This is one of the biggest dilemmas an investor faces when starting their investment journey of market-linked financial instruments.

For those investors who are looking for extremely high returns, investment in stocks seems to be a more attractive option compared to mutual fund investment. Certainly, there is a good chance of getting high returns in investment in stocks, but the risk quotient is also very high.

Get Your Free Credit Report with Monthly Updates Check Now

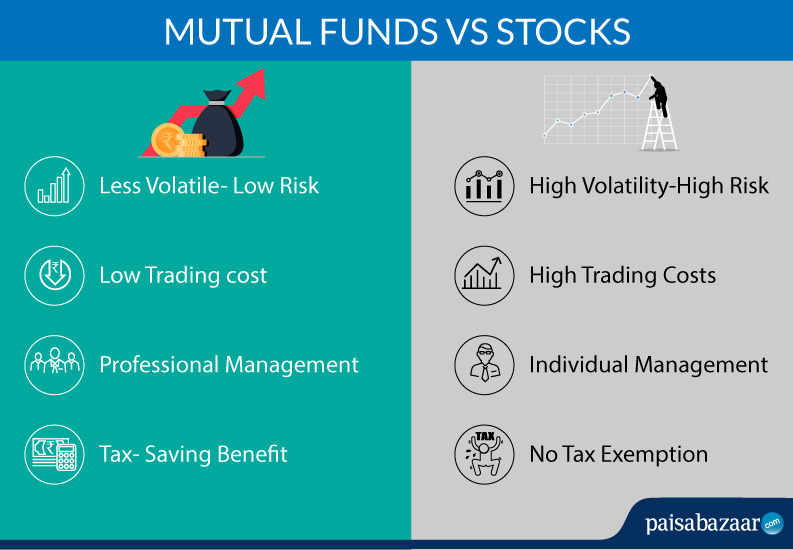

Mutual funds involve less risk because of the diversified investment portfolio which mitigates the overall market risk. Also, the trading costs incurred by individual investors for buying and selling stocks can add up to a huge amount, whereas one can save up on these trading costs through investment in mutual funds where equity and equity-related instruments are traded in bulk thereby reducing the cost per investor.

If you have in-depth knowledge of financial markets and full faith in your investing strategies, coupled with high risk tolerance, then equity investment is the perfect fit for you.

How Much Money Can You Lose in Mutual Funds?

How Much Money Can You Lose in Mutual Funds?

Here is a list of 5 worst performing Mutual Fund Schemes with lowest returns in the past 5 years:

| Fund Name | 5 years (Annualised) |

| Kotak PSU Bank ETF | -7.01% |

| Reliance ETF PSU Bank BeES | -7.06% |

| DSP World Energy Fund – Regular Plan | -4.04% |

| Aditya Birla Sun Life Global Emerging Fund- Regular Plan | -2.34% |

| Kotak World Gold Fund- Standard Plan | –0.47% |

Source: Value Research, Data as on Sep-16-2019

As the table above shows, the very worst mutual funds among the roughly 4,000 registered mutual fund schemes in India over the past 5 years have delivered -2.82% to -4.17% CAGR. The table does not account for poor mutual funds merging with better performing ones, but this factor will not dramatically change the picture.

Get Free Credit Report with Complete Analysis of Credit Score Check Now

Mutual funds can give much lower returns in the short term, UTI Transportation and Logistics Fund (Regular) has delivered -29.49% and HSBC Infrastructure Fund (Regular) has delivered -21.66% over the past year. However these poor performances tend to get ironed out over time as fund managers adjust their portfolios towards better performing companies and beaten down sectors move up again. In addition, a host of regulatory rules ensure that mutual funds do not expose themselves to a great deal of risk in the first place.

How Much Money Can You Lose in Stocks?

Your money in a stock, even a seemingly good company can go to zero. Recent prominent examples of corporate failures include Jet Airways, Yes Bank, DHFL, Reliance Capital. An even a more ‘blue chip’ company than these, Vodafone Idea (formed by merging Vodafone and Idea Cellular) has lost around 79% of its value in a single year.

Needless to say, the opposite is also true. Your money in the right stock can multiply several times over in a single year, but the probability of picking up that particular stock is quite low.

The speed and time at which you can lose money in a stock is completely unpredictable. If you are leveraged (borrowed money to invest in stocks) or you invest in futures and options (F&O) or are engaged in intraday trading, you can even lose money more than you have invested. This is because such trades involve only a small amount of margin money rather than buying the whole stock upfront. A dramatic fall in the stock price can more than wipe out your margin money and make you liable for additional losses.

Why Choose Mutual Funds Over Stock?

Here we list 5 most important reasons why an investor should choose Mutual Funds over Stocks:

1. Professional Management of Money:

Leveraging the knowledge and expertise of a professional fund manager to earn good returns is one of the primary reasons for investing in mutual funds.

Investment in stocks without prior experience or knowledge of the working of financial markets can be disastrous and easily drain away your savings. Therefore, it is advisable to invest in mutual funds if you don’t have thorough knowledge of financial markets and want to keep your money in safe hands.

Checking Credit Report Monthly has no impact on Credit Score Check Now

2. Diversification:

Instead of investing in individual stocks, mutual funds invest in a variety of asset classes to hedge the investment portfolio during turbulent market conditions. Even equity oriented mutual funds invest some portion of their total assets in fixed income or low-risk securities for market risk mitigation.

3. Convenience:

Buying and selling stocks require a lot of time and formalities which are not present in mutual funds. In case of mutual funds, all these formalities are done by the Asset Management Companies which manage the fund, for which they charge a nominal fee.

Moreover, the investor doesn’t need to time the financial market regularly. S/he can just keep the money invested in the scheme for a long term and earn good returns.

4. Tax-Saving Benefits:

Income generated from equity investment is taxable. However, there are certain mutual fund schemes where you can avail tax-saving benefits. Equity Linked Savings Schemes (ELSS) are equity mutual funds where investment upto ₹1.5 lakh is eligible for tax deduction under Section 80(C) of the IT Act.

5. Overseen by market regulator:

Unlike stocks, mutual fund houses are subjected to certain restrictions by the national market regulator-Securities and Exchange Board of India (SEBI).

Here are the List of Top Performing Mutual Fund Schemes, that can give highest returns in FY 2020:

Your Credit Score Is Now Absolutely Free Check Now

| Fund Name | AUM (cr.) | 3 -Year Returns | 5 – Year Returns |

| Mirae Asset Large Cap | ₹16,873 | 13.71% | 11.99% |

| SBI Bluechip | ₹23,641 | 10.46% | 9.90% |

| HDFC Mid-Cap Opportunities | ₹23,788 | 7.47% | 10.50% |

| Franklin India Prima | ₹7,583 | 8.46% | 10.25% |

| SBI Small Cap | ₹3,156 | 15.05% | 15.93% |

| Axis Small Cap | ₹2,084 | 16.58% | 14.49% |

| Axis Long Term Equity | ₹21,997 | 17.58% | 12.75% |

| Mirae Asset Tax Saver | ₹3,066 | 16.33% | — |

| Axis Focused 25 | ₹9,627 | 18.56% | 14.14% |

| Motilal Oswal Multicap 35 | ₹13,131 | 10.00% | 12.54% |

{Data as on February 10, 2020; Source: Value Research}