What Does Investment Mean?

Investment is a process of allocating money to different financial instruments with the goal of earning good returns in the future. There are numerous investment vehicles such as mutual funds, equities, debt securities, etc available in the market for investors. Some of these investments are riskier as compared with others. Before investing in different types of investment avenues, it is imperative for investors to know their financial goals and assess risk appetite.

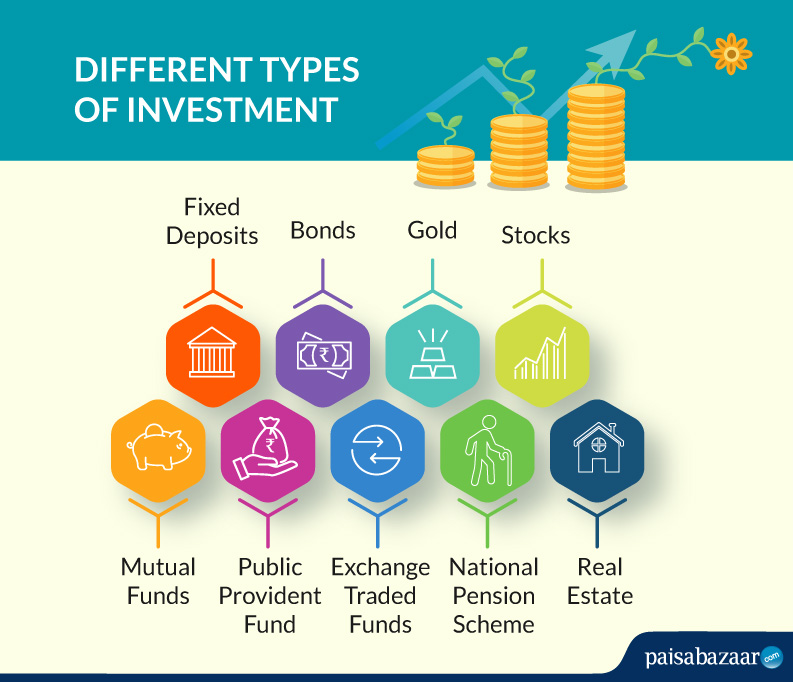

Let’s look at the various modes that people invest in.

What are the Different Types of Investment?

1. Fixed-rate Investment Instruments: These financial instruments give fixed returns over a period of time. They are considered a low-risk investment as chances of default by the issuer/bank/government are negligible. Below is a list of some of the best fixed-income investment instruments:

- Bank Fixed Deposits

The most common type of investment vehicle in India is Bank Fixed Deposits (FDs). It offers fixed interest rate on your principal amount. Almost all scheduled banks in India offer this investment option. You can visit a branch of the bank or use net banking to open a FD account.

With guaranteed fixed returns and flexible maturity periods, fixed deposit is the most sought after investment avenue. An investor makes a lump-sum deposit and earns interest at a rate which is greater than that of a savings account.

This lump-sum deposit plus interest accrued is withdrawn at maturity. Different banks offer fixed deposits investments with different maturities. In case of emergencies, an investor can also withdraw his/her money before the maturity ends, by paying a small amount of penalty. This penalty amount also differs from bank to bank.

- Public Provident Fund

Public Provident Fund is another fixed income savings scheme started by Government of India. Under this scheme, the interest on your principal investment is paid by the government.

Facilities such as withdrawal and extension of maturity are available in a PPF account. You can also avail loan backed by your PPF account. Typically, a PPF account has a maturity period of 15 years which can be extended further.

PPF account also has tax benefits. Investment upto ₹1,50,000 is tax deductible and interest earned on this amount is also tax-free. This is the USP of PPF account which has attracted numerous investors throughout its lifetime.

- Bonds

Bonds is another fixed-income instrument which yields returns at a fixed rate of interest. In essence, it is a loan which an investor lends to the issuer of the bonds. These issuers can be corporate firms or the Government of India. They issue bonds to raise funds to finance their operations or expand their business.

