Agriculture sector holds a significant position in the Indian economy. Conditions like variations in weather, pest attack, erratic rainfall and humidity affecting agricultural produce is a common problem in India. Thus, it is important to get a coverage in the form of crop insurance for the yield and yield-based losses. Crop insurance is a way to reduce farmers’ distress and to promote their welfare.

Table of Contents:

What is Crop Insurance?

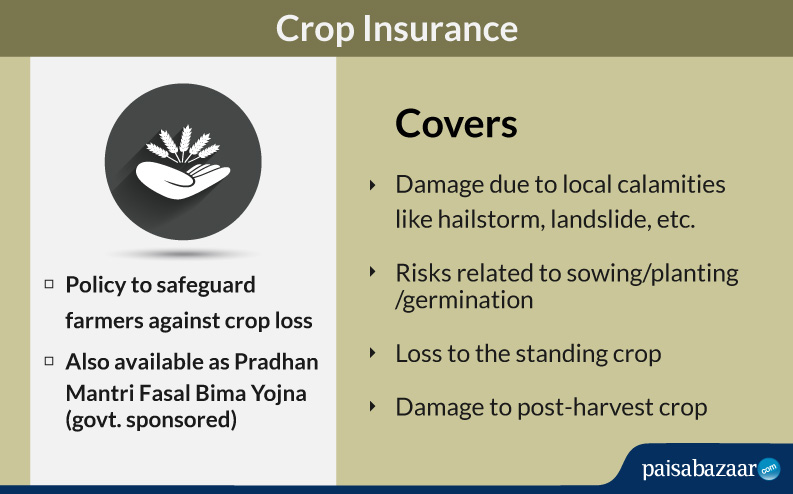

Crop Insurance is a comprehensive yield-based policy meant to compensate farmers’ losses arising due to production problems. It covers pre-sowing and post-harvest losses due to cyclonic rains and rainfall deficit. These losses lead to reduction in crop yield, thus, affecting the income of farmers. In India, crop insurance is offered in the form of Pradhan Mantri Fasal Bima Yojna.

What is Pradhan Mantri Fasal Bima Yojna?

Pradhan Mantri Fasal Bima Yojna is a crop insurance scheme sponsored by the Government of India. The policy was launched in 2016. It aims to provide financial aid to farmers in case of crop loss or damage. Thus, it helps to reduce farmers’s stress and keep them motivated to continue with farming as an occupation.

The risks covered in the scheme include prevention of sowing or planting of seeds, damage to the standing crop due to non-preventable risks like drought, flood, landslide, etc. along with post-harvest losses. This policy can be purchased from a selected set of insurance companies like SBI General Insurance and HDFC Ergo General Insurance.

Also Read: Rural Insurance: Coverage, Claim & Exclusions

Types Of Crop Insurance

Crop insurance is categorised into 3 types:

- Multiple Peril Crop Insurance: Provides financial coverage to manage risks arising from weather-related losses, such as a flood, drought, etc.

- Actual Production History: Covers losses due to wind, hail, insects, etc. Also includes coverage for lower yield and compensates for the difference between the estimate and the real

- Crop Revenue Coverage: This is based not only on the crop yield but on the total revenue generated from this yield. In case of a drop in crop price, the difference is covered by this type of crop insurance

Also Read: Kisan Suvidha Bima and its Coverage, Claim & Exclusions

What Crop Insurance Covers?

Following stages of the crop loss are covered under crop insurance:

- Localised calamities: It covers localised calamities and risks like hailstorm, landslide affecting isolated farms in the notified area

- Sowing/Planting/Germination risk: Any problem in planting or sowing because of deficit rainfall or adverse seasonal conditions

- Standing crop loss: Comprehensive risk insurance to cover yield losses because of non-preventable risks, such as dry spells, flood, hailstorm, cyclone, typhoon

- Post-harvest losses: It covers losses for up to a maximum period of two weeks from harvesting

How Crop Insurance Functions?

