‘Repo’ stands for repurchase agreement and it is defined as money market instrument which allows short term borrowing using specified debt instruments such as government bonds and treasury bills as collateral. When central banks lend money to commercial banks, the interest rate charged by the central bank is termed as the repo rate. In the Indian context, repo rate is the rate at which the Reserve Bank of India (RBI) lends money to commercial banks. When acting as a lender of last resort, RBI lends money to banks using government bonds of the bank as security. At the end of the loan tenure, the bank “repurchases” these bonds by repaying the money lent by RBI. In India, the repo rate is decided at the MPC (Monetary Policy Council) Meeting which is presided over by the RBI Governor.

On This Page

What is the Repo Rate Trend in India?

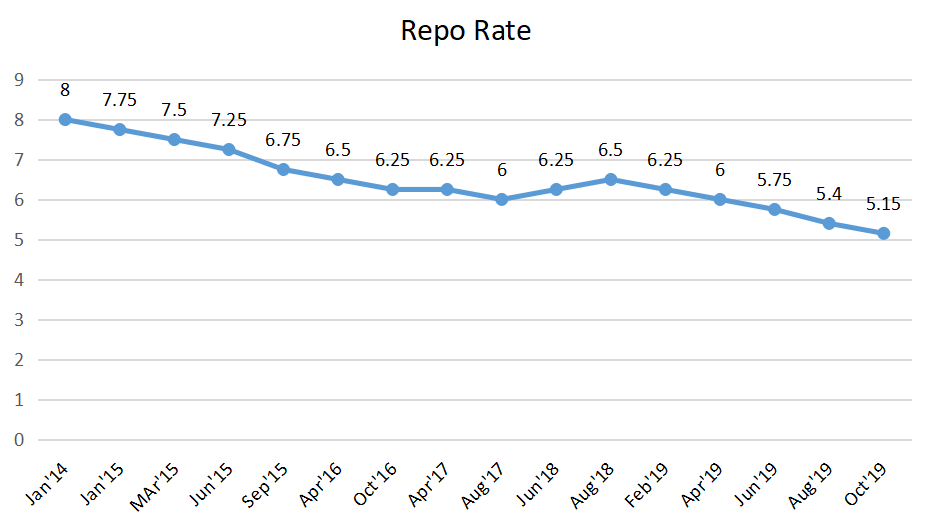

In recent months, the repo rate trend in India has witnessed a downward movement as RBI has cut this rate multiple times in line with the requirements of the economy. The repo rate as of February 2020 is 5.15% after rates were held steady subsequent to a rate cut of 25 basis points (bps) announced at the MPC Meeting held on 10th October 2019. The current rate is the lowest since 24 January 2014 when the repo rate was significantly higher at 8%. The following is the historic repo rate trend in India:

| Date of Announcement | Repo Rate (%) |

| 6 February 2020 | 5.15 (current/unchanged) |

| 10 October 2019 | 5.15 |

| 7 August 2019 | 5.4 |

| 6 June 2019 | 5.75 |

| 4 April 2019 | 6 |

| 7 Feb 2019 | 6.25 |

| 1 August 2018 | 6.5 |

| 6 June 2018 | 6.25 |

| 2 August 2017 | 6 |

| 4 October 2016 | 6.25 |

| 5 April 2016 | 6.5 |

| 29 September 2015 | 6.75 |

| 2 June 2015 | 7.25 |

| 4 March 2015 | 7.5 |

| 15 January 2015 | 7.75 |

| 28 January 2014 | 8 |

Source: RBI Website

The following is the representation of the repo rate trend in India for the past 5 years:

Why was RBI Repo Rate introduced?

Repo rate is one of the key components of LAF (Liquidity Adjustment Facility). Introduction of repo agreements under LAF in India was a key banking sector reform introduced based on the recommendations of the Narasimhan Committee. The key role of repo rate as currently managed by the Reserve Bank of India is to control the amount of liquidity in the economic system. Reduction in repo rate allows banks get loans and advances at a cheaper rate, which increases liquidity in the system. On the other hand, when repo rate increases, borrowing becomes more expensive for banks which leads to an increase in loan interest rates and reduces liquidity in the financial system.

