Important Things to Consider before Transferring Your Home Loan

PPF vs FD: Which is Better?

COVID Crisis: Keep your cash handy – Later invest in FD

Your Step-By-Step Guide To Buying a House

For a majority of us, buying a house is a once in a lifetime exercise that we have to get right the first time around. The main reason for this is of course the fact that property investments are substantial and made with a long term perspective in mind.

Merger of 10 Public Sector Banks into 4 Starts Functioning from 1st April

हिंदी में पढ़े The Union Cabinet approved the merger of 10 public sector banks into 4 entities that have become effective from 1st April 2020. After this merger drive, the number of Public Sector Banks has reduced to 12 which was 27 before 2017. “The amalgamation is being done so that customers are able to…

HDFC Diners Club Rewardz Review

The HDFC Diners Club Rewardz Credit Card is one of the best cards if you are looking for some travel and dining benefits. Also, this card provides complimentary services and exclusive offers to you with an extra range of rewards. If you love travelling and wish to avail great dining discounts this card can be the right choice for you. Hence for your help, we have given a detailed review of the card along with some other similar credit cards that might suit your financial requirements.

HDFC All Miles Credit Card Review

HDFC All Miles Credit Card lets you earn reward points on every purchase you make. The accumulated points can then be converted to air miles, which can then be used to book flight tickets in the future. This card accelerates reward earning rate thereby facilitating redemption of rewards for air miles. If you are a frequent traveller, this card can be the right choice for you. Hence to make the decision a lot easier for you, we have given a detailed review of the card that will help to decide if this card suits your needs or not.

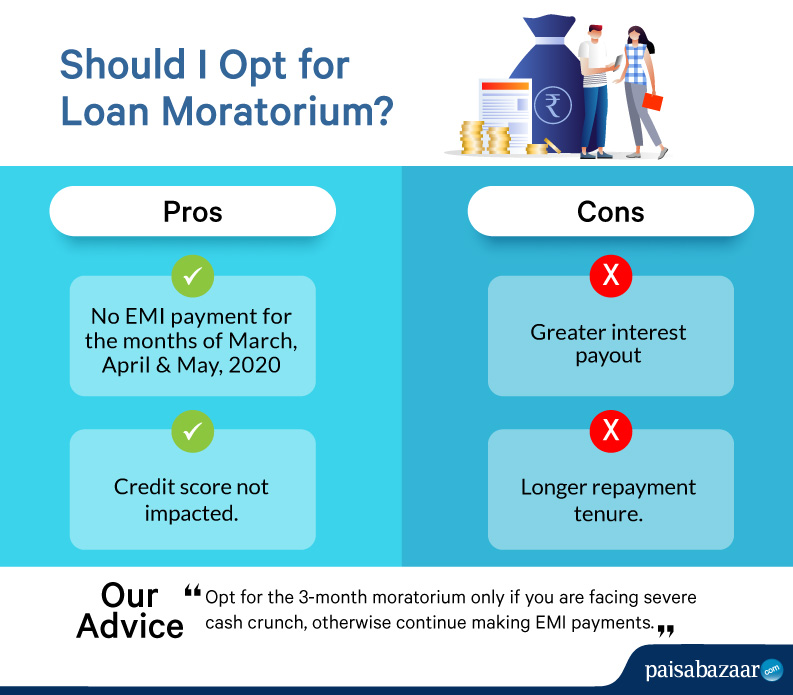

Should you opt for the moratorium on Personal Loans?

हिंदी में पढ़े Amid the widespread panic and resultant losses due to COVID-19 pandemic, Reserve Bank of India permitted all banks and financial institutions to provide a 3-month moratorium on all term loans, including personal loans, as a temporary relief for those severely impacted by the health crisis and the lockdown. What Does the Moratorium…

How to Prepare for a Financial Crisis

Life is uncertain and tough situations can arise anytime. If you want to be prepared financially to face those circumstances, you should plan. With the right preparation and planning, you can prevent a financial crisis from becoming grave and only deal with a temporary setback. Any event like a job loss, illness, market meltdowns, or…