A PAN (Permanent Account Number) card is a unique number comprising of 10 characters that is allotted to every tax payer. An individual can have only one PAN throughout his lifetime. There may come a time when you are required to surrender your PAN card. It could be due to duplicity or other reasons. Read on to know the detailed process on how to surrender PAN card online and offline.

Get Free Credit Report with monthly updates. Check Now

Surrender Duplicate PAN Card

If you have a duplicate PAN, you can surrender one of them in the following two ways:

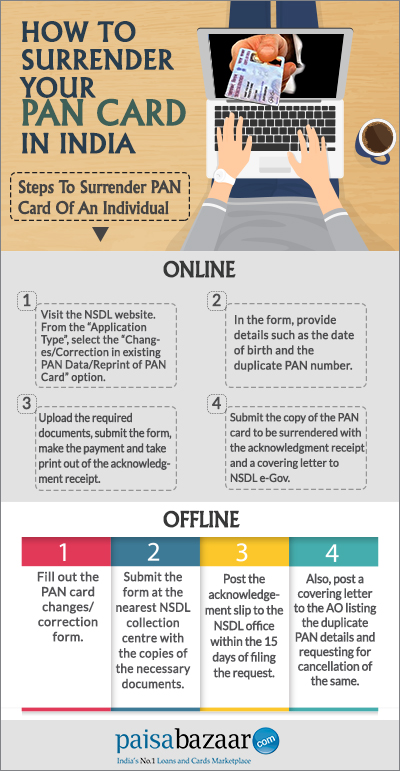

How to Surrender a Duplicate PAN Card – Online

Follow these steps to surrender your PAN card online:

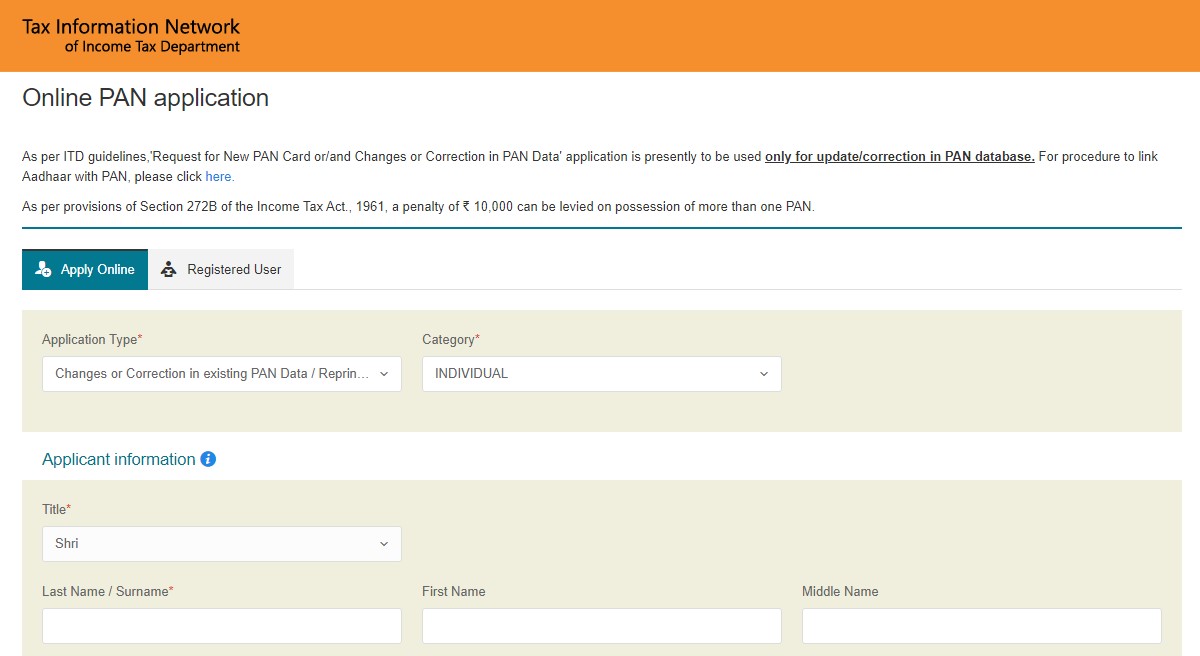

Step 1: Visit the ‘PAN Change Request Online Form’ page on the NSDL website.

