Home Credit personal loan is easy to avail so it is the perfect choice if you need cash instantly. The proceeds of a personal loan can be either deal with a medical emergency or to get married, go on a vacation, renovate your home, etc. Home Credit Personal Loan can be availed online from the comfort of your home or office. Home Credit offers a loan amount of up to Rs. 2.4 lakh and you can get instant online approval if you meet the eligibility criteria and submit the basic documents required.

Transfer Your Personal Loan at Lower Interest Rates Apply Now

How to pay Personal Loan EMI?

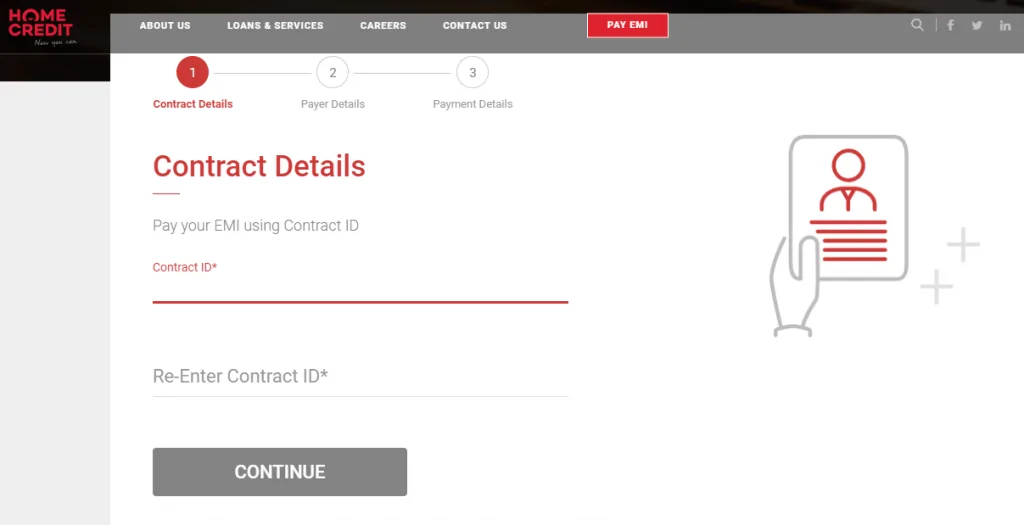

- Through the website:

1. Go to the Loan EMI payments page on the Home Credit website

2. Enter the loan contract details and confirm it

3. Subsequently, you will be directed to a page that contains details of your personal loan EMI payment dues as well the available payment options

4. Choose either debit card or any of the net banking options to make the payment

5. You will receive an OTP on your registered mobile number. Either enter the OTP or type in the transaction password

6. Once the payment is done, you will receive confirmation through e-mail or SMS

- Through Credit Mobile App: All Android users can download the Home Credit app from the Google Play Store and repay the outstanding loan amount

- At authorized branches: You can also pay EMI dues for your Home Credit personal loan by depositing cash at authorised branches of Axis Bank, ICICI Bank and India Post

- Through Mobile Wallet: You can easily pay the EMI dues of Home Credit India by transferring the amount through PayTm or PayU

- Through Net Banking: Personal loan EMI dues of Home Credit India can also be paid through Internet-banking by using bank NEFT/RTGS

How to Check Home Credit Personal Loan Statement?

You can view the statement of your Home Credit Personal Loan anytime, anywhere using the Home Credit India app from the Google Play Store.

Home Credit Personal Loan Interest Rate

The interest rate of Home Credit personal loan starting from 2.00% per month. However, the interest rates on personal loans offered to an individual by Home Credit depends on multiple factors including but not limited to credit score, loan amount, age, repayment history, etc.

Contact Details of Payment Related Issues

If you have any issue/query related to the payment of your EMI, you can get in touch with the customer care team of Home Credit.

- You can call on (+91)124-662–8888

- You can send an email on care@homecredit.co.in

- You can fill a complaint form online

FAQs

Q1. What if I miss an EMI?

If you don’t pay the EMI before or on the respective due date, you will have to pay late payment charges as follows:

| 1 day after due date | Rs. 350 |

| 30 days after due date | Rs. 800 |

| 60 days after due date | Rs. 1350 |

| 90 days after due date | Rs. 2100 |

Q2. What happens if I wish to cancel my Home Credit Personal Loan after I have taken it?

If you wish to cancel the loan after taking it, make sure you cancel it within 15 days of signing the contact so that you won’t have to pay a prepayment penalty.

Q3. Is it possible to foreclose my Home Credit Personal Loan?

Yes, you can foreclose your personal loan before the contracted tenure by paying off the outstanding amount. Do note prepayment charges of up to 3% of the principal amount prepaid will be applicable.

Q4. Will I get a notification when the monthly instalment is debited?

Yes, once Home Credit has received the due EMI payment, you get a payment confirmation through SMS on your registered mobile number.

Q5. Can I change my scheduled EMI payment date for Home Credit personal loan?

No, this facility is not currently offered by Home Credit India.