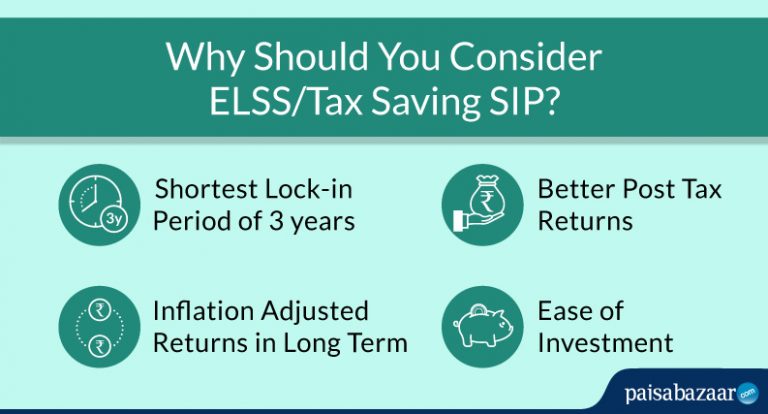

Equity Linked Saving Schemes (ELSS) are a type of mutual funds that come with a statutory lock-in period of 3 years and are eligible for a tax deduction of up to Rs. 1,50,000 under section 80C of the Income Tax Act.

You can invest in any mutual fund via two modes – either by making a lump sum investment or by starting a systematic investment plan (SIP). A SIP allows investors to invest a fixed sum in a mutual fund scheme at fixed intervals.

Get Your Free Credit Report with Monthly Updates Check Now

Under a SIP, a fixed amount is deducted from your savings account on a daily/monthly/quarterly/semi-annually basis and the amount is invested in the chosen mutual fund schemes. Here are the top 5 tax saving SIPs.

| Scheme Name | Latest NAV | 1Y Return | 3Y Return | 5Y Return |

| Aditya Birla Sun Life Tax Relief ‘96 | 33.96 | 6.65% | 13.28% | 11.14% |

| Axis Long Term Equity Fund | 51.71 | 15.32% | 16.74% | 12.35% |

| DSP Tax Saver Fund | 53.34 | 16.67% | 12.57% | 11.82% |

| IDFC Tax Advantage Fund | 58.23 | 4.11% | 12.23% | 10.07% |

| Mirae Asset Tax Saver Fund | 19.73 | 16.59% | 18.26 | – |

{Data as on December 10, 2019; Source: Value Research}

1. Aditya Birla Sun Life Tax Relief ‘96

Inception Date: March 1996

Fund Manager: Mr. Ajay Garg (since 2013)

AUM: ₹9,814 crore

Fund Category: Equity: ELSS

Fund Benchmark: S&P BSE 200 TRI

Expense Ratio: 1.06% (Direct)

| Returns | 1 Year | 3 Year | 5 Year |

| Trailing Returns | 6.65% | 13.28% | 11.14% |

| Category Average Returns | 10.15% | 11.49% | 9.13% |

| Benchmark Returns (S&P BSE 200 TRI) | 10.77% | 13.13% | 9.12% |

{Data as on December 10, 2019; Source: Value Research}

Aditya Birla Sun Life Tax Relief ‘96 is a veteran tax saving mutual fund scheme which is present in the ELSS category for nearly 23 years. The scheme has performed impressively well in the last 5 year period.

It generated a return of 11.14% during the last 5 year period, nearly 2% more than its category average and its benchmark. Aditya Birla Sun Life Tax Relief ‘96 is a relatively aggressive scheme that has invested around half of its assets (44.22%) in mid-caps. The scheme has a large-cap holding of around 44% and small-cap holding of around 11%.

In the sector-wise allocation of funds also, the scheme follows an aggressive approach as it has given a higher weightage to consumption-driven sectors than defensive sectors. The scheme is a good pick in the tax saving funds category considering its impressive performance over the long term and the experience of its fund manager who has been managing the scheme for the last 6 years.

A Good Credit Score ensures you manage Your Finances Well Check Score

Also Read : Best ELSS Funds to Invest

2. Axis Long Term Equity Fund

Inception Date: December 2009

Fund Manager: Mr. Jinesh Gopani (since 2013)

AUM: ₹21,492 crore

Fund Category: Equity: ELSS

Fund Benchmark: S&P BSE 200 TRI

Expense Ratio: 0.92% (Direct)

| Returns | 1 Year | 3 Year | 5 Year |

| Trailing Returns | 15.32% | 16.74% | 12.35% |

| Category Average | 10.15% | 11.49% | 9.13% |

| Benchmark Returns (S&P BSE 200 TRI) | 10.77% | 13.13% | 9.12% |

{Data as on December 10, 2019; Source: Value Research}

Axis Long Term Equity Fund is a 9-year-old ELSS fund which featured a staggering AUM (Assets Under Management) of ₹21,492 crore, ending September. It has provided returns better than its category average during all the above-mentioned tenures – 1 year, 3 years, and 5 years.

The scheme has also outperformed its benchmark during the last 1 year, 3 year and 5 year framework. It is a relatively conservative scheme as it has invested around 76% of its assets in large caps and another 23% in mid-caps. However, in the sector-wise allocation of funds, the scheme has invested the majority of its assets in consumption-driven sectors than defensive sectors.

