SBI Mutual Fund AMC is a leading fund house run by the State Bank of India, India’s largest public sector bank. The SBI AMC (asset management company) is engaged in providing a range of mutual fund investment services across key categories such as equity, debt and hybrid funds to millions of investors across the country.

One of the most popular ways to invest in SBI mutual fund schemes is to invest through a systematic investment plan popularly known as SIP. SIP plans provide investors, even those with small savings, the opportunity to create a large cumulative savings corpus for the future by investing small amounts at regular intervals of time.

Get Your Free Credit Report with Monthly Updates Check Now

Table of Contents :

Best 5 SBI Mutual Funds for SIP Investment

| Fund Name | Category | 1 Year Returns | 3 Year Returns | 5 Year Returns |

| SBI Small Cap Fund | Equity: Small Cap | 2.28% | 16.04% | 22.27% |

| SBI ETF Nifty Bank Fund | Equity: Sectoral Banking | 19.17% | 20.69% | N/A |

| SBI Magnum Multi-Cap Fund | Equity: Multi Cap | 9.23% | 12.15% | 14.65% |

| SBI Dynamic Bond Fund | Debt: Dynamic Bond | 12.51% | 9.05% | 9.81% |

| SBI Magnum Children’s Benefit Plan | Hybrid: Conservative Hybrid | 3.70% | 11.39% | 12.20% |

What is SIP?

Systematic Investment Plan (SIP) is a facility offered by mutual funds to its investors which allows them to invest at fixed time intervals in mutual funds. An investor can start investing in mutual funds via SIP with an amount as low as Rs. 500.

A fixed amount of money is debited from the bank account of the investor periodically (say a month) and gets invested in the selected mutual fund. The investor, in return, is allocated a certain number of units depending on the Net Asset Value (NAV) of the fund.

Also Read : Top Mutual Funds to invest in 2020 vis SIP

A Good Credit Score ensures you manage Your Finances Well Check Score

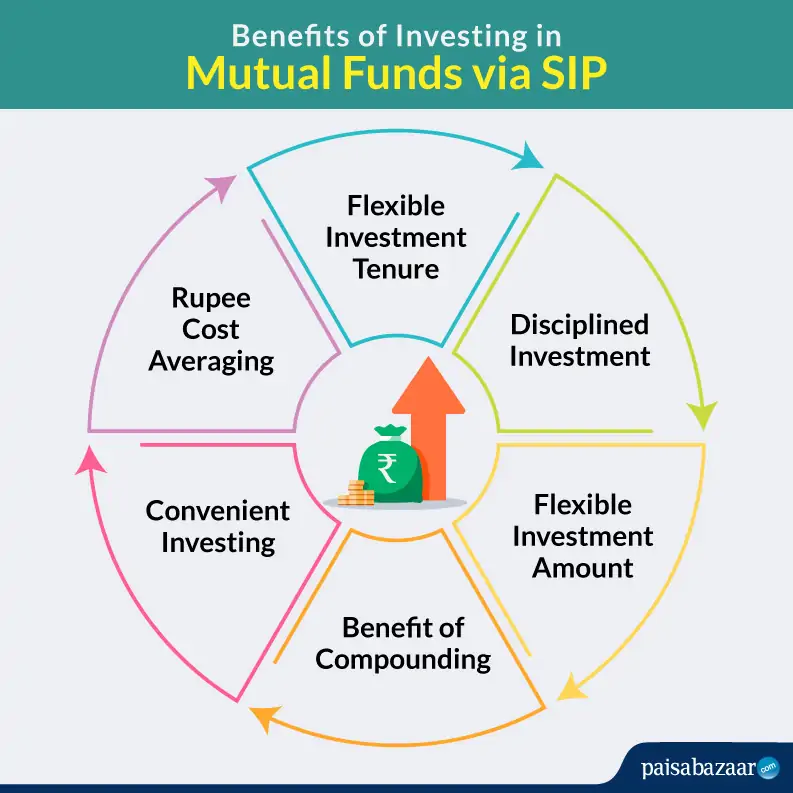

Benefits of Investing in Mutual Funds via SIP

Disciplined Investments: A disciplined approach towards investing helps greatly in wealth creation over the long term. It not only involves consistent and incremental savings but also investing in the right kind of options. A SIP can help you in staying consistent with your investments as the SIP amount gets automatically invested in the selected mutual fund as well as balancing the market risk.

Rupee Cost Averaging: Since a SIP involves investing a fixed amount at fixed intervals, it enjoys the benefits of rupee cost averaging to steer out of the market volatility. If the markets are bullish, the NAV of the fund increases, which means the investor will be able to buy lesser number of units of the mutual fund.

