Mutual funds are a great investment option for both beginners as well as experienced investors. Currently, they are the most preferred choice among investors owing to their ability to give inflation-beating returns.

Mutual funds pool money from multiple individuals and institutional investors and invest the collected corpus in a variety of asset classes such as equities, debt and other money market instruments after careful research so as to maximise capital appreciation or generation of income.

There are various types of mutual funds, however, for simplicity, mutual fund schemes can be broadly divided into the following 3 categories on the basis of type of asset classes in which they invest:

- Equity Funds: These are the mutual fund schemes which primarily invest (at least 65% of its assets) in equities i.e. stocks/shares of companies.

- Debt Funds: These are the mutual fund schemes which predominantly invest (a minimum of 65% of its assets) in debt and money market instruments.

- Hybrid Funds: These are the mutual fund schemes which invest in at least 2 asset classes among equity, debt, gold, etc. They can be considered as a combination of the features of an equity fund and a debt fund.

Also Read: Top 10 ELSS Tax Saving Mutual Funds in 2020

A mutual fund is one of the best investment options for long-term investors. It comes with a low cost of investment, has the potential of generating great returns and are managed by a team of professionals. However, like any other investment instrument, they also carry an investment risk.

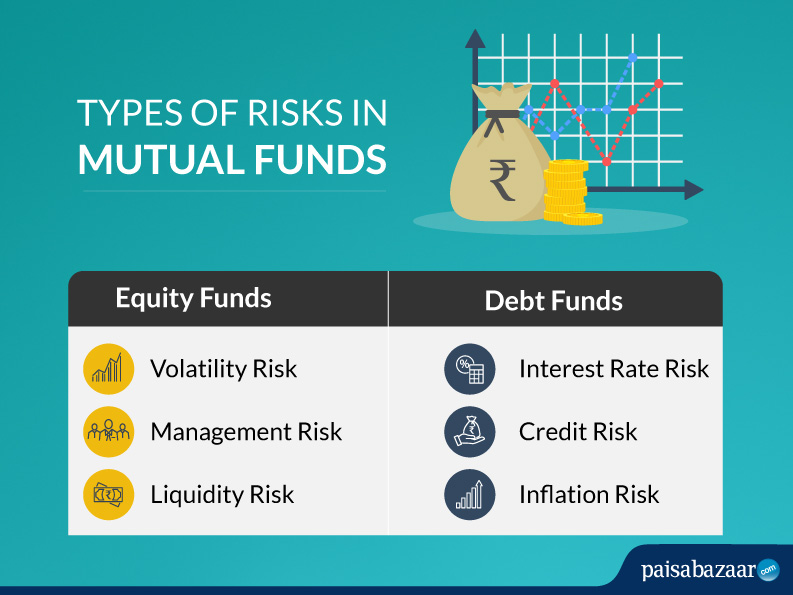

No matter which type of mutual fund you invest in, each features its unique nature of risk including but not limited to volatility risk, performance risk, interest rate sensitivity risk, liquidity risk and credit risk.

The following section discusses all such risks which come with an investment in a mutual fund scheme. A sound knowledge of these risks will not only help an investor in mitigating them to the maximum possible extent but also help in making an informed investment decision.

Risks of Investing in Mutual Funds

Risks of Investing in Equity Mutual Funds

The below are a few key risks involved with investing in equity funds:

Volatility Risk: An equity fund invests primarily in the shares of companies listed on stock exchanges. Thus, the value of an equity fund is directly related to the performance of companies, in stocks of which it has invested. The performance of a company is affected by prevailing macroeconomic conditions. Macroeconomic changes include changes with respect to government, SEBI and RBI policies, consumer preferences, economic cycle, etc. These factors directly impact the price of the stocks of a company either favourably or unfavourably causing either an upward or downward movement in its value of the share.

This movement is in turn reflected in the value of an equity fund. As a general rule, large cap companies are less prone to such volatility as compared to mid cap and small cap companies. Similarly, a diversified equity fund is relatively less prone to getting affected by such volatilities as compared to thematic or sectoral equity funds.

Management Risk: Management of a company refers to the team which is responsible for leading the company in the right direction. Changes in the management team and their actions such as pledging shares, decrease/increase in promoter stake, etc. can affect the price of shares for a company. While policies like good corporate governance and high transparency have a positive impact on a company’s share price, mismanagement, conflicts in the team etc. downgrade the price of a company’s shares.

Liquidity Risk: When it comes to equity investments, investing for the long term has the greatest chance of ensuring profitability of investment. Thus, it is often difficult for equity mutual funds to buy or sell equity investments quickly in order to make a profit or minimise a loss. This may lead to a situation where the scheme does not have sufficient liquidity to meet redemption obligations placed by investors.

Such a liquidity crunch is most commonly observed during situations when a large number of redemption requests are made by investors as a result of a sustained bear run in equity markets. In order to reduce this risk, many equity funds also invest a small portion of their capital in debt and money market instruments to ensure higher levels of liquidity for the scheme.

Risks of Investing in Debt Funds

The following are some of the key risks associated with investing in debt funds:

Interest Rate Risk: Interest rates and the price of a debt instrument are inversely related. When interest rates go up, bonds are perceived to be less lucrative investment options and thus their prices go down. Similarly, when interest rates decrease, bond prices experience a hike. The degree of interest rate sensitivity varies from one type of debt fund to another and is indicated by a debt fund’s modified duration. As a general rule, debt funds which invest in instruments of shorter duration are less prone to interest rate risk as compared to funds invested in longer maturity instruments.

Credit Risk: Debt funds invest in a wide array of debt and money market instruments such as government securities, corporate bonds, certificates of deposit (CDs), commercial papers, etc. The credit worthiness of these investments vary depending on the issuer and are determined by the credit ratings (such as AAA, AA+, AA, AA-, etc) provided to them by credit rating agencies such as CRISIL, ICRA, Fitch, and Brickworks.

Credit worthiness refers to the repayment ability of the issuer of the instrument. A higher rated debt or money market instrument features a higher level of credit worthiness than a low rated instrument.

Inflation Risk: Bonds and money market instruments are mostly fixed rate investments as they feature a fixed coupon rate. Hence, an increase in inflation tends to erode coupon rate based earnings that the debt fund is liable to receive. As a result, increase in inflation makes bonds trade lower on bond markets which adversely impact the potential returns that a debt fund investor is to receive. On the other hand, lower inflation levels tend to push bond prices and debt fund investment values to higher levels.

The Bottom Line

In view of the above risks, it is important to remember that although mutual fund performance is always subject to various risks, every fund house uses a range of strategies to minimise and even eliminate these well-known risks. Therefore, as long as you have invested with a well-known fund house, chosen a fund with a proven track record and made the investment with a long term horizon, your chances of growing your wealth will be high even if your profits from the investment are not guaranteed.

1 Comment Comments

This is truly helpful, thanks.