Step 2: From the “Application Type” drop-down, select the “Changes or Correction in existing PAN Data/Reprint of PAN Card (No changes in existing PAN Data)” option.

Step 3: Fill out the form completely including fields such as citizenship, category, title, etc. and click on the ‘Submit’ button. After you submit the form, your request will be registered and a token number will be generated and sent on the email address mentioned in the application.

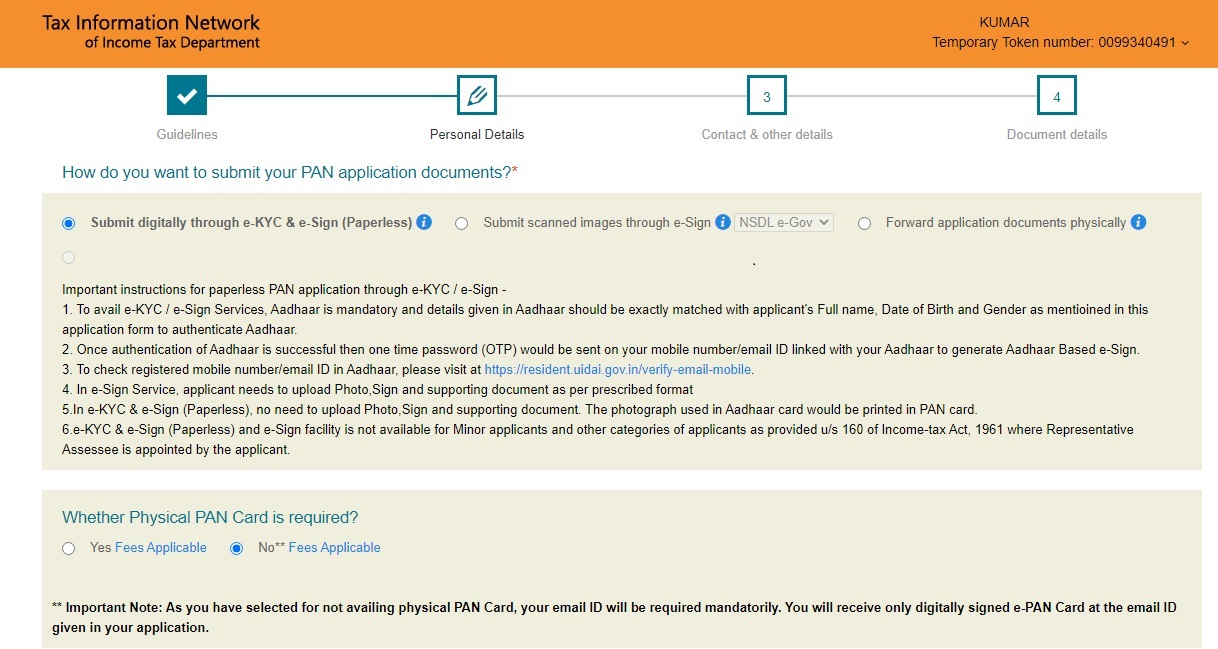

Step 4: Note down your token number for future reference and continue the process by clicking the “Continue with PAN Application Form” button given below it.

Step 5: Now select how would you submit your PAN application documents, i.e, either digitally through Aadhaar based e-KYC/e-Sign (paperless), Digital Signature Certificate (submit scanned images through e-Sign) or send application documents physically.

Note that, in case of Aadhaar based e-KYC/e-Sign, Aadhaar is the primary supporting document and you need not send the PAN application form or any supporting documents physically to NSDL e-Gov. The same is also true in case you opt for Digital Signature Certificate (DSC). However, in case you opt for physical acknowledgement you need to print the complete application form, affix latest coloured photographs, sign it and send the same along with the necessary documents to NSDL e-Gov office.

