Permanent Account Number or PAN is a 10-digit alphanumeric code that contains all taxable financial history of the cardholder. An individual can have only one PAN card as per the Income Tax laws. The Income Tax Department has deactivated more than 11 lakh duplicate and fake PAN cards. However, there might be instances where a genuine PAN was deactivated. In such cases, you can apply to activate PAN card again but you will have to provide required documents to validate your request for PAN reactivation.

Get Free Credit Report with monthly updates. Check Now

Process to Activate PAN Card

In case your PAN is deactivated by the IT Department, it will be difficult for you to make cash transactions above ₹ 50,000. You will also not be able to login to the e-Filing website or file ITRs. There are a lot of other things which will become nearly impossible for you to do if your PAN card gets deactivated. You can activate PAN card again by following the process mentioned below:

- Write a letter addressing the Assessing Officer (AO) for reactivation of your deactivated card

- Attach the self-attested copy of the deactivated PAN card

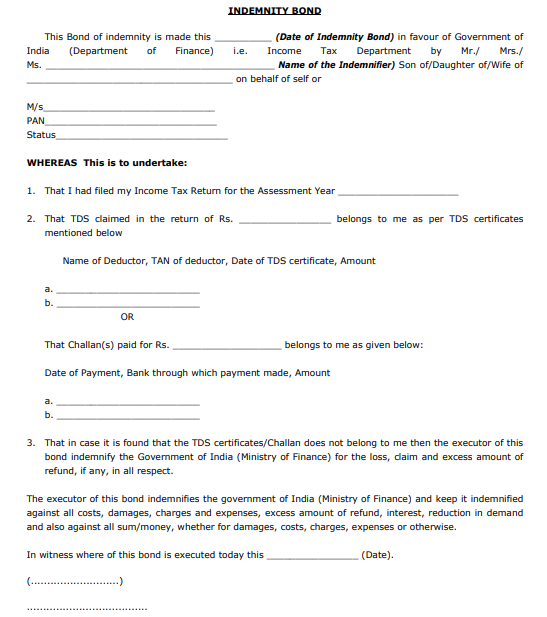

- Fill the Indemnity Bond in favour of the Income Tax Department

- You can also submit the Income Tax Returns filed using the deactivated PAN for the past three years

- Submit the letter and enclosed documents in the regional Income Tax Department office

- It takes around 15 days for the reactivation of the PAN card by the Income Tax Department

How to Deactivate PAN Card

The online process is very easy and hassle-free. Follow the steps mentioned below to deactivate your PAN card online:

- Visit the NSDL portal for PAN applications

- Select the “Changes or Correction in existing PAN Data” from the “Application Type” section

- Submit the application and note the “Token Number”

- Continue filling the form but do not select any ticking boxes (Ticking boxes are selected to make changes in PAN data)

- Now submit the form and e-Sign it using Aadhaar (optional)

- At the end of the form, mention the PAN that you want to retain

- In the next section, mention any or all PAN cards that you want to surrender

- Now submit the application form and make the payment online using a debit/credit card or netbanking

- You have to download the submitted application for future reference

- If you fill the form using the paperless method, you have to e-Sign using Aadhaar OTP method

- If you want to send the documents to NSDL, take the print out of the application and send it to NSDL mentioning “Application for PAN Cancellation” on the envelope

Get Free Credit Report with Complete Analysis of Credit Score Check Now

Reasons for PAN Card Deactivation

There can be various reasons for the deactivation of a PAN card. The Income Tax Department deactivates PAN cards because of the following reasons:

- Duplicate/Multiple PAN Cards – There are instances where an individual is assigned multiple PAN cards. The Income Tax Department deactivates additional PAN cards assigned to an individual.

- Fake PAN Cards – The Income Tax Department deactivates those PAN cards from time to time that are issued on fake documents by the applicant. Such cards contain the fake name, photograph and signature of the cardholder.

- PAN Card Deactivation for Foreigners – Foreigners, who do not intend to continue conducting financial transactions in India, often surrender PAN cards to the Income Tax Department to prevent misuse by others.

- PAN Card Deactivation for Deceased – The Income Tax Department deactivates PAN of deceased cardholders when their heirs or nominees file a formal application for deactivation along with a copy of death certificate of the deceased.

How to Check PAN Card Status

You can check your PAN card active status online or if it has been deactivated by the Income Tax Department. Follow these simple steps for NSDL PAN card status check:

- Visit the Income Tax Department’s e-Filing website

- Click on “Verify your PAN”

- Enter the details required such as PAN, Full Name, Date of Birth, Mobile Number and click on the “Continue” button

- The status of your PAN will be displayed on the screen.

In case your PAN is deactivated, you can apply to activate PAN card.

Read More: PAN Card Verification

Why Should PAN Cards be Deactivated

The Income Tax Department has observed that people get multiple PAN cards or fake PAN cards to evade taxes. In a move to prevent such illegal activities, the government made it mandatory to link PAN with Aadhaar.

There are cases where people are ignorant about what to do if they lose their existing PAN card. They apply for a new PAN instead of getting a reprint of the existing one. The cardholder should get additional PAN cards deactivated so that all his financial history is covered under the same PAN.

If the PAN of the deceased is not deactivated, anybody can use it to carry out financial transactions and evade applicable taxes. The Income Tax Department deactivates PAN cards of deceased cardholders to prevent its misuse in any case.

How to Prevent your PAN from Deactivation

The Income Tax Department does not deactivate PAN cards of assessees unnecessarily. However, some PAN cards can get deactivated by mistake. You can prevent your PAN from getting deactivated by keeping a few points in mind:

- File your Income Tax Returns every year

- Link your PAN card with Aadhaar

- Login to the e-Filing website from time to time to check whether your card is active or not

FAQs

Q. How do I know my PAN card is misused?

You can know if your PAN card has been misused by checking your credit score from time to time. You can visit the website of on of the credit bureaus and check your credit score.

Q. Can I change my PAN card number?

Your PAN card number has lifetime validity and hence, cannot be changed. However, you can make changes/corrections to your PAN card details both online and offline.

Read more: PAN Card Update/Correction

Q. What are the charges to activate PAN card?

You are not required to pay any charges to activate your PAN card.

Q. I have lost my PAN card. Should I deactivate it and apply for a new PAN card?

In case you have lost your PAN card, you need not deactivate it and apply for a new one. Instead, you can request a duplicate PAN card or reprint your PAN card.

Read more: Duplicate PAN Card/PAN Card Reprint