You should not worry about short term volatility when making equity investments. That said, in the short term, rupee depreciation does impact certain mutual funds and it is important to know which funds these are, in such a situation. The following are the top equity investment to avoid during rupee depreciation:

Schemes with International Equity Exposure

These are domestic mutual funds that invest in international equities i.e. stocks of companies that domiciled outside of India. The potential returns of these schemes are derived from a combination of two factors – performance of the market in which the mutual fund has invested and movement of currency rates. The depreciation of rupee value has a positive impact on the returns of these schemes hence their returns will see an upward movement at least in the short term.

Though these might seem to be lucrative investments on the basis of short term returns data, investing in them during the current rupee meltdown can decrease potential returns for an investor. This is because these schemes could be overvalued due to the short term surge in their NAV. So it might be a good idea to steer clear of these schemes at the moment.

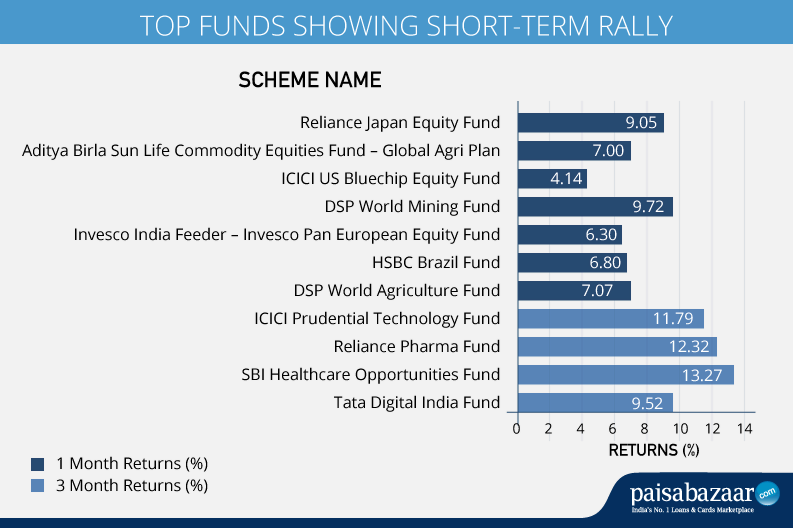

Top schemes to watch out for in the international equities category include the following*:

| Scheme Name | 1 Month Returns (%) | 3 Month Returns (%) | 1 Year Returns (%) | 3 Year Returns (%) |

| Reliance Japan Equity Fund | 9.05 | 12.33 | 23.16 | 11.75 |

| Aditya Birla Sun Life Commodity Equities Fund – Global Agri Plan | 7.00 | 7.63 | 9.10 | 10.73 |

| ICICI US Bluechip Equity Fund | 4.14 | 10.64 | 28.73 | 17.99 |

*The returns data is based on market closing values on 26th September, 2018.

International Fund of Funds

Fund of funds (FoFs) are schemes that invest primarily in units of other mutual funds. International fund of funds invest primarily in units of one or more international mutual funds. Thus, these schemes provide you indirect exposure to international equities and the impact of rupee devaluation in the short term is similar to that of international equities i.e. higher short term returns.

Some funds to watch out for in the international FoFs category include the following*:

| Scheme Name | 1 Month Returns (%) | 3 Month Returns (%) | 1 Year Returns (%) | 3 Year Returns (%) |

| DSP World Mining Fund | 9.72 | 3.23 | 13.65 | 21.86 |

| Invesco India Feeder – Invesco Pan European Equity Fund | 6.30 | 7.86 | 13.29 | 10.71 |

| HSBC Brazil Fund | 6.80 | 7.92 | -10.55 | _ |

| DSP World Agriculture Fund | 7.07 | 9.95 | 13.02 | 10.73 |

*The returns data is based on market closing values on 26th September, 2018.

Thematic Schemes of Export-oriented Industries

Currency valuation changes can significantly impact international trade. As the rupee depreciates, Indian imports such as crude oil and gold become more expensive, while Indian exports such as IT, pharmaceuticals and agricultural products grow more competitive globally. It should therefore come as no surprise that IT and pharma funds are trending upwards as the rupee depreciates.

The following are some of the key schemes to look out for in the thematic segment:

| Scheme Name | 3 Month Returns (%) | 1 Year Returns (%) | 3 Year Returns (%) |

| ICICI Prudential Technology Fund | 11.79 | 52.08 | 13.72 |

| Reliance Pharma Fund | 12.32 | 25.09 | 2.60 |

| SBI Healthcare Opportunities Fund | 13.27 | 6.18 | -3.50 |

| Tata Digital India Fund | 9.52 | 63.83 | _ |

*The returns data is based on market closing values on 26th September, 2018.

Things to remember when Investing in International Fund

The following are a few things you need to remember when investing in international funds:

- International funds are rupee denominated in i.e. the purchase can made in local currency, instead of foreign currency purchases.

- These schemes allow you to gain exposure to foreign markets without need to perform direct equities trading on foreign stock exchanges.

- International fund investments and redemptions work the same way as any domestic mutual fund.

- Some international funds feature a longer redemption time as compared to other funds, so do check this prior to making your investment.

- International equity fund investments (including international FoFs) are taxed similar to debt schemes. You should check details of debt fund taxation rules in order to estimate your gains better.

What about everyone else?

It is always important to bear in mind that you are an investor, not a trader. So short term volatility must not make you panic. The following are our suggestions:

- Short term volatility represents an opportunity to purchase units of schemes such as diversified funds at comparatively reasonable valuations.

- In case you are already invested in other equity schemes, do not redeem out of panic. Holding on to the units increases you opportunity of generating long term capital appreciation.

- In case you have an existing SIP in place, do continue with your contributions. Short term volatility doesn’t last for long but long term returns from systematic investments can last a lifetime.

- Take the help of a certified financial planner in case you are unsure what type of mutual fund will work best for your unique requirement.

- In case you aren’t investing yet, start today as the longer your money stays invested, the more you stand to gain in the long term.