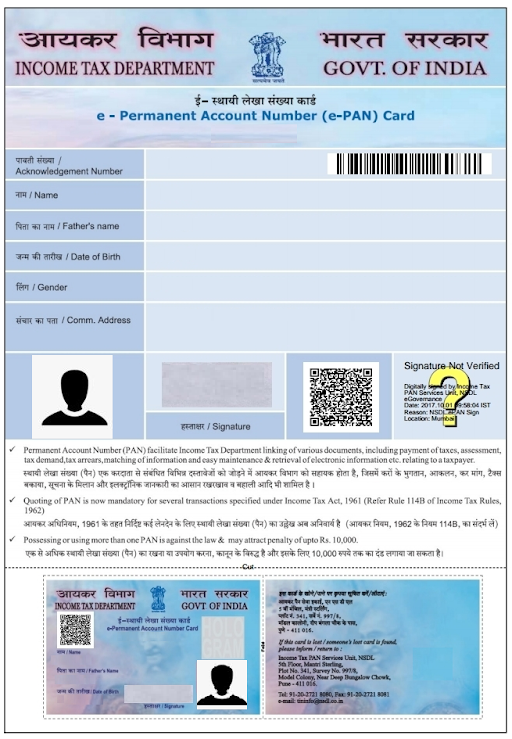

The Income Tax Department has changed the design of the PAN card. It has made a few additions to it to make it more user-friendly and secure. The IT Department has started providing new PAN cards post July 7, 2018. It is worth noting that PAN cards issued prior to the aforementioned date will also remain valid. However, if one wants to issue the new PAN card, he will have to submit an application for reprinting the PAN card online.

6 Comments

I want to make my own pan card please you can help to make it

You can apply for a PAN card online either via the NSDL or UTIITSL website or offline by visiting the nearest PAN center. Moreover, you can also apply for an instant e-PAN via the income tax e-filing website if you have never possessed a PAN card and have a valid Aadhaar card. To know more about the instant e-PAN, click here.

Hi I need old format type of pan card for some Bussiness work but I unable to get in.pls help me I already got order through nsdl website for reprint my pancard but they are sending only new format type of pancard either physically or digital..help me solve it how can I get my old type of pancard?

You can only get the PAN card in new format now.

Hi I have downloaded pan card from E filling link but there is not father name and signature.

I just want to know if there is any problem or is this normal?

Hi Supriya, you can update your father’s name and signature both by visiting NSDL offical website and “Changes or Correction in existing PAN data” and follow the procedure by editing the contact details where you can update your father’s name and for the signature, you can go the paperless way by either uploading the photo of the changed signature or can also upload the digital signature certificate or DSC.