Why you should invest in the NPS now

India’s National Pension System (NPS) has undergone a dramatic overhaul over the past few days. Most of the changes apply to government employees but a key tax change applies to everyone – including private sector employees and the self-employed. This tax reform has made the NPS corpus, completely tax free on maturity, thereby making it…

How to Pay Your LIC Premium from EPF Corpus

Paying LIC (Life Insurance Corporation of India) premium regularly can be a daunting task at times, especially for people belonging to lower income group. However, if you are a salaried individual with an EPF account, you can pay your LIC premium from your EPF corpus. Though the facility has been in place for a long…

Aadhaar-enabled Payment System (AePS) to Continue Functioning

UIDAI, the 12-digit Aadhaar issuing authority, provides a number of facilities to empower the government to carry out tasks of the service delivery system efficiently and without much delay. Aadhaar-enabled Payment System is one such system through which bank account holders can withdraw, deposit and transfer funds from their bank accounts with the help of…

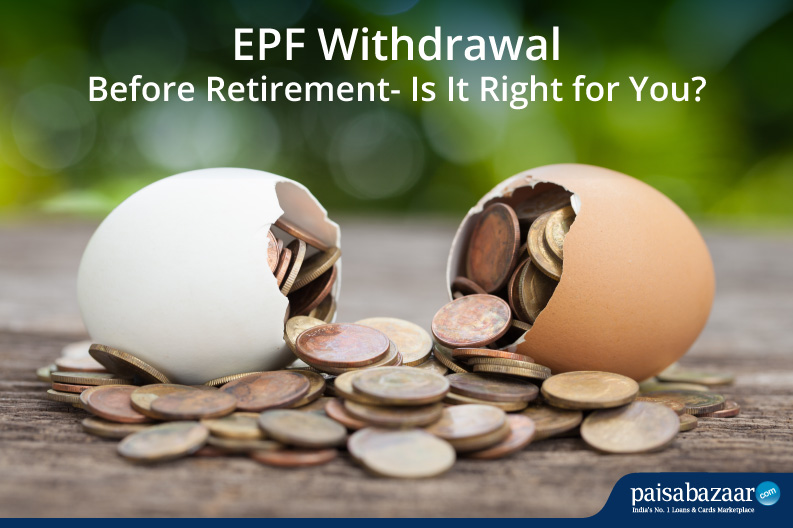

EPF Withdrawal Before Retirement- Is It Right for You?

Employee Provident Fund is basically a retirement fund managed by the Employees’ Provident Fund Organization (EPFO) under the Employees’ Provident Fund and Misc. Act, 1952. Since the private sector employees do not have a dependable pension offering, PF savings play a crucial role in ensuring social and financial security post-retirement. Generally speaking, you can withdraw…

Don’t miss these 7 sources of income while filing Income Tax Return

Note: The information on this page may not be updated. For latest updates, click here. Filing income tax returns (ITRs) is an important step in managing one’s personal finance. One should be vigilant and should not be in a hurry while calculating income tax and filing income tax returns, else one can end up receiving…

Linking PAN with Aadhaar Deadline Extended

In good news for those who had not been able to link their PAN card with Aadhaar, the Central Board of Direct Taxes (CBDT), working under the Central Government has yet again extended the deadline. Taxpayers have now got time till 31st March 2020 to link their PAN cards with Aadhaar. Earlier, the deadline was set…

Baal Aadhaar – Give Your Child the Identity

Here’s How the Union Budget is Making Life Easier through Aadhaar