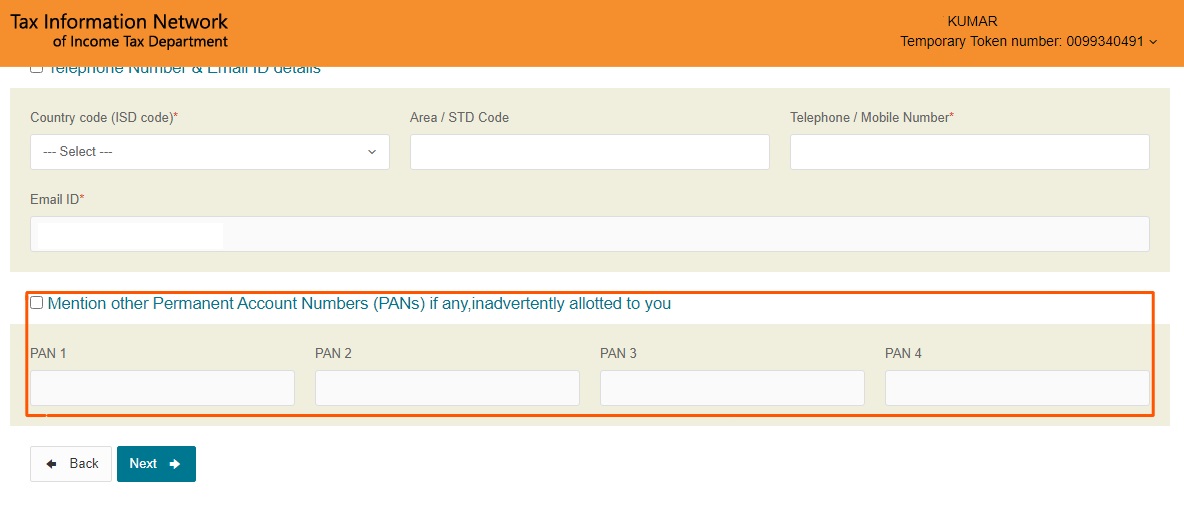

Step 6: Fill up all other mandatory fields, mention additional PANs that you want to surrender/cancel and select the check box on left margin and then click the ‘Next‘ button

Step 7: On the next screen, select the proof of identity, residence and date of birth you want to submit.

Step 8: Upload the scanned images of your photograph, signature and the required documents. If an individual is requesting for the surrender of PAN, they themselves should sign the declaration, else they must be signed by the authorised signatories. For instance, Director in the case of a company and partner in the case of a partnership firm/LLP.

Step 9: After submitting your details, you will get a preview of your application form. Verify your details and make necessary edits wherever required or proceed to make the payment.

Step 10: Make the required payment via demand draft, credit card, debit card or internet banking.

Step 11: Once the payment is successful, you will see a downloadable acknowledgement. Save and print the acknowledgement for future reference and as proof of payment.

Step 12: If you opt for sending the application form and documents physically, affix 2 photographs on the printed acknowledgement copy, sign it and send the same to NSDL e-Gov. Before sending the acknowledgement, label the envelope with ‘Application for PAN Cancellation’ and the acknowledgement number.

Step 13: Your acknowledgement, demand draft (in case any) and document proof should reach NSDL e-Gov within 15 days from the date of online application. Also, note that the guidelines mentioned above would not be applicable in case of DSC or Aadhaar based e-Sign online PAN application.

- Send the signed acknowledgement along with the demand draft (if required) and the required documents (proof of an existing PAN (if any), proof of (identity, address and date of birth)) to the following address:

NSDL e-Gov at ‘Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling,

Plot No. 341, Survey No. 997/8,

Model Colony, Near Deep Bungalow Chowk,

Pune – 411 016.

How to Surrender a Duplicate PAN Card – Offline

To surrender your PAN card offline, follow these steps:

- Fill out the “Request For New PAN Card Or/And Changes Or Correction in PAN Data” form.

- Submit the PAN form at the nearest NSDL collection centre with the copies of the necessary documents.

- Once you submit the form, you will get an acknowledgement slip, which is to be sent to NSDL office. This letter should reach the office within 15 days of filing the request.

- Also, file a letter with the Assessing Officer listing the duplicate PAN details and requesting for cancellation of the same. The Assessing Officer may also demand for an affidavit stating that the individual does not own any other PAN card except the one that is in use.

- You may also visit the nearest Income Tax Assessing Officer of your jurisdiction and submit a letter to them stating the duplicate PAN details and requesting for cancellation of the same. Then, post or hand over the letter to the nearest tax office and save the acknowledgment number.

A Good Credit Score ensures you manage Your Finances Well Check Now

Surrender PAN Card of a Deceased Individual

On the death of the PAN cardholder, his/her relatives need to write a letter to the Income Tax Officer of the respective jurisdiction along with the reason of surrender (i.e. death of the holder) and the death certificate. Few other details are also required to be specified in the letter like the name, PAN card number, date of birth, etc. The process to surrender PAN card is same in case of the demise of Indian residents, NRIs as well as foreign nationals.

