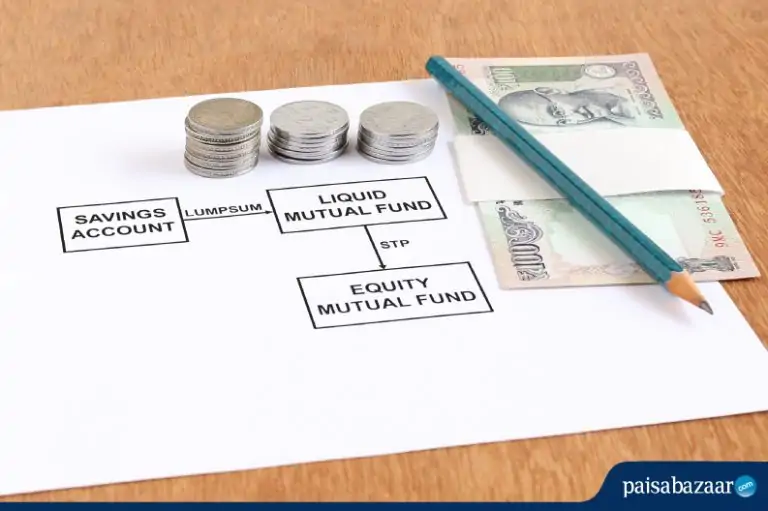

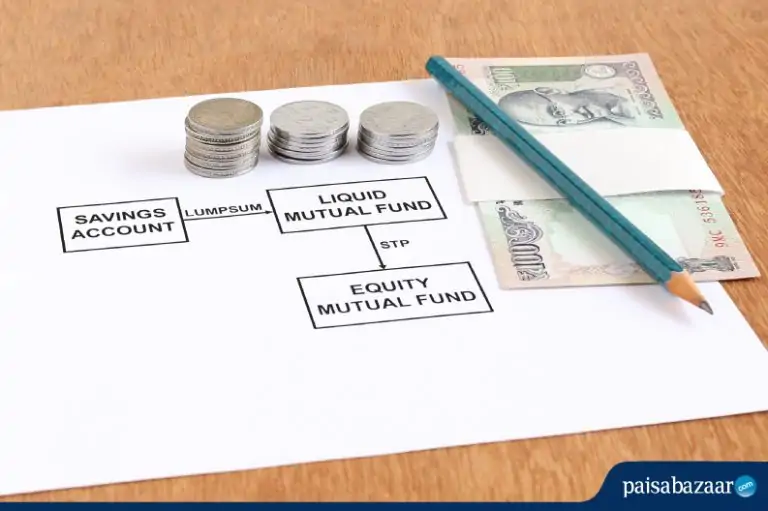

An STP or Systematic Transfer Plan moves a fixed amount of money from one mutual fund to another at regular intervals. For example, an STP can transfer Rs 10,000 each month from Axis Liquid Fund to Axis Bluechip Fund. Typically, an STP is used to transfer money between liquid or debt fund to an equity fund. This averages out an investor’s buying price in the equity fund and reduces his or her risk.

Get Your Free Credit Report with Monthly Updates Check Now

How Does an STP Work?

An STP transfers a fixed amount of money from one mutual fund to another. Your balance in the first fund is reduced and your balance in the second fund is increased. This happens automatically and you do not have to do anything to transfer the money.

An STP is closely related to SIP and Systematic Withdrawal Plan (SWP), two other common techniques of mutual fund investing. A SIP invests a fixed amount in a mutual fund at regular intervals and an SWP withdraws a fixed amount from a mutual fund at a regular interval.

It should be noted that STPs can only transfer money between two mutual fund schemes of the same Asset Management Company (AMC). For example, an STP cannot transfer money each month between Axis Liquid Fund and ICICI Long Term Equity Fund.

Benefits of STP

- Rupee Cost Averaging: An STP averages out an investor’s purchase price and protects him from catching a market high. For example, if the NAV of the fund is Rs 10 in the first month, Rs 8 in the second month and Rs 6 in the third month, an STP will get him an average price of Rs 8. On the other hand, a lump sum in the first month would get him a price of Rs 10.

