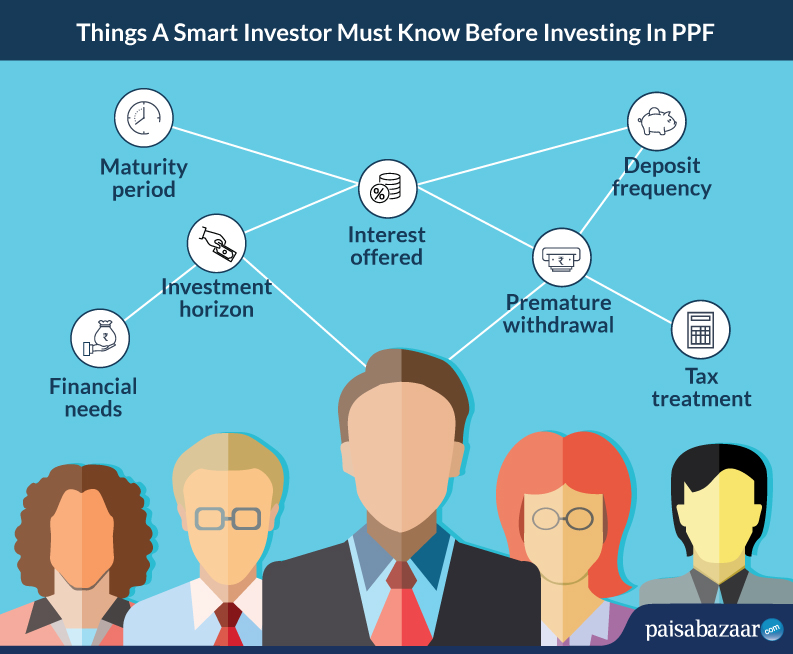

10 Important Things You Should Know Before Investing in PPF

Besides high returns, the safety of investments is what makes a scheme attractive to investors. In both aspects, PPF remains an effective long-term investment scheme. As it is a government-backed scheme, PPF offers safety along with appealing returns. Being a savings scheme exempt from taxes, PPF is especially suitable for self-employed professionals and small businesses which…

Important Points to Consider Before Prepaying Your Home Loan

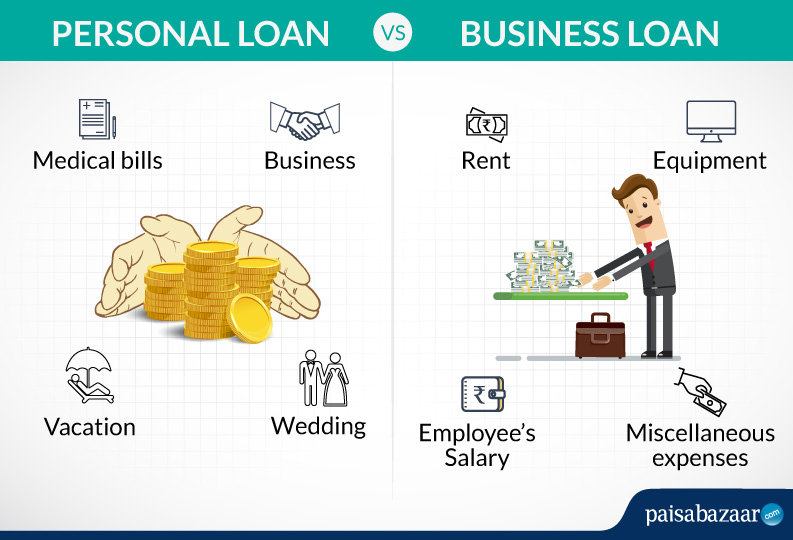

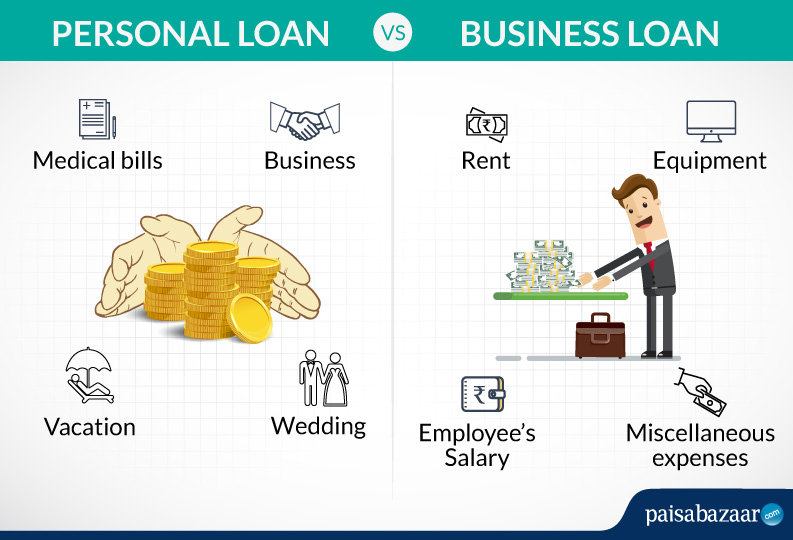

We, Indians, are averse to debt. Therefore, whenever we have surplus funds, we use it to prepay our loans. However, a home loan should not be seen under the same lens as other lending products such as car loan and personal loan. Unlike other loan products, home loan offers a number of benefits, which might…

New ICICI Bank Whatsapp Banking Services: Create FD, Pay Utility Bills

On 15th October 2020, ICICI Bank added new features in its WhatsApp Banking services using which customers can create fixed deposits, pay utility bills, and access trading finance details instantly. The primary objective of launching these services on WhatsApp is to make banking even more convenient and accessible for the customers. This service is available…

How to Avail Home Loan Subsidy Under Pradhan Mantri Awas Yojana?

How to Choose the Right Mutual Fund for Investment?

Amazon Great Indian Festival: Use Credit Cards for Maximum Benefits

Save More on Flipkart Big Billion Days with the Right Credit Cards

How to Prevent Misuse of Aadhaar Card

The Unique Identification Authority of India issues the 12-digit Aadhaar Number to all the residents of India which acts as the proof of identity and proof of address for availing government subsidies and benefits. The Aadhaar Number, however, is not a citizenship certificate but it is imperative to protect the security of Aadhaar and prevent…

Aadhaar Permitted by Telecom Department for Online Verification of Mobile Connections

The Department of Telecom has now allowed the use of Aadhaar Card or Virtual ID for the online verification (e-KYC process) of mobile connections with effect from 29th September 2020. In the e-KYC based process, the Aadhaar Authentication will now be authorized online using the customer’s Aadhaar number or virtual ID and biometrics to provide…