Reserve Bank of India formulates and administers monetary policies specifically for the purpose of controlling the supply of money in the economy to stimulate various aspects of economic growth. The primary objective of such monetary policies are promoting economic development through price stability, regulation of the volume of bank credits, improving efficiency of the financial system, promoting investments and increasing diversification in financial markets. In this context, repo rate and reverse repo rate are instruments of RBI’s monetary policy that can help control the money supply in the economy.

Best Personal Loan offers from top banks are just a click away Apply Now

On This Page

- What are Repo Rate and Reverse Repo Rate?

- How do Repo and Reverse Repo Rates Differ?

- Historic Repo Rate vs. Reverse Repo Rate Comparison Chart

- Importance of Repo Rate and Reverse Repo Rate

- Significance of Repo Rate and Reverse Repo Rate

- Impact of Repo Rate and Reverse Repo Rate Increase by RBI

- Impact of Repo Rate and Reverse Repo Rate Cuts by RBI

What are Repo Rate and Reverse Repo Rate?

Repo Rate: The term ‘Repo’ stands for ‘Repurchase agreement’. Repo is a form of short-term, collateral-backed borrowing instrument and the interest rate charged for such borrowings is termed as repo rate. In India, repo rate is the rate at which Reserve Bank of India lends money to commercial banks in India if they face a scarcity of funds. Commercial banks sell government securities and bonds to Reserve Bank of India with an agreement to repurchase the securities and bonds from Reserve Bank of India on a future date at a pre-determined price including interest charges. Current Repo Rate as of February 2020 is 5.15%.

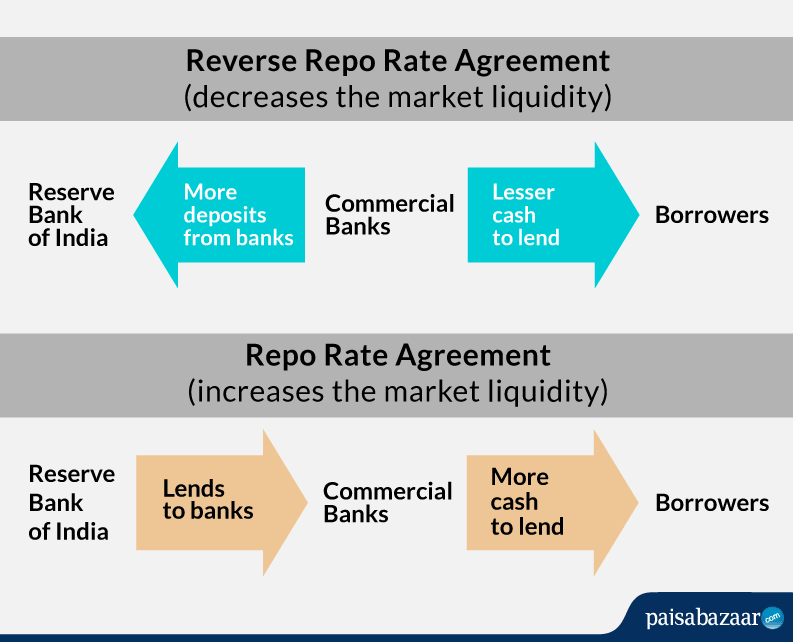

Reverse Repo Rate: Reverse repo as the name suggests is an opposite contract to the Repo Rate. Reverse Repo rate is the rate at which the Reserve Bank of India borrows funds from the commercial banks in the country. In other words, it is the rate at which commercial banks in India park their excess money with Reserve Bank of India usually for a short-term. Current Reverse Repo Rate as of February 2020 is 4.90%.

How do Repo and Reverse Repo Rates Differ?

How do Repo and Reverse Repo Rates Differ?

The following are the key differences between repo and reverse repo in India:

| Comparison Criteria | Repo Rate | Reverse Repo Rate |

| Lender and Borrower | Lender – RBI, Borrower – Commercial Banks. | Lender – Commercial Banks, Borrower – RBI. |

| Borrower’s Objective | To manage short term deficiency of funds | To reduce overall supply of money in the economy |

| Rate of Interest | Higher than reverse repo rate | Lower than repo rate |

| Interest Charge Applicable to | Repurchase Agreement | Reverse Repurchase Agreement |

| Mechanism of Operation | Commercial banks get funds from RBI using government bonds as collateral. | Commercial banks deposit their excess funds with RBI and receive interest from the deposit. |

| Impact of Higher Rate | Cost of funds increases for commercial banks hence loans become more expensive. | Money supply in the economy decreases as commercial banks park more surplus funds with RBI. |

| Impact of Lower Rate | Cost of funds is lower for commercial banks leading to reduced interest rates on loans. | Money supply in the economy increases as banks lend more and reduce their deposits with RBI. |

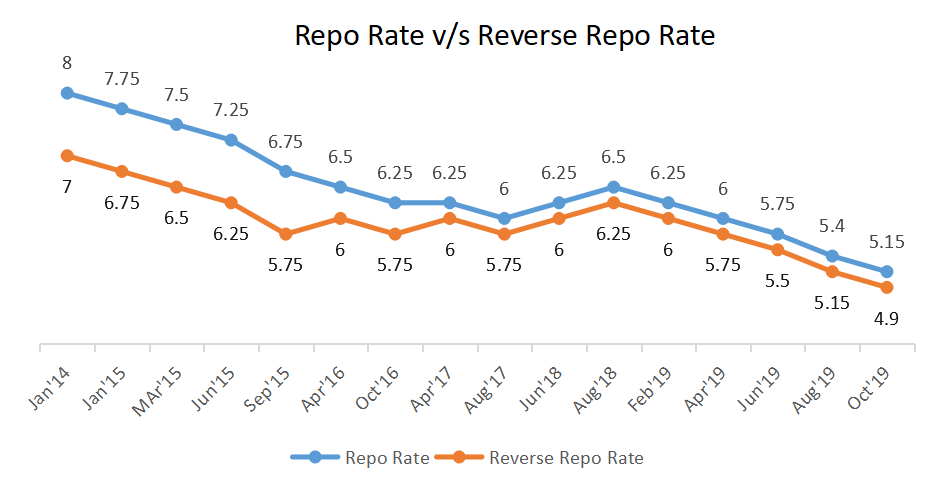

Historical Repo Rate vs. Reverse Repo Rate Comparison Chart

The following are the historic repo rate vs. reverse repo rate trend in India for the last 5 years:

