A Politically Exposed Person (PEP) is an individual with a prominent public post or a public function. Members of Parliament, State Assemblies, Judges, Governors and senior government officers would come within the PEP category along with their close relatives (people in direct contact). The PEPs fall under the category of high-risk customers by the financial institutions and thus need additional KYC.

According to Financial Action Task Force (FATF), a PEP is:

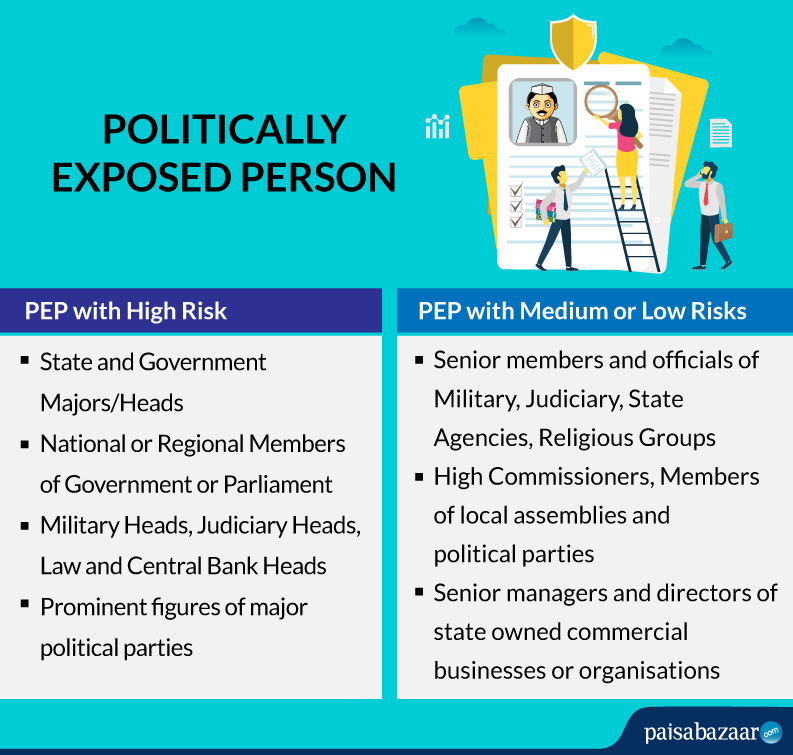

- a person who is or has been in the executive, legislative, military, administrative or judicial branch of the government

- a senior post holder in a renowned political party

- a personal in direct contact or relation to such person- spouse, mother, father, brother, sister or child

- a publicly known or entrusted person, personnel or associate

- a senior person of any commercial organisation, business or entity owned by the government

You would come across a question asking if you are a politically exposed person (PEP) while filling the KYC details for bank acccounts, mutual funds, NPS etc. If you fall within this set of persons, you would have to declare your PEP status.

As per the provisions of Securities and Exchange Board of India (SEBI), it is mandatory for mutual funds to keep a check on the PEP investors.

What happens when you declare PEP status?

Once you declare the PEP status, your transactions come under more detailed scrutiny from the Anti-Money Laundering (AML) committee of the concerned bank, mutual fund or pension fund. This does not necessarily mean that you cannot invest or that you will be subject to any restrictions. However it means a more detailed scrutiny of your transactions to check for corruption or money laundering.

According to SEBI rules, financial intermediaries (such as banks and funds) are also required to get senior management approval before entering into financial relationships with PEPs. A circular was rolled out stating that every bank must verify identity of such individual and seek for a closure of each and every details about the person before enrolling him as a PEP.

RBI rules require banks to do additional due diligence about the identity of PEPs. A drastic change in the transaction amount or pattern of PEPs could invite further investigation by regulatory authorities. Your KYC process will also take longer than the KYC process for ordinary individuals and additional documents may be required from you.