Also Check: RBI Increases Repo Rate by 0.25% to 6.25%

Types of Repo Agreements in International Markets

Internationally repo agreements are broadly classified into 4 categories. These are as follows:

- Classic Repo: In this type of repo transaction, securities are initially sold with a concurrent agreement to repurchase the same at a future date with no actual transfer of ownership. In this case, interest i.e. repo rate is charged separately but the price of repurchasing is the same as the price of selling. A classic repo agreement specifies that securities are just treated as collateral against the loan or funds borrowed. As there is no transfer of ownership, coupon interest earned on securities used for the repo agreement is accrued to the seller of the securities. This is the one currently employed by the Reserve Bank of India when lending to commercial banks.

- Buy-Sell Repo: It is a type of repo transaction under which possession of the collateral is taken over by the lender. In this case, there is outright sale of securities and buy back of the same for settlement at a future date. In this case, the agreement specifies the period for which ownership of securities is passed on to the buyer with the seller “repurchasing” the security at the end of the period. In this case, the coupon interest accrued for the period also gets passed on to the buyer. Future price of securities/bonds are set in advance and adjusted according to the difference between repo interest and coupon interest earned. This means, spot borrower earns the yield on the borrowed securities along with differential interest and the repo rate.

- Hold in Custody Repo: This type of repo transaction does not have any settlement requirements as securities are held in the custody of the seller till the end of repo period.

- Tripartite Repo:This particular type of repo transaction involves a clearing agent or a custodian entrusted with custody, clearing and settlement of the securities. This type of repo agreement involves signing the Global Master Repurchase Agreement which specifies key aspects of the transaction including substitution of securities, automatic mark-to-market, etc.

Types of RBI Repo Agreements based on Maturity

Repo agreements in India feature specific maturity periods. Under the monetary policy of Reserve Bank of India, the following are the key types of repos used to ensure liquidity in the banking system:

- Overnight Repo: When the repo transaction is for a day, it’s referred to as overnight repo. This type of repo is available to commercial banks from Monday to Friday (except RBI holidays).

- Term Repo:If the duration of the repo is more than a day, then it is known as term repo. The borrowing bank should submit the securities to the Reserve Bank of India. Since it is a term (i.e. longer period) repo, the applicable interest rate varies depending on the auction rate. The usual duration of term repo is 7 days, 14 days and 28 days. Normally, the Reserve Bank of India will announce the term repo auction by specifying the total amount as and when there is requirement of funds by commercial banks for more than a day’s duration. Term repo is also called as variable rate term repo. It is auctioned either twice a week or depending on the market requirement.

Importance of Repo Rate

Importance of Repo Rate

The following are key reasons why RBI repo rate is important for the Indian economy:

- It serves as a control mechanism by the RBI for infusing/decreasing liquidity in the system.

- Changes in repo rate impact the cost of funds for banks.

- Repo is one of the key tools used by Reserve Bank of India to fight the inflation and achieve price stability in the economic system.

- Repo rate changes can lead to changes in other interest rates such as the interest earnings from deposits and interest rate applicable to loans.

Also Read: Repo Rate vs. Reverse Repo Rate

Impact of Repo Rate Changes

Repo rate changes impact various aspects of the economy and this is the key reason, why the RBI uses it is a policy instrument. The following are some key impacts of repo rate changes:

Impact of Repo Rate Cut

Whenever Reserve Bank cuts the Repo rate, loans from RBI become cheaper for commercial banks. This prompts them to offer loans at cheaper rate to consumers. When bank loans are available at cheaper rates, retail customers as well as businesses tend to opt for higher loans. This can lead to increased liquidity in the market which increases overall consumption in the economy. Increase in consumption is among the key drivers of economic growth. However, the increased liquidity from lower repo rate can also have a side effect in the form of increased inflation. This is the key reason why repo rate cuts usually occur in relatively smaller amounts such as 25 basis points i.e. 0.25% but higher/lower quantum of change might be applicable if the situation so demands.

Impact of Repo Rate Increase

When there is an increase in repo rate, borrowing becomes more expensive for banks. In other words, banks are obliged to pay more interest on short term loans availed from Reserve Bank of India. The increased cost of funds for the bank prompts them to increase the rate of interest on loans which they offer to their customers. When the bank loans become expensive, it discourages the customer from borrowing money. This leads to a reduction in money supply and reduces liquidity in the market. Decrease in liquidity tends to reduce inflation, which is the key reason why RBI has historically increased repo rate. However, increasing repo rate can also have an adverse effect on economic growth due to the decrease in consumption resulting from lower money supply in the economy. It is important to remember that repo rate is only one of the many tools at the RBI’s disposal to positively impact/control various aspects of the economy.