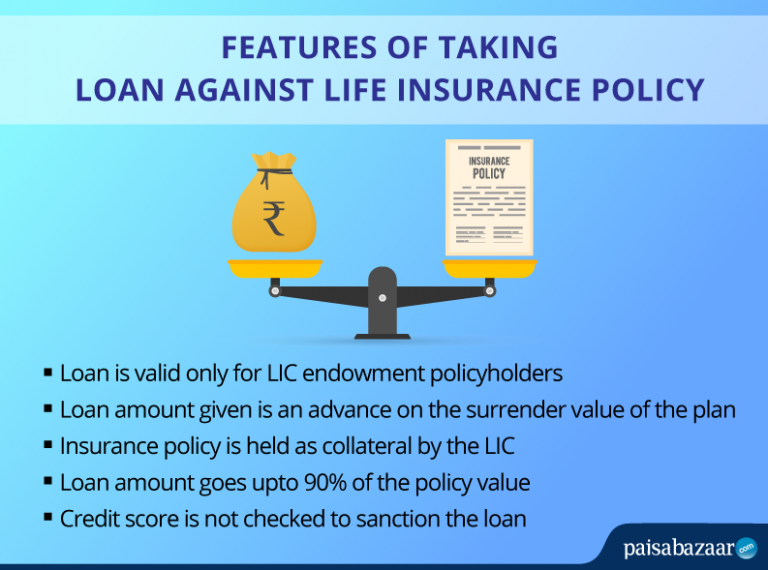

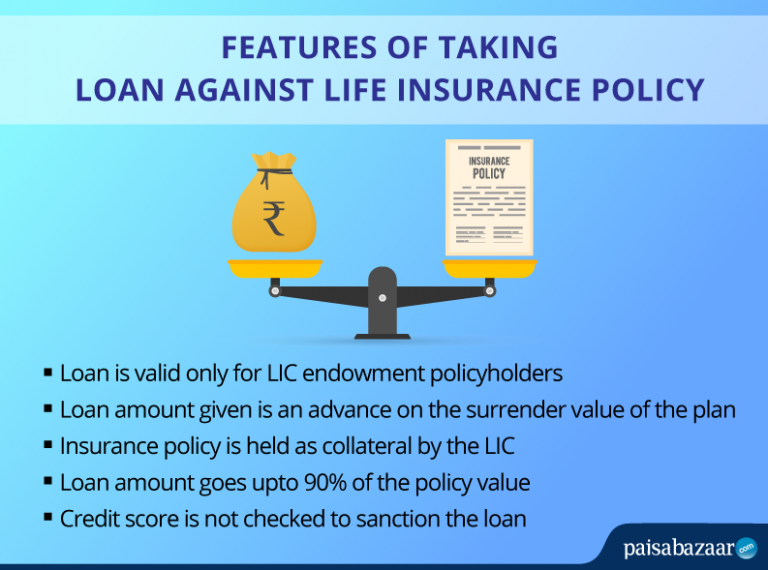

A life insurance policy is a reliable and useful investment option as it not only offers protection cover but also provides additional benefits including taking a loan against the policy. At the time of financial crises, one can consider taking a loan against Life Insurance Policy as it is easier to get and is secured against your policy for which you have been paying premium. Also, unlike loan against shares and gold, the value of Life Insurance Policy does not change with change in market.

Pros of Taking a Loan Against Life Insurance Policy

- Higher loan value: The maximum loan amount that you can avail against your insurance policy depends upon the insurance company. However, usually a loan amount of up to 80% to 90% of the surrender value (value of the policy that you get when you terminate the policy on your own) of the policy is offered to the policy holders. Let’s say, if you have an insurance cover of Rs. 60 lakh and its surrender value at the time of requesting the loan is Rs. 30 lakh, you may get loan of upto Rs. 27 lakh

- Hassle- free application process: Unlike other loans, loan against Life Insurance Policy is quick to avail as it involves minimum paperwork and easy application process. Usually, a policyholder gets the loan within 3 to 5 working days of application approval

- No credit score needed: Unlike other loans, when you apply for a personal loan against Life Insurance Policy, your credit score is not checked and no questions are asked. If your policy is eligible to offer a loan against it and if you have paid all the premiums in the past on time, you may easily avail a loan. Also, like other loans or credit card debt, policy loans don’t get displaced on your credit report and hence keeps it clean (even if anything goes wrong)

- Low interest rate: As compared to most of the loans, the interest rate charged on a life insurance policy is lower and mainly depends upon the premium that you have already paid and number of times the premium is being paid. The more the premium paid, the lower would be the interest rate. The interest rate offered on loan against life insurance varies from 10 to 12%

List of Top Banks/NBFCs in India Offering Personal Loans at Low Interest Rates Click Here

Cons of Taking a Loan Against Life Insurance Policy

- Limited availability of loan: Not all insurance policies offer the benefit of taking a loan against them. Loan can only be taken against traditional life insurance policies like Jeevan Pragati, Jeevan Labh, Single Premium Endowment Plan, New Endowment Plan, New Jeevan Anand, Jeevan Rakshak, Limited Premium Endowment Plan, Jeevan Lakshya, etc. and not against a term plan. Therefore, you first need to check with the insurance provider if your policy is eligible for a loan or not

- Waiting period: Many of you might not be aware of this but you won’t be eligible to take a long against life insurance policy before the waiting period ends. The waiting period is usually of 3 years. Before sanctioning the loan amount, the lender checks if you have paid the premium without any default during the waiting period and if everything goes right, your loan gets approved

- No room for default: If you take a loan against Insurance Policy, it has to be repaid during the term of the policy. After availing the loan, the policyholder would be paying interest on the loan against policy and premiums of the policy. In case you miss a repayment or there is a default in payment of your future premiums, your Life Insurance Policy will collapse and the insurer will hold the right to recover the dues from the surrender value of your policy

What is the Eligibility Criteria to Avail Loan Against Life Insurance Policy?

- You should be a resident of India

- You should be at least 18 years old

- You should have a Life Insurance Policy

- Your policy should be an endowment policy with a surrender value.

- You should have completed the waiting period of 3 years

What Are the Documents Required to Avail Loan Against Life Insurance Policy?

- Original policy document

- Proof of identity: Aadhaar Card, Voter ID Card, Passport

- Proof of residence: Aadhaar Card, Voter ID Card, Driving License, Utility Bills

- Proof of income: Salary Slips, Bank Account Statement

- Deed of assignment

A Life Insurance Policy is taken to provide financial security to the loved ones. However, if you wish to avail a loan against the policy, do it only when there is an emergency situation and there is no other option left. Also, make sure to avail a loan for 6 months or maximum 1 year so that you can restore the benefits of the policy.