Please Note: Punjab National Bank is not a Paisabazaar partner. Offers would be from partner banks/NBFCs only.

Punjab National Bank (PNB) provides its customers the facility to check/track the status of their housing loan application status. Customers can check their PNB housing loan status for free through both online and offline modes. Read further to learn how to track your PNB housing loan status with a reference number.

How to Check PNB Home Loan Status Offline

To check the status of home loan application through offline mode, customers may follow either of the below-mentioned procedures:

- Connect with the loan agent

- Get in touch with PNB’s customer care at:

| Toll-Free No. | Landline | |

| 1800 180 2222 1800 103 2222 |

011-28044907 0120-2490000 |

care@pnb.co.in |

How to Check PNB Housing Loan Status Online

Follow the below-mentioned steps to check the status of home loan application through online mode.

Step 1: Visit the PNB Home Loan page at https://www.pnbindia.in/housing-loan.html

Step 2: Click on the ‘Housing Loan’ button in the right panel of the page.

Step 3: A new page will open. Click the ‘Click Here To Check your Applications Status’ button to proceed further.

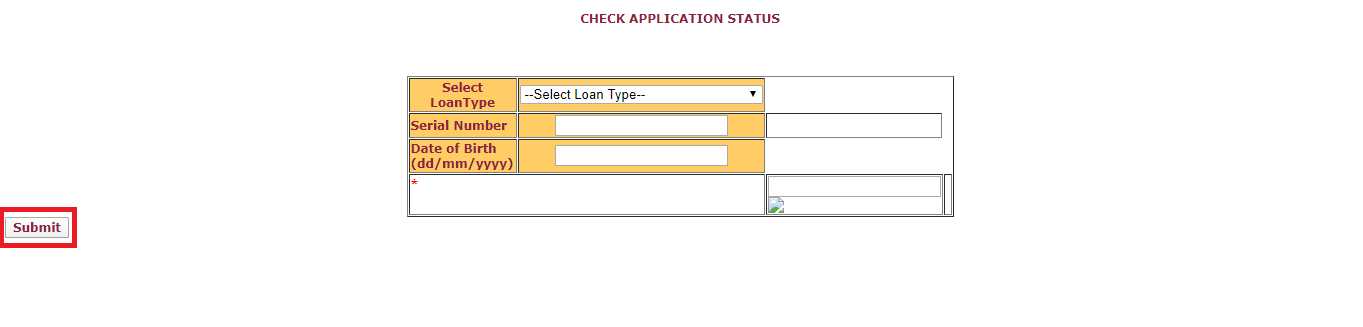

Step 4: On the next page,

-

-

-

- Choose the ‘Housing Loan’ option from the ‘Select Loan Type’ drop-down menu

- Enter the Serial Number (Serial Number is a unique code that every applicant receives after completing the home loan application)

- Enter the Date of Birth of the applicant and click the ‘Submit’ button

-

-

Get Home Loan at the Low Interest Rate from Top Lenders Apply Now

Advantages of Check Housing Loan Status

-

-

- Keep track of your home loan application throughout the process

- No more standing in long queues – know your home loan status online quickly

-

FAQs

Q1. How to avail PNB Home Loan?

Simply visit the official website of the bank and provide details such as name, income, employment, and necessary documents to apply for a home loan.

Q2. What are the documents required to apply for PNB Home Loan?

Mentioned below are the documents required to apply for PNB Home Loan.

-

-

- Identity Proof

- Residence Proof

- Income Proof

- Property related documents (Buyer agreement, Title deed, etc.)

- Business profile (including proof and P&L statements) for self-employed professionals

-

Q3. What is the maximum loan amount a customer can avail against his/her salary?

The loan amount that a customer can avail against his/her salary depends on his/her repayment capacity, which is determined by age, number of dependents, education qualification, current liabilities, credit history, etc.

Q4. What is the maximum loan tenure available under PNB Home Loan?

The maximum tenure available under PNB Home Loan is 30 years.

Q5. Are there any tax benefits available under PNB Home Loan?

Yes. You are eligible for tax benefits on the principal and interest components of your Home Loan under Sections 24(b) and 80C of the Income Tax Act.