Surrender PAN Card of a Firm/Partnership Firm/Company

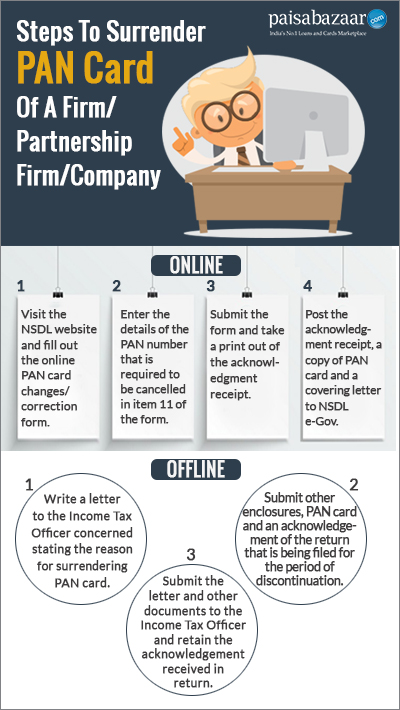

Surrender PAN Card of a Firm/Partnership Firm/Company – Online

Step 1: Visit the NSDL website.

Step 2: Fill out the online form with the required details.

Step 3: Enter the details of the PAN number that is required to be cancelled in item 11 of the form.

Step 4: Review the form carefully and proceed to make the payment of the required amount via credit/debit card or net banking.

Step 5: After submitting the form, take a print out of the acknowledgement receipt.

Step 6: Enclose the acknowledgement receipt along with the dissolution deed (if the company is dissolving) and a copy of PAN card that you wish to surrender and a covering letter, which will state that you wish to surrender your PAN card.

Step 7: Post the envelope at the address of the “NSDL e-Gov at Income Tax PAN Services Unit” along with the required necessary documents.

Step 8: You will receive a notification once the request has been processed.

A Good Credit Score can help in getting Loan Approvals Easily Check Now

Surrender PAN Card of a Firm/Partnership Firm/Company – Offline

- A letter to the Income Tax Officer, under whose jurisdiction the firm/company was filing its taxes, is required to be written stating that the firm/company is being dissolved, thus the PAN card is being surrendered.

- Along with the letter, some other enclosures are also required like a copy of the deed stating that the firm/company is being dissolved, the PAN card and also an acknowledgement of the return that is being filed for the period of discontinuation.

- The letter and other documents shall be submitted to the Income Tax Officer and retain the acknowledgement received in return.

Surrender PAN in Use

It is advisable for Indian citizens not to surrender the PAN card in use since it serves as a valid identity proof. But in case of foreign nationals who are leaving India and would no more be paying taxes to the Indian government, the PAN card would be of no use. Such individuals can write an application to the Income Tax Assessing Officer of their respective jurisdiction to surrender their PAN card. They need to mention the reason for surrendering the PAN card in the application. This would lead to cancellation of PAN card after which it can be surrendered to the tax office by the holder.

FAQs

Q. Under what circumstances can I surrender my PAN card?

Some circumstances under which you can surrender your PAN card are:

- The Income Tax Department has issued the taxpayer more than one PAN card by mistake

- There are errors on your current PAN card

- In case of death of the PAN card holder, his/her immediate family members can appeal to the Income Tax Department to have his/her PAN cancelled

- In case a firm, corporation or partnership seizes to operate, they can get their PAN card cancelled

Q. Should I surrender my PAN card and apply for a new one if I relocate within India?

No, the PAN card carries a 10-digit alphanumeric number with nationwide validity. Thus, there you need not revoke your existing PAN card if you are relocating within India.

Q. What should be done if I have been issued two PAN cards by the Income Tax Department?

In case you have been issued more than one PAN card by mistake by the Income Tax Department, you can make a request to cancel the duplicate PAN card. The duplicate PAN card will be cancelled once the Assessing Officer has completed his/her verification of the application.

Q. Should an Indian working in a different country cancel his/her PAN?

No, in case an assessee is working abroad on an employment visa and plans to return to India , his/her PAN need not be cancelled during their time away from India.

| Other PAN Card Forms |

| Form 60 |

| Form 61 |

| PAN Form 49A |

| PAN Form 49AA |