Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

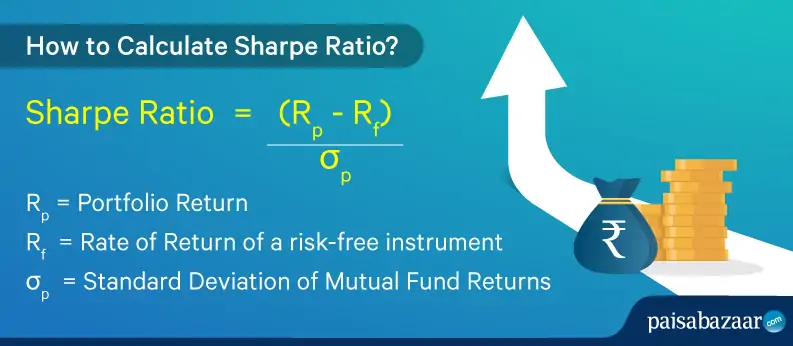

Generally, a mutual fund’s performance is judged based on its historical returns. However, past years’ returns of a scheme tell only half of the story and are not entirely indicative of the future returns. It is important to know the risk profile of various mutual fund’s schemes and then invest accordingly. One of the quantifiable variables used to assess the returns delivered by a fund for each unit of risk taken, is Sharpe Ratio.

Table of Content:

Sharpe Ratio gives an overview of the risk-adjusted performance of a mutual fund scheme. Risk-adjusted returns refer to the returns generated above the returns delivered by a risk-free asset.

This ratio tells investors how better the fund has performed when compared to the performance of risk-free instruments such as government bonds or bank fixed deposits.

Also Check: How to Calculate Information Ratio

Q.1: What does a negative Sharpe ratio mean?

Ans: Sharpe Ratio shows negative results when the investment returns are lower than the risk-free rate. However, a negative sharpe ratio does not completely denote anything. There can be two cases, either the risk-free rate is greater than the portfolio returns or the portfolio returns are expected to be negative. The higher the sharpe ratio, the better is the risk-adjusted performance.

Q.2: What is the difference between the Sharpe ratio and the information ratio?

Ans: Information Ratio is a tool used to measure the performance of an investment as compared to its benchmark with risk-adjusted returns over a period of time. On the other hand, Sharpe Ratio helps to measure the risk-adjusted returns of a mutual fund scheme.

Q.3: What is a good information ratio for a mutual fund?

Ans: 0.4 to 0.6 is a good information ratio for any mutual fund. And, if it is greater than 0.61 to 1.00, it is considered as a great investment option.