Axis Long Term Equity fund which is being managed by Mr. Jinesh Gopani since 2013 is an attractive ELSS pick that is capable of generating superior returns and features a strong portfolio.

3. DSP Tax Saver Fund

Inception Date: January 2007

Fund Manager: Mr. Rohit Singhania (since 2015)

AUM: ₹6,186 crore

Fund Category: Equity: ELSS

Fund Benchmark: Nifty 500 TRI

Expense Ratio: 0.85% (Direct)

| Returns | 1 Year | 3 Year | 5 Year |

| Trailing Returns | 16.67% | 12.57% | 11.82% |

| Category Average | 10.15% | 11.49% | 9.13% |

| Benchmark Returns (S&P BSE 500 TRI) | 9.51% | 12.33% | 8.77% |

{Data as on December 10, 2019; Source: Value Research}

DSP Tax Saver Fund is a 12-year-old fund which has been in the space since 2007. The scheme has outperformed its category average during both 3 year and 5 year periods. It has also given returns better than its benchmark in all the 3 periods – 1 year, 3 year and 5 year.

DSP Tax Saver fund is slightly conservative in its asset allocation. It has around 73% of its assets invested in large caps, around 17% in mid-caps and 8% in small caps. As far as the sector-wise allocation of funds is concerned, the scheme has given maximum exposure to the Financial sector (37.24%), followed by Energy (15.08%) and Construction (8.47%).

The scheme’s fund manager, Mr. Rohit Singhania has been at the helm since 2015. DSP Tax Saver is a good ELSS pick that has given extraordinary returns by outperforming its benchmark and category average from time to time.

Get Free Credit Report with Complete Analysis of Credit Score Check Now

4. IDFC Tax Advantage Fund

Inception Date: December 2008

Fund Manager: Mr. Daylynn Gerard Paul Pinto (since 2016)

AUM: ₹2,053 crore

Fund Category: Equity: ELSS

Fund Benchmark: S&P BSE 200 TRI

Expense Ratio: 1.11% (Direct)

| Returns | 1 Year | 3 Year | 5 Year |

| Trailing Returns | 4.11% | 12.23% | 10.07% |

| Category Average | 10.15% | 11.49% | 9.13% |

| Benchmark Returns (S&P BSE 200 TRI) | 10.77% | 13.13% | 9.12% |

{Data as on December 10, 2019; Source: Value Research}

IDFC Tax Advantage Fund is a decade old fund that is being managed by Mr. Daylynn Gerard Paul Pinto since 2016. It has given higher returns than its category average during the 5 year period.

IDFC Tax Advantage fund has outperformed its benchmark during the 5 year periods. It is a relatively aggressive ELSS as it has allocated around 48% of its assets to large-cap stocks, 25% to mid-caps and the remaining 27% to small caps.

In the sector-wise allocation also, the scheme maintains an aggressive stance as cyclical investments weigh more than defensive investments in its portfolio. The scheme is a good pick for investors who wish to invest in a relatively aggressive scheme which has demonstrated its ability to provide superior returns.

5. Mirae Asset Tax Saver Fund

Inception Date: December 2015

Fund Manager: Mr. Neelesh Surana (since 2015)

AUM: ₹2,671 crore

Fund Category: Equity: ELSS

Fund Benchmark: S&P BSE 200 TRI

Expense Ratio: 0.30% (Direct)

| Returns | 1 Year | 3 Year |

| Trailing Returns | 16.59% | 18.26% |

| Category Average | 10.15% | 11.49% |

| Benchmark Returns (S&P BSE 200 TRI) | 10.77% | 13.13% |

{Data as on December 10, 2019; Source: Value Research}

Mirae Asset Tax Saver Fund is a relatively new entrant in the ELSS category which got launched in December 2015. However, even in the short span of time, the scheme has made an entry in the top 5 ELSS funds with his extraordinary performance.

It generated a return of 18.26% during the last 3 year period, nearly 7% more than its category average and around 5% more than its benchmark. The scheme has placed its maximum assets (71%) in large-cap stocks, thereby adopting a relatively conservative stance. The mid-cap and small-cap holdings of the scheme are 24% and 5% respectively.

The scheme has given maximum exposure to the Financial sector (36.63%), followed by Energy (11.90%) and FMCG (9.93%). Mirae Asset Tax Saver fund is one of the must have tax saving schemes which is capable of giving highly impressive returns.

Here are the top 10 tax saver SIP Plans to Invest:

| Fund Name | 1 Year Returns | 3 Year Returns | 5 Year Returns |

| ICICI Prudential Bluechip Fund | 11.90% | 13.17% | 9.20% |

| DSP Tax Saver | 17.40% | 13.08% | 11.17% |

| Franklin India Equity Fund | 6.50% | 9.03% | 7.90% |

| ICICI Prudential Value Discovery Fund | 3.40% | 6.08% | 6.32% |

| Axis Long Term Equity Fund | 16.48% | 17.05% | 12.01% |

| Nippon India Tax Saver (ELSS) Fund | 1.04% | 4.04% | 2.86% |

| DSP Equity Opportunities Fund | 14.96% | 12.53% | 11.06% |

| Motilal Oswal Long Term Equity Fund | 15.31% | 14.61% | – |

| Aditya Birla Sun Life Pure Value Fund | -7.01% | 2.26% | 4.51% |

| HDFC Equity Fund | 9.01% | 11.50% | 7.06% |