Bonds are another low-risk investment option as the chances of the issuer party to default on payments are miniscule.

2. Market- Linked Investment Instruments: Returns from these instruments are directly related to market fluctuations. If the company where any investment has been made performs well, the returns will be significant. Being sensitive to movements in the market makes them a relatively riskier investment compared to other investment avenues. Here is a list of some popular market-linked investment instruments.

- Stocks

Stocks refer to equity investment made in any company. When you buy stocks of a company, you are in essence taking partial ownership of that specific company.

An individual need to have in-depth knowledge of financial markets to actually benefit from investment in equities. Since returns from this investment are wholly dependent on market fluctuations, it is considered the riskiest investment option compared to other alternatives.

To invest in stocks, you need to have a demat account which can be opened online or through a broker. Trading of stocks takes place on various stock exchanges where an investor can buy and sell shares as per their profit-maximising strategy.

- Mutual Funds

Mutual fund investment is one of the best investment options available in the market right now. Mutual Funds pool in resources from multiple investors and invests in various financial instruments including equities, debt securities, venture capital etc.

It is an apt investment option for those investors who don’t have the required financial knowledge and sufficient time to study the market. Investors can leverage the knowledge of professional and experienced fund managers to earn significant returns from mutual fund investment.

Investors who don’t have enough money for lump-sum investment, can also opt for Systematic Investment Plan (SIP) which involves regular payment in a mutual fund. This amount can be as low as ₹500.

Also Read : Top 10 ELSS Mutual Funds for SIP to Invest in 2020

- National Pension Scheme (NPS)

NPS is a savings scheme administered and regulated by the Pension Fund Regulatory Authority of India (PFRDA). It pools in money from numerous investors and then invests the corpus in various equity and debt securities.

This saving scheme is especially designed for building retirement corpus. Regular investment throughout your working life is withdrawn partially at retirement and the remaining amount is disbursed as regular pension.

Any indian citizen between the age of 18-60 years can open an NPS account. The maturity of the account happens at the age of 60 years which can be extended till 70 years. Partial withdrawals upto 25% are allowed after 3 years of opening the account.

- Exchange Traded Funds

Exchange Traded Funds are passively managed funds which invest pooled funds in diversified securities taking an index fund as a benchmark. It is a marketable security which can be traded on stock exchanges across the country.

The risk associated with ETFs depends on the type of underlying index. If it is a mid-cap index, then it carries moderate risk. Also, compared to mutual funds, ETFs have a relatively lower asset management fee.

These funds are highly liquid as they can be traded on stock exchanges as per the wishes of the investor.

3. Alternative Investment Instruments: All those financial instruments that don’t feature under fixed-rate and market-linked investment instruments come under alternative investment instruments. Gold and Real Estate are the most common and profitable alternative investment vehicles:

- Gold

Gold is a commodity whose price fluctuation over the years has made it the most reliable investment vehicle. There has been a steady rise in the price of gold in the last decade or two.

It is considered a low-risk investment when viewed from a long-term perspective. An investor should invest some percentage of their total investment amount in gold to hedge themselves against any potential market risk.

- Real Estate

Real Estate Investment refers to any investment made in physical properties such as land, buildings, shops, etc. It involves purchase, ownership and management of the real estate property.

An individual can earn from real estate in two ways. One way is to buy a property and then sell it at a higher price after few years. Another way to generate income on your real estate is to put it up on rent.

An investor should carefully analyse some key factors such as size and locality of the investment property as these factors play a significant role in price appreciation of real estate.

Your investment goals may also change from time to time, however, it is advisable from the perspective of generating a large corpus to remain invested for the long term. If non-availability of finances for investment creates an issue look for options that can yield high returns, you could start a SIP or invest little every month with an instrument of your choice.

1 Comment Comments

Like!! Great article post.Really thank you! Really Cool.