When you apply for a loan or a credit card, lenders check your credit score to assess your creditworthiness. But what if you’ve never used credit before?

New-to-credit individuals often find it challenging to build a good credit score. However, with the right credit products and responsible usage, you can build a strong credit history over time. Here’s a guide to help you understand how to build credit, and why it is important.

Why Is It Important to Build Credit?

Your credit history is your financial reputation—it opens doors to better financial opportunities in the future. Lenders check your credit history when you apply for a credit product, such as a loan or a credit card. A good credit score, preferably above 750, increases your chances of approval, as it represents responsible credit behaviour.

While a strong credit score can help you get approved for loans and credit cards at lower interest rates, having a low or no credit score can make it challenging for you to access credit. If you don’t have a credit profile, it means there’s no credit history for lenders to assess your creditworthiness, which impacts your chances of approval. Therefore, it is important to start building and managing credit responsibly to maintain a strong credit profile.

How to Start Building Credit

While building credit might seem easy, choosing the right credit product at the beginning of your credit journey is important, as it lays the foundation for a strong credit profile. Here’s how you can start building a credit history:

Entry-Level Credit Cards

Credit cards are primarily known for offering benefits across various spending categories. However, if you are just starting out, you may not qualify for premium benefits right away. Most card issuers offer entry-level credit cards that come with relaxed eligibility criteria, lower credit limits, and basic features like cashback, reward points, and fuel surcharge waiver for new-to-credit individuals. While these cards may not allow you to save significantly on your spends, they can help you start building your credit history.

Also, if you have a salary or savings account with a bank, consider applying for a credit card through that issuer. Since you already have an existing financial relationship with the bank, it may increase your chances of approval.

Secured Credit Card

If you don’t qualify for a regular credit card but still want to build your credit history, a secured credit card can be a significant alternative. A secured card is issued against a collateral, such as a fixed deposit—which acts as security for the issuer in case of default payments. The credit limit on a secured card is usually 90–100% of the fixed deposit amount.

You can use a secured credit card just like a regular credit card to make purchases and repay the amount through monthly bills. However, it is important to pay your bills on time and in full, as your repayment behaviour is reported to the credit bureaus. With responsible usage of secured credit cards, you cannot only build your credit profile but also improve your chances of becoming eligible for better credit products in the future.

Consumer Durable Loan

Another option for beginners to start building credit is by availing a consumer durable loan. With these loans you can make big-ticket purchases, such as electronics, furniture, and household appliances, and repay the amount through affordable monthly EMIs. Since these are typically small-ticket and short-term loans, they are easier to manage, especially for beginners.

It is generally easier for new-to-credit consumers to qualify for consumer durable loans as compared to other lending products like personal loans, home loans, or business loans. Regular and timely repayment of these loans helps you build a positive credit history.

Personal Loan

If you’re planning to build credit and also need funds, taking a personal loan can be a good way to establish your credit history. If you do not want to borrow a large amount initially, you can opt for a smaller loan amount to begin with. However, the eligibility for a personal loan also depends on other factors such as your monthly income and employment status. But getting approved for a lower loan amount may be easier for individuals who are new to credit. By availing a personal loan and making timely EMI payments, you can start building a positive credit history.

In case you do not need funds and want to start your credit journey, it is advisable to avail other credit products like credit cards, which offer the flexibility to spend only what you can repay. By paying your credit card bills on time and in full, you can build your credit without the burden of fixed monthly EMIs.

Buy Now, Pay Later (BNPL)

Nowadays, many fintech platforms such as Simpl, LazyPay, and others offer the Buy Now, Pay Later (BNPL) option. This facility allows you to make purchases and repay the amount later in monthly EMIs, based on your repayment capacity and the available tenure options. While some BNPL services may charge interest on the borrowed amount, choosing a shorter repayment tenure with manageable monthly installments can make it easier to build credit responsibly.

BNPL services function like credit cards—you can buy now and pay later, even if you don’t have a credit card. Since your credit activity is reported to credit bureaus, maintaining a good repayment history by paying on time can help you build a strong credit profile.

