Mutual funds can be a good choice of investment for wealth creation over a period of time. Whether investors are looking for capital gains or seeking regular income, they can choose to invest in a wide range of mutual funds.

There are different types of mutual funds such as equity funds, thematic funds, index funds, tax-saving funds, debt funds, money market funds, Exchange Traded Funds (ETFs), etc. Depending on your investment amount, time horizon and risk appetite, you can select a mutual fund scheme that would help you in achieving your financial goal.

The investment time horizon is an important factor which can help an investor pick the right mutual fund scheme. Ideally, mutual fund investment is suited for long term investors. However, investors with a short-term perspective can earn smart returns through mutual funds. Here is how:

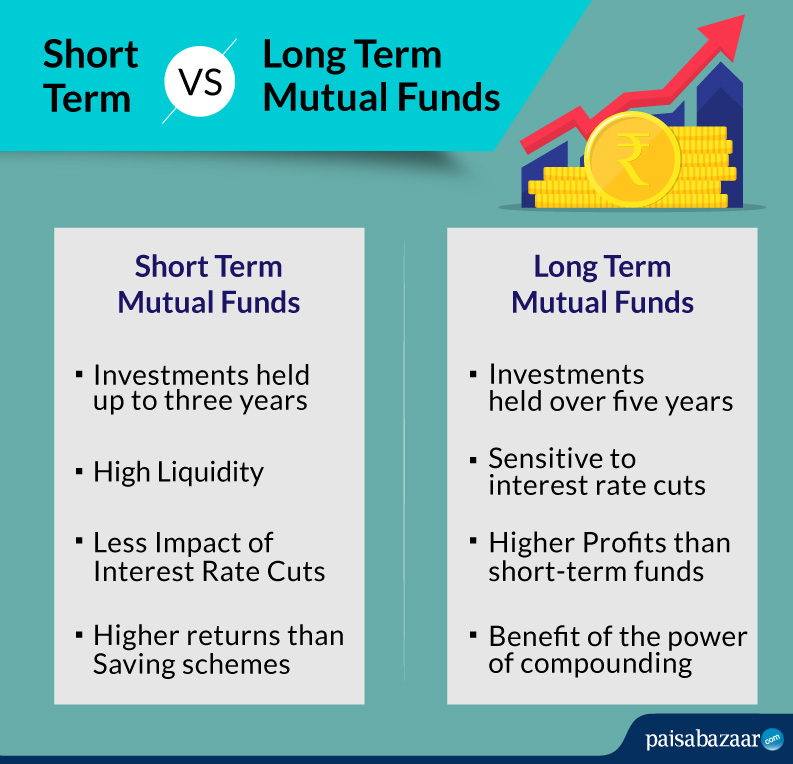

Short Term vs Long Term Investment in Mutual Funds

From the point of view of most experts, short term investments are usually those that need to be liquidated within a 3-year period, whereas, any investment held for over 5 years is considered as a long-term investment.

Though empirical data suggests that staying invested in a mutual fund for a longer period of time has been beneficial to the investor as one can get the benefit of the power of compounding. Compounding, of course, works best in case one stays invested over a longer period of time.

That said, due to the vast array of mutual funds on offer, investors do have the opportunity to take the benefit of short term investments too. Fund selection plays a critical role in the success of mutual fund investment, especially for short-term players.

Mutual Funds for Short Term Investment

If you are investing for the short term that could range from a week to a year, some of the top choices include liquid funds and ultra short term debt funds. Both of these offer returns that are significantly higher than savings accounts, which currently provide interest in the range of 3.5% to 4%.

Also Read: All You Need to Know About Liquid Funds

In case of ultra short term mutual funds, the returns can potentially exceed returns of bank fixed deposits even if you are staying invested for only a short period of time. These debt funds feature a unique ability mainly as a result of their investments being made into certain bonds that have a much higher yield as compared to the returns offered by traditional savings options such as fixed deposits.

However, like any other mutual fund investment, these are subject to market risk hence returns are not guaranteed. In case you are investing for a period of up to 3 years, debt funds such as short term funds and credit opportunities funds might be a better option as these are potentially capable of offering higher returns in the medium term.

Also Read: Best Short Term Debt Mutual Funds

Mutual Funds for Long Term Investment

In case you are planning to invest for the long term i.e for 5 years or even more like for retirement planning, it is recommended to invest in equity funds such as large-cap funds, diversified equity funds and equity-linked savings schemes (ELSS).

The benefit in case of long-term equity investments is two-fold. Firstly, no tax is payable in case the investment is held for over a year and secondly the power of compounding works in your favour. Historic data regarding equity fund investments show that those staying invested in equities over the long term have a significantly greater chance of earning higher profits as compared to short term equity investments.

It is, however, worth pointing out that the value of your equity investment will not go up at the same rate during the period you stay invested in the scheme. Some years might feature annual returns of over 20% while during other years the scheme might feature annual returns of 10% or less. Though on average, those staying invested for a longer term are potentially better placed to make their initial investment grow significantly.

Taxation Rules of Short Term and Long Term Investments

The definition of short term vs. long term investment from a taxation perspective depends on whether you are invested in an equity mutual fund or a debt mutual fund. According to existing rules, a short term investment in an equity fund is for a period of 1 year or less calculated from the date of unit allotment.

Therefore, in case you have held equity fund units for a period of over 1 year from the date of unit allotment, they would qualify as long-term investments. In case you redeem or switch your mutual fund units before the completion of 1 year from the date of unit allotment, you are liable to pay 15% tax on profits as short term capital gains.

At present long term capital gains (LTCG) i.e. profits from equity investments that have been held for over a year are taxed at 10% If net profits of redeemed unit exceeds Rs. 1 lakh. However, if the long-term gains are any less than Rs. 1 lakh, they are treated as tax-exempt gains.

The definition of short term and long term with respect to non-equity investments such as debt investments is completely different. For debt funds, the short-term refers to investments that have been held for 3 years or less. In case non-equity investments have been held for over 3 years from the date of unit allotment, long-term capital gains rules apply.

Short-term capital gains on debt funds are taxed as per the investor’s applicable income tax slab. These gains are categorised as income from other sources, added to the annual taxable income of the investor and subsequently taxed as per the applicable slab rate.

While long-term capital gains of non-equity investments are taxable using different criteria. Profits from long-term debt investments are charged a tax rate of 20% on profits if indexation benefits have been availed otherwise the tax rate is 10% on profits if indexation benefits have not been availed.

Read more: about Mutual fund tax benefits

Our observation

The flexibility provided by mutual funds as an investment option is near unparallel as you not only get the option of making solid investments for both the short term as well as the long term but also end earning higher returns than most other investment products.

Moreover, there is enough flexibility in terms of choosing your investment amount starting with a sum as small as Rs. 500 to as high a number as you are prepared to invest through a Systematic Investment Plan (SIP). All one needs to do is choose the correct investment instrument for the job. All in all, mutual fund schemes are definitely among the best investment options available to Indian investors from every walk of life.

1 Comment Comments

Like!! Really appreciate you sharing this blog post.Really thank you! Keep writing.