considered long term only if they are held for more than three years or 36 months from the date of allotment.

The long term capital gain on debt mutual fund is taxed at the rate of 20 percent with a benefit of indexation on their original investment. Indexation is a method by which the returns are adjusted for the price of inflation during the invested period. The original cost of investment goes up after factoring in inflation, which impacts the overall returns of the investment. But if the debt mutual fund is redeemed or sold before three years or 36 months, it will be considered as short term capital gains and will be taxed as per the applicable tax slab of the investor.

Dividend income from debt mutual fund is exempt from tax. However, dividend distribution tax of 28.84% is applicable on dividend distributed by non-equity mutual funds. This tax is indirectly paid by investors as part of the expense ratio of the mutual fund.

Returns/Income

The income from the above mentioned mutual fund schemes are distributed in the form of Dividends as well as Capital Gains from increase in the fund’s NAV. The type of returns depend on the nature of mutual fund opted by the investor. Unit holders earn dividends from the income generated through dividends on stocks and interest on other instruments. They get capital gains on selling of securities from the fund that has appreciated. Profit from NAV is earned when the fund value increases the NAV of the fund. Investors can book their profit by redeeming or switching their units to a different scheme at the end of the maturity period.

How to Choose Mutual Funds Scheme

With so many options available in the market, it becomes very difficult to pick the best investment scheme. The simplest way to choose is to first understand the investor’s needs and thus figure out the objective for the investment. Some investors invest to make their money grow; some for tax saving purpose; whereas few enjoy safe and secure returns offered by investments made for the long term. Once this is decided, it becomes easy for an investor to make up his/her mind regarding the ideal mutual fund investment.

It is said that “high risk equals high returns”. So if your objective is to generate high capital appreciation, then an equity fund is the one to go for. If you wish to invest conservatively, then debt mutual funds are the best choice. Before investing in mutual fund scheme, it is important to read and understand the documents carefully because mutual funds always come with risk factors associated with them.

Remember to look at the market and performance history before investing in a particular mutual fund scheme. One of the best ways to judge the fund is by checking how the fund is performing in the context of its benchmark. A fund is supposedly considered good if it has beaten its benchmark with a significant difference. One should always choose similar category of funds to compare the performance with. For instance, mid-cap stocks should be compared with other mid-cap stocks only and same is applicable to other categories as well. A fund is good if it has beaten its benchmark and the category average by a significant margin.

Lastly, you need to look at the funds consistency in outperforming the benchmark and category average to take the right decision. Consistent good performance over the past few years indicate that the fund is strategized to target the benchmark and category to yield good returns on a continuous basis. So a fund is a good performer if it has beaten its benchmark and category average consistently over past few years. Therefore, never panic about the temporary poor performance of your fund, before judging the the performance history of the fund.

What is SIP?

SIP means Systematic Investment Plan – a method of investing a fixed amount on a monthly/quarterly/yearly basis into a mutual fund scheme. As the name suggests, SIP follows a systematic approach of managing your investments. This can be viewed similar to recurring deposits where we set aside a fixed amount on a monthly/quarterly basis.

Before investing in SIP it is important for an investor to set attainable goals with a specific timeline or investment tenure. The amount required for investment to accomplish the set goals need to be figured out with the help of a financial advisor or expert.

The money for SIP is debited automatically from your bank account at specified interval. The amount is then invested in the mutual fund chosen by you. Systematic Investment Plan works on the mechanism of compounding. As a fact, compound interest leads to an exponential growth of your money and brings down the risk factor substantially.

In SIP investment, you need to be patient for your money to grow, continue to hold the plan for longer period to enjoy the compounded returns and last but not the least you need to be disciplined or consistent in your monthly payment. The performance is only marginally affected due to daily market volatility due to the benefit of rupee cost averaging. You can also enjoy tax benefits by investing in ELSS mutual funds through the Systematic Investment Plan.

Investing early and for longer duration is the key to earning good returns via the SIP route. The ideal way to reap the greatest benefit from a SIP is by staying invested for a longer period of time. To get maximum mutual fund benefits, younger investors having the time on their hands that allows to explore aggressive investment strategies.

Key Mutual Fund Terms

Unit – A unit represents a portion of the ownership of a mutual fund similar to an equity share of a company.

NAV – Net Asset Value of the units of the scheme is computed by dividing the net assets of the scheme by the number of units outstanding as on the valuation date.

Redemption – means selling of the units by investors in lieu of money. This process allows investors to achieve capital gains.

Switch – means an option available to the investor to shift his existing investment in a mutual fund scheme to any another mutual fund scheme or a different option of the same scheme.

AMC – Asset Management Company is a company registered with SEBI that invests its clients or investors pooled funds into the securities that match declared financial objectives.

Load – in simple terms this is a “charge” which the Asset Management Company (AMC) or the fund house you have purchased the mutual fund scheme from may collect on exit from a scheme.

ELSS – Equity Linked Saving Scheme is a type of diversified equity mutual fund scheme with a lock in period of three years this gives you the dual benefit of tax deduction and capital appreciation under section 80C of the Income Tax Act.

ETFs – ETF is short for exchange traded funds. These are marketable securities which track a specific commodity, index, bond or even an index fund. Unlike mutual funds these are traded on stock exchanges in a fashion similar to securities.

Every mutual fund advertisement comes with a disclaimer which says “Mutual funds are subject to market risk. Please read the offer documents carefully before investing”. Therefore one should always remember that there are various risks to consider before investing in a mutual fund scheme and plan contingencies accordingly.