While, in case of bearish markets, your SIP gets you higher number of units and thereby, balancing the market risk. This approach which is inherent to SIP mode of investment is called rupee cost averaging.

Get Free Credit Report with Complete Analysis of Credit Score Check Now

Flexible Investment Tenure: Flexible investment tenure facility allows you to start and stop a SIP as per your need. Moreover, you can also change the tenure at a later date after the SIP has been started without a hitch.

Flexible Investment Amount: You can increase or decrease the SIP amount as per the income and savings capability. If you like your fund and want to increase your SIP contribution to it, you can do that without starting a new SIP by simply increasing the amount of the existent SIP.

Long term Benefit of Compounding: Though not a fixed rate instrument, mutual fund investments are subject to the general rule – the earlier you invest, the more your wealth grows over time. Thus, even small amounts invested in mutual fund schemes through an SBI SIP can provide you significantly high returns due to the power of compounding.

For this reason, the SIP calculator – a vital tool used to calculate future value of your fund investment – uses the compounding system to provide you with approximate returns.

Also Read : Calculate the Future Value of Your Investment using SIP Calculator

How Does SBI Mutual Fund SIP Work?

The concept of SIP is pretty similar to the bank recurring deposit for the most part. When you set up a SBI SIP, the monthly, weekly or daily investment capital specified by you gets debited from your registered bank account automatically on a specific date.

This predetermined amount then gets invested in a SBI mutual fund scheme of your choice. It is important to note here that though your individual investment amount will remain unchanged, you do have to keep in mind that the NAV of the fund that you have chosen will vary daily; thus, the number of units purchased will tend to vary from one SIP installment to another.

Let’s take an example. Suppose you are investing Rs. 500 per month through a SIP. And the first time you invest through the systematic plan, the NAV of your chosen SBI MF scheme is Rs. 50 and thus you purchase 10 units of the scheme. The next time your SIP payment occurs, assume that the scheme NAV has increased to Rs. 60, in that case, you are able to purchase only 8.33 units of the scheme.

Alternately, if the NAV declines to Rs. 40, would be able to purchase 12.5 units in the same scheme. Thus the average price of each scheme unit will change whenever you make a new SIP investment in your chosen SBI MF scheme. This feature known as “rupee cost averaging” can be quite beneficial in the long term and in the following section, we will take a look at some of the key benefits of investing in an SBI SIP including this one.

Your Credit Score and Report Is Now Absolutely Free Check Now

A Comparative Analysis of Top SBI Mutual Funds

SBI Mutual Fund AMC offers a number of open-ended mutual funds across diverse categories including equity, debt and hybrid. In the following section we will discuss the leading schemes from SBI MF AMC that have performed strongly in various market conditions and are potentially ideal for investment through Systematic Investment Plans.

1. SBI Small Cap Fund

This is one of the best performing equity schemes currently managed by SBI Mutual Fund AMC. With more than 22% annualized returns in the last 5 years, the fund has generated one of the best in class returns.

Further the fund has consistently outperformed its benchmark as well as category returns in 1-year, 3-year and 5-year framework. The fund has invested about 60% of its assets in small cap space and another 38% in the mid cap space.

High exposure to mid and small cap space makes the fund volatile and therefore, not suited for risk averse investors. However, you can minimize the market risk by staying put for a long term and investing through the SIP route.

SBI Small Cap Fund is ideally suited for investors willing to take high risk in expectations of high returns and investing with long-term goal.

2. SBI ETF Nifty Bank Fund

The fund is a sectoral equity fund which invests in the banking sector. Generally, sectoral funds can be risky because of high concentration risk but the SBI ETF Nifty Bank Fund has performed exceptionally well since its launch.

The fund has delivered about 20% returns per annum in both 1-year and 3-year time frame beating its category returns by a significant margin. Further, as the fund is a type of Exchange Traded Fund (ETF), it follows a simple strategy of following its benchmark S&P BSE Sensex in terms of asset allocation.

Further, being an ETF fund, the expense ratio of the fund is really low which is an added advantage. The fund has invested about 92% of its assets in large cap stocks which makes it quite sturdy in the times of market turmoil.

3. SBI Magnum Multi-Cap Fund

Multi-cap funds follow a strategy of investing in companies across market capitalization companies including large cap, mid cap and small cap. Therefore, the multi cap fund enjoys dual benefits of stability due to exposure to large caps and of high return potential due to its investment in small and large cap space.

SBI Magnum Multicap Fund has delivered returns at 15.27% a year for the last 5 years beating its benchmark returns (10.75%) by a significant margin. Further, the fund has invested about 62% of its assets in large cap stocks, 26% in mid cap and another 12% in the small cap space giving it a balanced outlook.

