Short Duration Funds (SDFs), Ultra Short Duration Funds (USDFs), Liquid Funds and Fixed Income Investments are mutual funds suited for risk averse investors. Fixed Income Investments include Exchange Traded Funds (ETFs), Debt Funds, Money Market Funds and Bank Deposits. Short Duration, Ultra Short Duration and Liquid Funds are classified under debt funds that have different maturity periods or Macaulay Duration. All these invest in Corporate/Government/PSU bonds, non-convertible debentures, certificates of deposit, treasury bills, commercial papers and bank deposits.

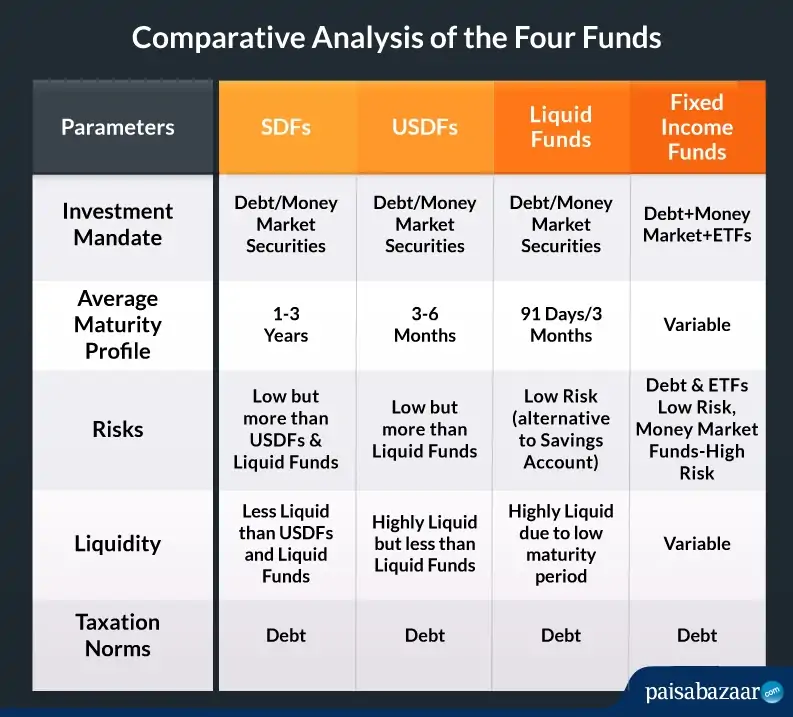

Comparative Analysis of the Four Funds

What are Short Duration Funds?

These are open-ended debt schemes with relatively low returns, but involve low risks with average maturity of 1 to 3 years. As Debt Funds, they invest in debt and money market securities and have associated credit risk and interest rate risk. Credit risk is when the issuer of the bond or other debt securities defaults on timely payment whereas the interest rate risk refers to the change in interest rates that leads to the fluctuation of the bond prices. Short Duration Funds carry higher risks due to the longevity of its Macaulay Duration in comparison to the Ultra Short Duration or Liquid Funds.

However, they are less sensitive to inflation, suitable for conservative investors seeking stability and better tax adjusted returns than Bank Fixed Deposits (FDs). It is also easily convertible to cash.

Read more about Short Duration Funds

What are Ultra Short Duration Funds?

Ultra Short Duration Funds are mutual funds investing in fixed income securities that mature within 3 to 6 months. They are highly liquid and carry low risks. Due to the short maturity duration, they carry low interest rate risks. Investors with low risk appetite who seek a regular income or a safe alternative to bank deposits can invest in these schemes.

It provides fixed returns to the investors. You can take advantage of rate changes and low yields. They are similar to Liquid Funds and hence was earlier known as Liquid Plus Fund.

Know more: What are Ultra Short Duration Funds

What are Liquid Funds?

Liquid Funds are debt mutual funds that offer fixed returns and have short term maturity periods of only 91 days. It is one of the safest and most liquid investments. One added advantage is that Liquid Funds generally have zero exit load. It is suitable for short term financial goals for upcoming 3-4 months where investors can earn decent returns by parking their idle money in Liquid Funds.

Also Read: Definition, Benefits and Taxation of Liquid Funds

What are Fixed Income Funds?

Asset Allocation of Fixed Income Funds are in fixed income instruments i.e. the debt instruments offering fixed interest income on investments. Fixed Income Securities include debt instruments, bonds, bank deposits, recurring deposits, treasury bills and so. Investment in Fixed income Funds assures stability even as it is not exposed to high risk as equity and derivatives are. It is liquid and a reliable asset investment as it aims for regular income generation through stable returns and not capital appreciation. Fixed Income is an umbrella term that includes Liquid Funds, SDFs and USDFs as all three are Debt Funds which is itself a type of Fixed Income Fund.

Learn more about Fixed Income Investments

Which one to choose?

The choice depends mainly on the investor’s financial goal as well the time duration s/he wants to stay invested. You can compare the following parameters:

- All these funds are suited for investors with low risk appetite and who are seeking better returns than savings accounts or fixed deposits

- If one has to invest money for a very short duration and wants to achieve optimum returns on it then one can go for Ultra Short Duration Funds or Liquid Funds.It is suggested for an investor to have a portfolio containing mix of both USDFs and Liquid as the former provides higher returns and the latter is relatively more liquid, less risky and has shorter maturity

- If an investor wants a slightly longer periods and seek stable returns from less risky investment ventures, then they can opt for Short Duration Funds (SDFs)

- Fixed Income Funds help diversify the portfolio and can yield returns even in fluctuating markets. ETFs are considered to be an ideal Fixed Income Fund as they are listed in indexes like Sensex or Nifty, function like equities and are traded in the cash market on a daily basis while Money market instruments are highly exposed to market fluctuation and thus suitable for short term investors

- If a company goes bankrupt, then lenders hold a priority over stock holders. Fixed Income Securities

- One can also consider the CRISIL ratings so as to assure the credit quality of the debentures the fund is invested in