| Date | Repo Rate(%) | Reverse Repo Rate (%) |

| 6 February 2020 | 5.15 (current) | 4.90 (current) |

| 10 October 2019 | 5.15 | 4.90 |

| 7 August 2019 | 5.40 | 5.15 |

| 6 June 2019 | 5.75 | 5.50 |

| 4 April 2019 | 6.00 | 5.75 |

| 7 February 2019 | 6.25 | 6.00 |

| 1 August 2018 | 6.50 | 6.25 |

| 6 June 2018 | 6.25 | 6.00 |

| 2 August 2017 | 6.00 | 5.75 |

| 6 April 2017 | 6.25 | 6.00 |

| 4 October 2016 | 6.25 | 5.75 |

| 5 April 2016 | 6.50 | 6.00 |

| 29 September 2015 | 6.75 | 5.75 |

| 2 June 2015 | 7.25 | 6.25 |

| 4 March 2015 | 7.50 | 6.50 |

| 15 January 2015 | 7.75 | 6.75 |

| 28 January 2014 | 8.00 | 7.00 |

Source: RBI Website

The following graph shows the Historic Trend of Repo vs. Reverse Repo in India

From the above historic data, it is clear that while the reverse repo rate has always been maintained at a lower level that the repo rate of RBI. The difference between the two rates has not always been the same. While in last couple of years, the difference has been maintained at only 25 basis points (0.25%), earlier this was higher – even as much as 100 basis points (1%).

Importance of Repo Rate and Reverse Repo Rate

- Repo and reverse repo are the monetary measures used by the Reserve Bank of India to deal with the deficiency of funds and liquidity in the market. It is a vital money flow control mechanisms used by the central bank.

- Bank lending rates are impacted by repo rate and reverse repo rate. Know about Repo Linked Lending Rate (RLLR)

- Repo and reverse repo are the most effective and efficient tools used by the Reserve Bank of India to achieve price stability and to boost economic development.

- Repo and reverse repo agreements help banks manage their liquidity requirements easily and with a high degree of safety.

Significance of Repo Rate and Reverse Repo Rate

Liquidity Regulation: Under the liquidity framework designed by RBI, many facilities are offered to commercial banks to meet their requirement of immediate liquidity or deficiency of funds. The main motive of the liquidity framework is to avoid any liquidity crisis in the Indian banking system through implementation of repo agreements. In the similar way, RBI has a framework for managing surplus funds/cash in the banking system which ensures there is no excess liquidity in the system. And this framework is referred to as reverse repo. Basically, repo transactions inject liquidity into the Indian banking system. On the other hand, reverse repo absorbs liquidity from the Indian banking system.

Inflation Control: Reserve Bank of India holds a key responsibility with respect to striking a balance between inflation and economic growth by managing the repo rate and/or reverse repo rate periodically. By changing the repo/reverse repo rate, the RBI can control money flow i.e. liquidity in the economy – too much liquidity usually leads to inflation which can adversely affect the economy, while too little liquidity can lead to an economic slowdown.

Impact of Repo Rate and Reverse Repo Rate Increase by RBI

The following is the impact of increase in repo rate and reverse repo rate by the RBI:

- Increase in Repo Rate: Increase in repo rate makes borrowing from the RBI more expensive for commercial banks and this can lead to increase in rates applicable to loans. As the interest rates on various loans increases, fewer loans are applied for disbursed, which restricts the money supply in the economy and may adversely affect the country’s economic growth.

- Increase in Reverse Repo Rate: If there is excessive liquidity in the banking system, RBI may decide to increase the reverse repo rate. When there is a hike in reverse repo rate, banks can earn higher interest on their excess funds deposited with the Reserve Bank of India. This is a safer investment option for banks so overall flow of money into the markets will be decreased as more of the bank’s surplus funds are deposited with RBI instead of being lent out.

Impact of Repo Rate and Reverse Repo Rate cuts by RBI

The following is the impact of repo rate and reverse repo rate cuts by RBI:

- Repo Rate Cut Impact: Banking is the first sector to get affected by any change in monetary policies. A cut in repo rate can allow banks to borrow from the Reserve Bank of India at a cheaper rate and infuse higher liquidity in the banking system. This can lead banks to reduce their lending rates for customer leading to cheaper loans in the long term. As bank loans get cheaper, consumers can borrow and spend more which boosts consumption and can eventually lead to economic growth. However, this is depends on the decision by the bank whether to pass on the RBI repo rate cut benefits to their customers through cheaper loan offers.

- Reverse Repo Rate Cut Impact: Whenever RBI decides to reduce the reverse repo rate, banks earn less on their excess money deposited with the Reserve Bank of India. This leads the banks to invest more money in more lucrative avenues such as money markets which increases the overall liquidity available in the economy. While this can also lead to lower interest rate on loans for the bank’s customers, the decision will depend on multiple factors including the bank’s internal liquidity situation and the availability of other potentially less risky and equally lucrative investment opportunities.