The fund can be a great investment option for investors with moderate risk and return expectations with medium to long term investment horizon.

Also Read : Best Multicap Funds to Invest in 2020

4. SBI Dynamic Bond Fund

Debt funds are meant for conservative investors who are willing to earn moderate returns but at a lower risk. However, debt funds are still better than fixed return investment options in terms of returns.

Checking Credit Report Monthly has no impact on Credit Score Check Now

SBI Dynamic Bond Fund is a debt fund which has invested about 60% of its assets in AAA and above rated debt instruments and another 40% in sovereign securities which makes it a safe bet. The fund has provided moderate returns which look really attractive with very low risk quotient.

The fund has given over 11% returns in last one year and over 9% returns in 3-year and 5-year framework. SBI Dynamic Bond Fund can be a good choice for an investor with low risk appetite and moderate returns expectation and a medium to long term horizon.

Also Read : All You Need To Know About Debt Funds

5. SBI Magnum Children’s Benefit Plan

This is a debt-oriented hybrid fund which means that though the fund is allowed to invest in both debt and equity instruments, this scheme is particularly focused on making debt and money market investments.

A conservative debt hybrid mutual fund category carries a lower level of risk than equity-oriented hybrid funds and an even lesser degree of risk as compared to equity schemes.

SBI Magnum Children’s Benefit Plan has invested about 25% of its assets in AAA and above rated instruments and about 8% in government securities. However, about 35% of its assets are allocated to AA and below rated debt instruments which are riskier but generate higher returns.

With 5 year returns at 12.20% per annum, the fund is best suited for investors with low risk appetite, long term investment horizon and moderate returns expectations.

How can you start SBI SIP online?

- Visit the official website of SBI MF and click on the ‘Invest Now’ Section

- LogIn if you are an existing user or Sign Up as a New User. You can also continue without logging in/up as a Guest User using your PAN

- Download the KYC form and fill in all the required details

- Submit the duly filled form to the nearest SBI Mutual Fund Branch. You can locate the nearest branch with help of their Customer Care phone number or email id

If you want to avoid all the hassle as mentioned above, and also have the benefit of comparison of various SBI mutual funds or funds of the same category from other fund houses, then you can invest through Paisabazaar.com. Here you can compare more than 1,700 funds based on ratings, returns or AMCs.

A high Credit Score may help you get a credit card with better benefits. Check Now

Frequently Asked Questions (FAQs)

Q. What is SIP and SWP?

A. SIP and SWP i.e. Systematic Investment Plan and Systematic Withdrawal Plan, as the name suggests are two different procedures, while one is an investment mode, the other is a withdrawal process. In SIPs, you invest a small amount of money monthly in a Mutual Fund plan. In SWPs, you withdraw a certain amount of money on a periodic basis which may be monthly, quarterly, bi-annually or annually. In SIPs, your MF units increase with each investment and in SWPs, your units decrease with each withdrawal, provided that it is Fixed Periodic Withdrawal (in Appreciation Withdrawal, only the interest is withdrawn and hence the number of units remain).

Q. Is SBI SIP safe?

A. SBI Mutual Fund is a reputed fund house that has offered mutual fund schemes out of which many have outperformed the benchmarks. Thereby, it can be trusted for SIPs. However, investments in any SIP (or even via lump sum payment in a fund scheme) depends on the performance of the mutual fund you are investing, apart from your risk tolerance and investment horizon. One must keep in mind that SIPs are generally used for equity funds and these can be volatile in terms of market risks.

List of Top Performing SBI Mutual Funds for SIP Investment

| Fund Name | 1 Year | 3 Year | 5 Year |

| SBI Focused Equity Fund | 19.44% | 16.16% | 12.90% |

| sbi consumption opportunities fund | 6.39% | 16.82% | 11.98% |

| SBI Equity Hybrid Fund | 15.62% | 12.90% | 11.42% |

| SBI BlueChip Fund | 12.68% | 12.51% | 10.52% |

| SBI Magnum Equity ESG Fund | 15.96% | 13.49% | 10.27% |

| SBI Large & Midcap Fund | 9.07% | 12.64% | 10.19% |

| SBI Magnum Global Fund | 10.42% | 10.37% | 9.33% |

| sbi technology opportunities fund | 9.26% | 17.32% | 8.63% |

| SBI Short Term Debt Fund | 11.10% | 7.69% | 8.58% |

| SBI Banking & Financial Service Fund | 24.92% | 22.51% | – |

Also Read:

HDFC SIP Plans

Kotak SIP Plans

Reliance SIP Plans

Axis SIP Plans