PAN (Permanent Account Number) is a unique 10-character code assigned to each entity carrying out financial activities in India. It also acts as a valid proof of identity for various purposes such as all financial transactions above ₹ 50,000, mutual fund investments, buying properties and other such activities.

Are there incorrect details in your PAN card? Do you want to get them updated? Are you not aware of how to do it? If any of your answers are in affirmative, read ahead to find out how can you update details in your PAN card.

Why You Should Update Your PAN Card Details?

The government has made it mandatory to link PAN card with Aadhaar. However, if there are incorrect details in your PAN card, your Aadhaar will not be linked with it and it may face deactivation post the deadline of 31st March 2019.

Your PAN also acts as a valid identity card. In case there is wrong information in PAN card, authorities may not approve your applications.

It may pose difficulty in future while filing Income Tax Returns if your details are incorrectly mentioned in PAN card.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to Update your PAN Card Details Online?

Updating PAN card details is not a tough task. You can do it online through the NSDL or UTIITSL portal easily. Follow these simple steps to update your PAN details online:

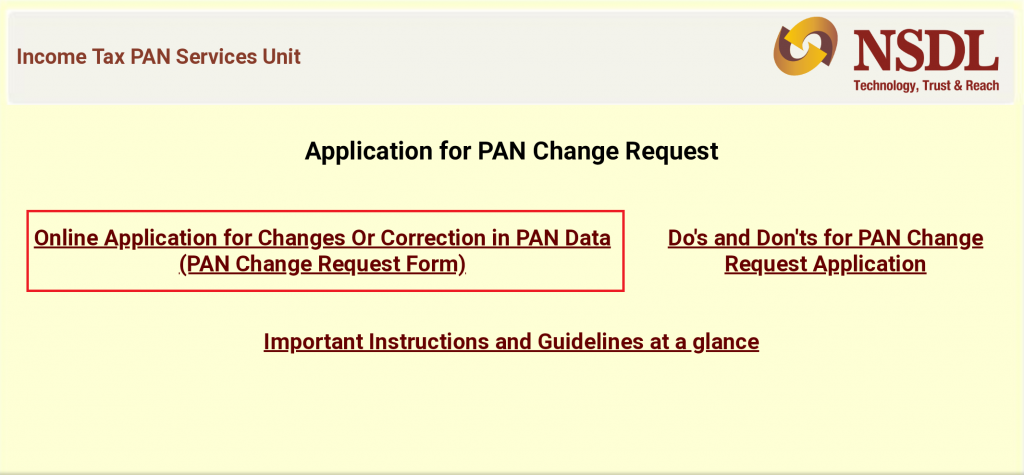

- Visit TIN-NSDL’s PAN portal at https://tin.tin.nsdl.com/pan/changerequest.html

- Fill all mandatory fields (marked with a *) in the form.

- Select the box corresponding to the details in which correction is required.

- In case the data submitted does not comply with the format, the portal will reflect errors in the specific field and you will have to rectify the errors.

- Once the PAN card application is free from errors, you will be redirected to make the payment online

- Once the payment is processed, your form will be submitted successfully.

- A 15-digit acknowledgement number will be provided to you in the acknowledgement receipt.

- You will have to submit scanned copies of proof of identity (POI), proof of address (POA), proof of date of birth (PODB), signature and your photograph

How to Update Your PAN Card Details Offline?

In case you are not comfortable in using the online service, you can apply for PAN card correction offline. You have to follow the steps mentioned below:

- Fill the PAN card correction form (Form 49A). You can download it online from https://www.incometaxindia.gov.in/Documents/form-for-changes-in-pan.pdf

- Place a Tick against only those fields that you want to update.

- In case multiple PAN cards have been assigned in your name, you have to get them deactivated. You can do so by mentioning duplicate PAN in item no. 11.

- Attach supporting documents with the application form.

- You also have to attach the demand draft of ₹ 110 (address within India) or ₹ 1020 (address outside India) with the form.

- The duly signed form has to be sent to the NSDL’s address at

INCOME TAX PAN SERVICES UNIT (Managed by NSDL e-Governance Infrastructure Limited),

5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8,

Model Colony, Near Deep Bungalow Chowk, Pune – 411 016

- You should also mention “Application for PAN Card Update” on the envelope

- Once updated, your updated PAN card will be delivered to you in about 45 days from the application date.

- The PAN card will be dispatched to the address of correspondence mentioned in the form.

How to Check PAN Card Update Status?

An applicant can check the PAN card update status online or by sending an SMS. Here’s how to do it:

An SMS has to be sent through the registered mobile number in the format

NSDLPAN <Acknowledgement No.>

The SMS has to be sent to 57575 to get the application status.

For example – Type ‘NSDLPAN 123456789012345’ and send to 57575

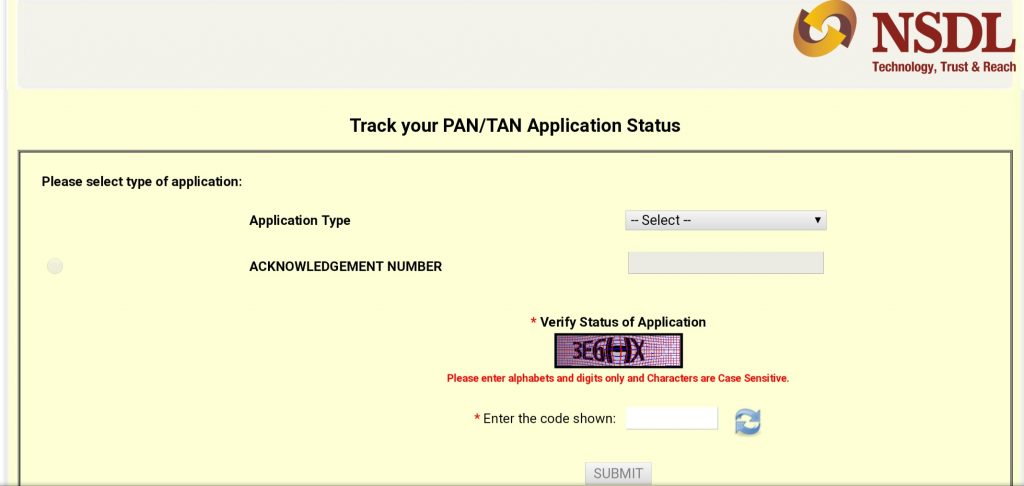

In case you want to check the PAN card status online, visit https://tin.tin.nsdl.com/pantan/StatusTrack.html and select the PAN option. Now enter the 15-digit acknowledgement number and submit the application. The status of your PAN card update application will be displayed on the screen.

As it is mandatory to link your PAN with Aadhaar, you should do it before the end of the deadline. You should also surrender all duplicate PAN cards issued in your name as having duplicate PAN cards may invite a fine of ₹ 10,000 as per section 272B of the Income Tax Act, 1961.

1 Comment Comments

Thanks to the great guide