Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Table of Contents :

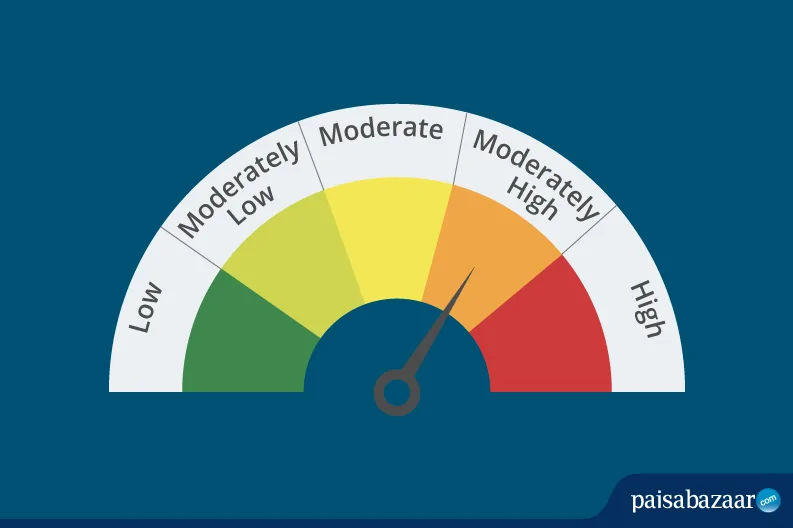

A riskometer is a pictorial depiction of the risk profile of a mutual fund scheme. It shows the level of risk associated with the principal amount invested in a mutual fund. The riskometer consists of 5 levels: low, moderately low, moderate, moderately high, and high.

In 2015, the Securities and Exchange Board of India (SEBI) made it mandatory for all mutual fund houses to display a riskometer for all of their mutual fund schemes to enable investors assess the amount of risk associated with mutual fund investments.

The below table gives a snapshot of risk profiles of some mutual fund categories:

| Low Risk | Moderately Low Risk | Moderate Risk | Moderately High Risk | High Risk |

| Liquid Funds | Short-duration Funds, Ultra Short-duration Funds | Fixed Maturity Plans (FMPs) | Large Cap Funds, Mid and Small Cap Funds, Balanced Funds | Sectoral Funds |

So, which risk profile is suitable for you?

You can understand which risk profile is suitable for you with the help of the below table:

| Risk Profile | Type of Investor |

| Low Risk | Investors willing to accept low returns for high safety of principal amount. |

| Moderately Low Risk | Investors willing to take a small amount of risk for potential returns. |

| Moderate Risk | Investors willing to accept a moderate level of risk for moderate returns. |

| Moderately High Risk | Investors willing to take relatively high risk for high returns. |

| High Risk | Investors willing to lose capital for significantly high returns. |

Debt Funds

Also Read : Best Debt Mutual Fund to Invest in 2019

Equity Funds

Also Read : Top 8 Equity Mutual Funds to Invest in 2020

Diversification: Diversify your fund portfolio by adding funds which were not previously present. For instance, if you do not hold in any gold in the portfolio, you can allocate 5%-10% of the portfolio to gold.