EPF Transfers To Get Automated Soon

Good news for Employee Provident Fund (EPF) subscribers! From the next fiscal, EPF account holders would not need to file EPF transfer claims while switching jobs as the process would be automated. How EPF Transfers would work from FY 2019-20 According to a senior labour ministry official, Employee Provident Fund Organization (EPFO) is currently testing…

EPFO Complaints : 5 Ways to resolve issues with your Employee Provident Account

EPF subscribers often face confusions regarding operations and services available under the scheme. In order to address, process and resolve the consumer’s issues, the EPFO has formulated various platforms & robust grievance management systems. There are online as well as offline platforms ensuring efficient monitoring of all the complaints. So, if you also have some…

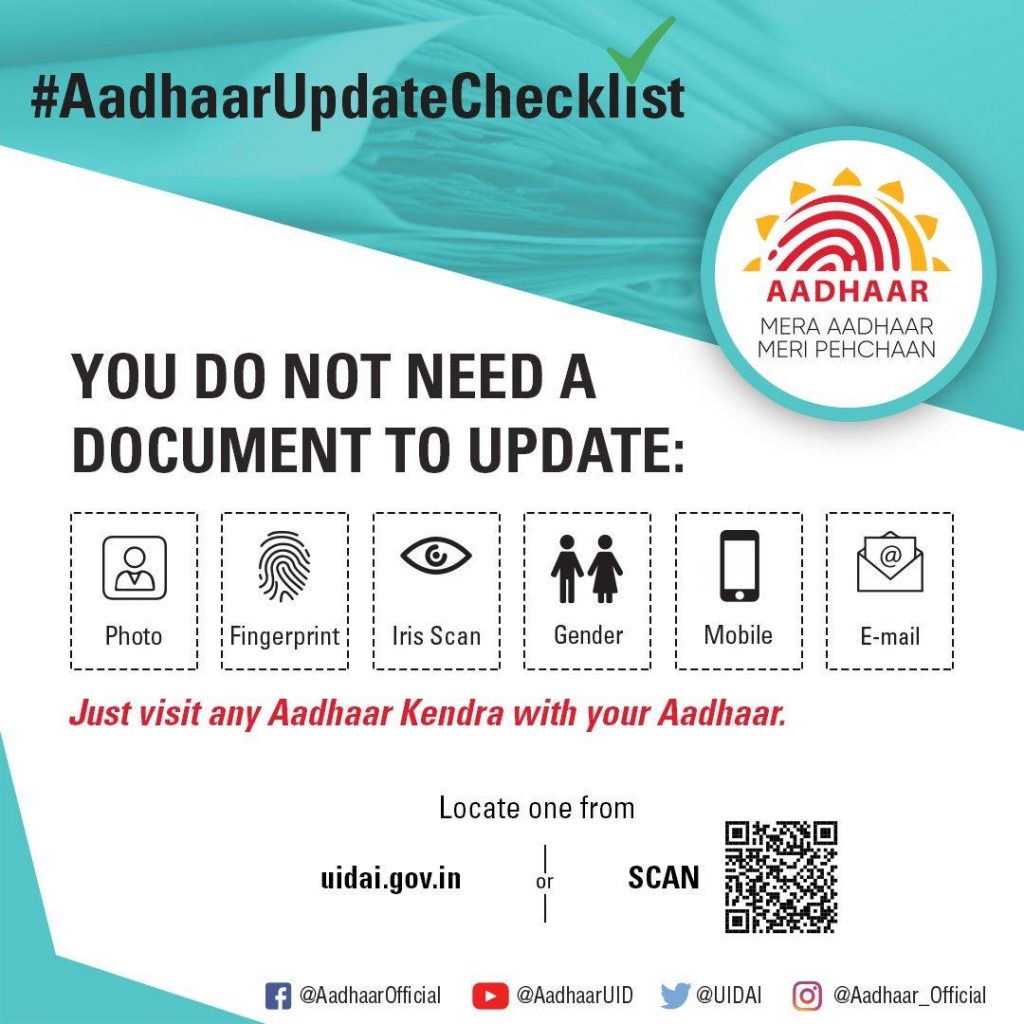

How is Aadhaar Card Generated and Issued to Individuals

Aadhaar Card is a 12-digit unique number issued by the Unique Identification Authority of India (UIDAI) by taking an individual’s biometric and demographic information such as fingerprints, iris scan, and date of birth, address and others. The Indian government has made mandatory for all the residents of India to link Aadhaar Card with that of…

How to Update Address in Aadhar Card without Address Proof

Best NPS Tier 2 Pension Fund Manager

Note: The information on this page may not be updated. For latest information, click here. India’s National Pension System (NPS) Tier 2 account offers a choice between 8 different pension fund managers. It does not have tax benefits or a lock-in for private sector subscribers. For government employees, it has a 3 year lock-in and tax…

DigiLocker – Free Cloud-based Document Storage Platform for Every Indian

Aadhaar Personal Details Update without Documents – How does it work?

Covid 19 :Govt. Declares 3- Month Reduction in EPF Contribution for Companies

On 13th May 2020, the Government announced a reduction in the EPF contribution rate from 24% to 20% of the salary, for private sector firms, for the next three months. As a consequence of this change, it is believed that employees will be able to benefit from a higher take-home salary and employees will be…

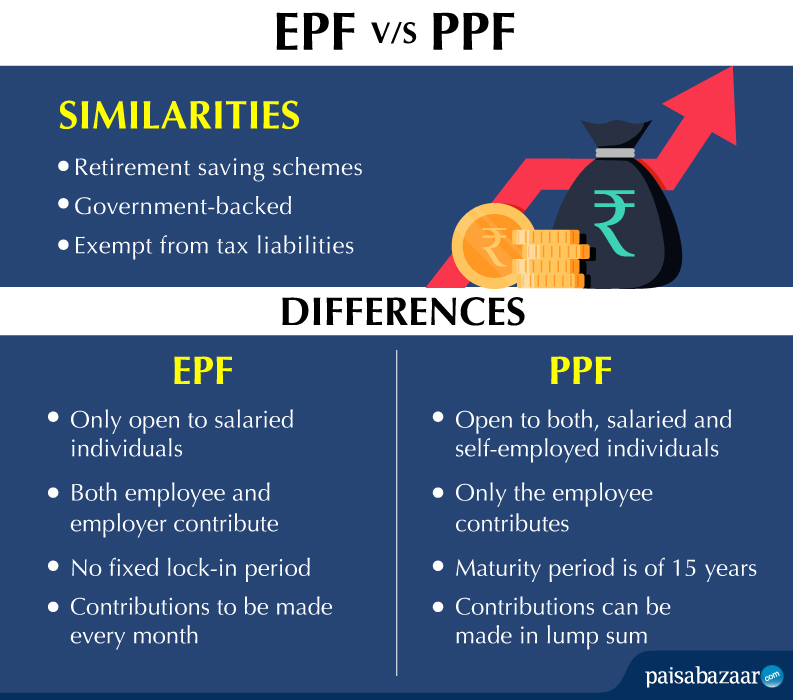

Differences between EPF and PPF that you must know about

Employees’ Provident Fund (EPF) and Public Provident Fund (PPF) are the two most popular retirement saving schemes in India. Since both are government backed and long-term retirement products, there is a lot of confusion among the investors regarding these investment products. Therefore, if you are planning for building a large retirement corpus, it becomes important…