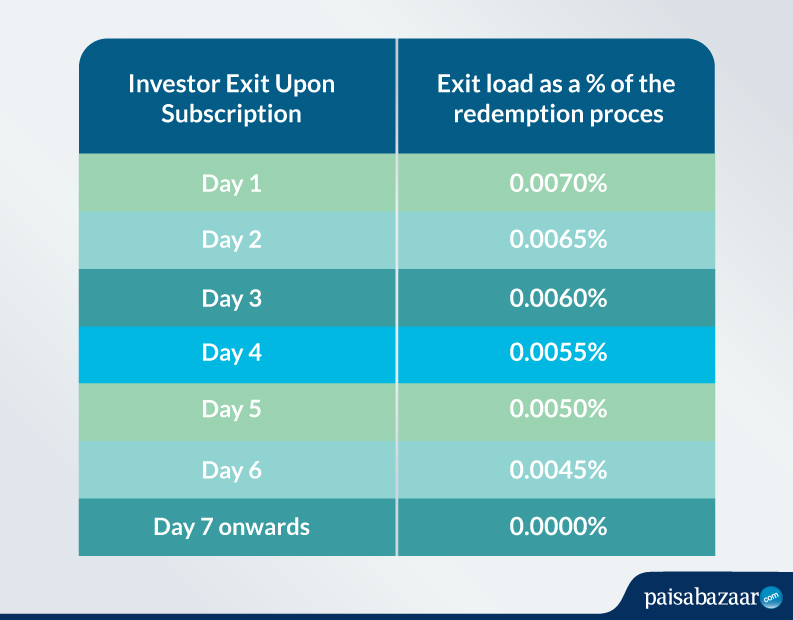

End of last month (October 2019) SEBI (Securities and Exchange Board of India) finalised and announced a new graded structure for exit loads on Liquid Funds. SEBI had earlier sent a letter to AMFI (Association of Mutual Funds in India) on October 11th putting forward the new plan. The exit load will apply to investors-both retail and institutional-if they redeem their investments before 7 days, and be reviewed annually by AMFI.

What is the New Exit Load on Liquid Funds?

Why the New Exit load?

The key aim of the graded exit load on liquid funds is to protect the interests of fund houses and retail investors who suffered from institutional investors redeeming their funds early, which could have led to a liquidity crunch.

Several fund managers had reported that at least 30% of the amount invested into liquid funds was being redeemed before the seventh day, on a regular basis. The trend had worried Asset Management Companies on account that it affected AUMs and left smaller retail investors vulnerable.

SEBI and fund managers hope the new exit load structure for the first seven days will encourage corporates and other large-scale investors to use overnight funds instead of liquid funds to park their surplus cash in.

How Does the Graded Exit Load Affect You?

As a retail investor the new structure for exit loads should not have a significant impact on your investment or redemption pattern. The move itself was made to protect investments by consumers like you and hence the proposed exit load should not act as a deterrent for individual investments in liquid funds.

For example, an exit load of 0.00070% on a Rs 10 lakh investment when redeemed in one day will amount to Rs 7, which is negligible if you need the amount in emergencies. The Exit Load continues to decrease and falls to 0% on the seventh day and henceforth.

This exit load may, however, run into lakhs of rupees when institutions redeem their investments which they park here for better cash management of surplus. SEBI now hopes that the new exit load structure and annual review of fees by AMFI will push organisations to choose overnight funds instead and deter their exit from schemes.

Should you Invest Elsewhere?

The simple answer, no. As a retail investor you are not expected to be investing crores of rupees into liquid funds. As earlier mentioned this exit load structure has been put in place to check the volatility in the inflow and outflow of cash by institutional investors (investors who exit scheme before the seventh day), thus reducing short-term liquidity crunch.

Nonetheless, if you are a new investor and have been lured in by schemes that offer instant redemption facilities or lower redemption charges when only part of the amount is redeemed, you will now have to pay the exit load as listed above.