How Long Does It Take to Build Credit?

Building a strong credit history takes time and requires responsible credit management. When you start using a credit product, your credit behaviour is reported to credit bureaus such as TransUnion CIBIL, Experian, Equifax, and CRIF High Mark. These bureaus track your credit activity and use the data to determine your credit score.

Typically, it takes around 3 to 6 months of consistent credit activity for your first credit score to be generated. It is important to use your credit wisely by making timely payments and keeping your balances low to start building a good credit score.

How to Build a Good Credit Profile

Starting afresh and building a strong credit history might be challenging, but with responsible credit usage such as making timely payments and not maxing out your card—you can maintain a healthy credit profile. Here are some tips to build and manage a good credit history:

Pay Bills on Time and in Full

Payment history is the most important factor in your credit score. Once you start using any credit product, it’s important to pay your bills on time and in full to avoid high interest charges. Although credit cards allow you to pay only the minimum amount due and carry forward the remaining balance, doing so results in hefty interest charges—not just on the outstanding balance but also on new purchases from day one.

Hence, paying your bills in full not only helps you maintain a strong credit profile but also saves you from high interest charges.

Maintain a Healthy Credit Utilization Ratio (CUR)

Credit Utilization Ratio is the percentage of your total available credit to the credit you’re currently using. It is advisable not to max out your credit cards frequently. While an occasionally high CUR might not affect your credit score if you pay the balance in full, consistently having a higher CUR can negatively impact your credit score.

A high CUR also reflects credit-hungry behaviour, showing over-dependence on credit, which may reduce your chances of approval for future credit products.

Limit Credit Inquiries

Each time you apply for a credit product, lenders check your credit report, which raises a hard inquiry. While one or two inquiries have no impact, multiple inquiries within a short period can harm your credit score. To avoid this, you should only apply for credit products that you are eligible for, rather than submitting multiple applications.

Monitor Your Credit Report Regularly

Once you’ve started building credit, it’s important to keep track of your credit score. You can download a free credit report every year from each of the major credit bureaus—TransUnion CIBIL, Experian, Equifax, and CRIF. You can also check your credit score using platforms like Paisabazaar. Regularly checking your credit report helps you identify and correct any errors by reporting them to the lender or bureau.

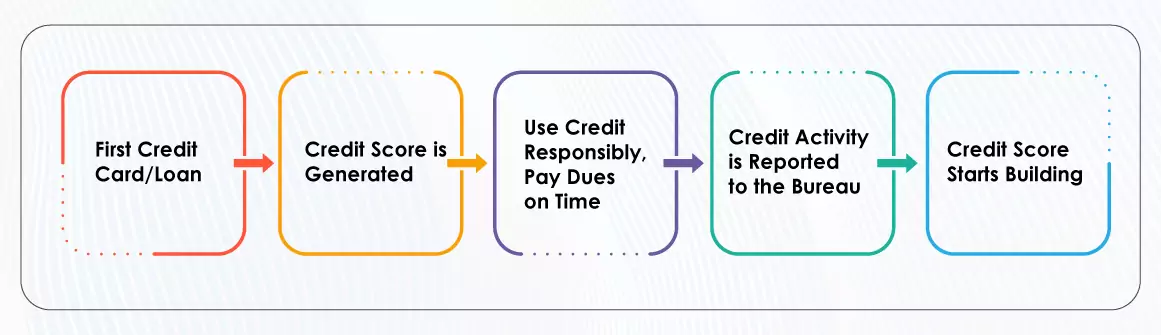

The Credit Journey of a New Borrower

Once you start using your first credit product, your credit score is generated within a few months of credit activity being reported to credit bureaus like CIBIL or Experian. You are required to continue managing your credit responsibly by paying bills on time, using your credit limit wisely, and avoiding unnecessary credit inquiries to start building a good credit score.

Starting your credit journey responsibly as a beginner is important for maintaining a strong credit history. Building a good credit score can take even more time for individuals who are ‘new to credit’ and have no prior credit history. However, by following the above-mentioned tips, such individuals can slowly and steadily build a solid credit profile over time.