- Lumpsum Investment: An investor who has obtained a lump sum, say through a bonus at work or from the sale of a property can invest in mutual funds through STPs rather than lump sums. For example, a person who has obtained Rs 50 lakh by selling a house can invest this amount in 1-2 liquid funds which are extremely low risk. From these liquid funds, he can initiate STPs into equity funds over the next 2-3 years. This is less risky than investing the entire Rs 50 lakh on a single day or over a few days.

STP vs SIP: Which one is better to Invest the Lump Sum?

STP indeed works like a SIP mechanism where a fixed amount gets invested in a particular fund. However, if you have a lump sum amount to invest then it is better to invest it through STP. This is because in SIP the amount will be left idle in your bank account or may earn some interest which is significantly lower than what it may earn on a low-risk liquid or ultra short term debt fund. So, it would be better to invest the lump sum in a low-risk debt fund and then schedule an STP to equity funds of your choice.

Also Read : Best SIP Plans to Invest in 2019

Get Free Credit Report with Complete Analysis of Credit Score Check Now

Investing in STPs vs Investing in a Market Correction

Many investors wait for market corrections instead of setting up STPs. Although this approach can yield higher returns, in theory, it may not work in practice. This is because it is impossible to tell how long a correction will run and how deep it will go. Investing in correction amounts to timing the market which is almost impossible to implement successfully.

How to Set up an STP

You need to fill up an STP form and submit it at the office of the concerned mutual fund house (AMC). If you are investing online through an aggregator AMC website, you can fill up this form online. In the STP form, you have to specify the date of the STP, the duration of the STP and the amount of the STP. For example, an STP of Rs 5,000 on the 15th of each month for a tenure of 1 year.

Also Check: SIP vs STP vs SWP

Tax Treatment of STP

The applicable tax on an STP depends on two factors – the type of fund you are transferring from and the length of your holding period. This is because an STP transfer is treated as a redemption and taxed accordingly.

In case of equity funds, transfers within 1 year of purchase will be taxed under the Short Term Capital Gains Tax (STCG) at 15%. Transfers after 1 year, more than Rs 1 lakh will be taxed under the Long Term Capital Gains Tax (LTCG) at 10%.

In case of debt funds, transfers within 3 years of purchase are taxed as per your slab and transfers after 3 years are taxed at 20% after giving you the benefit of indexation. Indexation reduces your tax liability to account for inflation. You can read more about mutual fund taxation here.

Typically, most STPs are from liquid funds and hence taxed at your slab rate. However, the returns/gains in such funds are also around 6-8% and hence the actual tax payable from STPs is not large. Each STP transfer is taken as part capital and part income as per the First-in-First-Out (FIFO) system of accounting.

For example, assume that you have invested Rs 1 lakh in a liquid fund and it has grown to Rs 1.1 lakh in 6 months. You start an STP from the 7th month onwards of Rs 10,000 per month. In this case, roughly Rs 9,000 (90%) of each transfer/STP installment is capital and Rs 1,000 (10%) is capital gains/income. This income component will be taxed at your slab rate. Let’s assume this rate is 20%. In this case, you will have to pay a tax of Rs 200 on every STP instalment.

Checking Credit Report Monthly has no impact on Credit Score Check Now

Exit Load in STP

Exit load is a charge imposed by the mutual fund if you withdraw your money before certain specified intervals – typically 1 year for equity funds. Hence it will apply to STP transfers made before the exit load period as well. However, there is no exit load on liquid funds and most STPs transfer money from a liquid fund to an equity fund, thereby avoiding exit load.

1 Comment Comments

Dear Gaurav ;

i am an NRI , not yet having a demat / trading account; but plan to invest via STP in mutual funds is that possible without opening a demat/trading account ?

i do not have any income source in india .

what will be my tax if i do STP of 10,000/- per month to mutual funds ?

Thanks and regards

Krishna Murari