- Policy seeker can get his food crops, oil seeds, annual commercial crops insured under crop insurance by submitting the required documents and paying the premium accordingly

- But one must choose a policy after evaluating the risks and comparing the different policies and companies

- Sum insured will be decided on various factors, such as the type of crop, location, and calamity years in that area and historical yield data

- In case of crop loss, the insured needs to intimate the insurance company or local agriculture department within 72 hours of calamity

- Claims under crop insurance are done on the basis of localised losses, post-harvest loss, mid-season calamity and wide spread calamities. Hence, the pay-out will be calculated taking factors like weather and yield per hectare.

Also Read: Weather Insurance

Eligibility Criteria

- Crop Insurance can be availed by the farmers including share croppers and tenant farmers provided they are growing the notified crops in the area

- Non-Loanee farmers are also eligible to avail benefits under crop insurance upon providing land documents

- Two more categories are identified in which the farmers can receive the perks. These are also called Types of Coverage Components and they are:

Compulsory Component: If farmers have applied for Seasonal Agriculture Operations (SAO) credit or loans from the financial institution for the notified crops, they will be covered compulsorily

Voluntary Component: Crop Insurance is option for those farmers who fall under non-loanee farmers. If they wish to, they can register and avail benefits from the government scheme

Claim Process

There are two scenarios in which the claim can be processed – I) Wide Spread Calamities and II) Local Calamities,

In the first case, the company would work out the claim settlement once the government puts forth actual yield data. The company would directly settle the claim with the insured without any intimation from the policyholder.

In the case of local mishap, the insured (i.e. the farmer) is required to intimate to the company not later than 24 hours of the event. This can either be done via concerned financial institution or directly.

Documents Required For Claim Process

Some of the key documents that are required by the farmers to make claims under crop insurance are mentioned below:

- Duly completed claim form

- Land Registration Papers or Land Patta Number

- Land Ownership Documents

- Aadhar Card

- Personal Identification Proof like ration card, PAN Card, and/or voter card

- Bank Account Details

- Sowing Declaration

- Claim Reimbursement Form or the Application Form

Time Taken to Settle Claims

Generally, the insurance company settles the claim within 30-45 days before the end of the risk period for seasonal crops provided all the required documents have been submitted to the insurance company.

Exclusions

Exclusions are situations not covered or not fit for claim by the insurance policy. An insurance provider is not liable to pay if the loss takes place due to the following conditions:

- Losses arising out of war, nuclear risks

- Malicious damage and other preventable risk arising out of negligence by the farmer or the manpower employed by the farmer

- Burning of the crop by order of a public authority

- Damage caused by birds or animals

- Ionizing radiations or contamination by nuclear waste

- Harvested crops bundled and heaped before threshing

Renewal Process

This insured himself needs to renew their crop insurance policy by either doing it through online or directly visiting the branch. One also needs to make sure the premium should be paid to the company before the due date

Insurance Companies Offering Crop Insurance In India

Some of the insurance companies offering crop insurance in India are:

- Tata AIG General Insurance

- Reliance General Insurance

- IFFCO-Tokio General Insurance

- Bajaj Allianz General Insurance

- SBI General Insurance

Advantages of Crop Insurance

Let us look at some of the advantages of buying crop insurance:

- Provides financial support to farmers thus, covers crop loss and damage arising out of unforeseen events

- Tax exemption on the premium paid by the farmers against the purchase of the crop insurance policy

- Farmers would get peace of mind as they don’t need to take loans from private lenders at higher interest rates

- Encourages farmers to adopt modern and innovative agriculture practices that further increase their personal income

- Economy of the country will get strengthened as farmers can repay loans with the reimbursement received from the crop insurance

FAQs

Q1. How is crop loss ascertained in a particular area of land?

Individual assessment is generally conducted in the insured area for ascertaining loss at pre-sowing and post-harvest stages along with crop cutting experiment.

Q2. What is the premium amount one needs to pay for crop Insurance?

The rate of insurance charges payable by the farmer is very nominal given below:

| Types of Crop | Premium % |

| Kharif | 2% of Sum Insured |

| Rabi | 1.5% of Sum Insured |

Q3. How is the maximum sum insured or the cover limit of crop insurance under the government scheme calculated?

Sum Insured would be equal to Scale of Finance per hectare multiplied by the area of the notified crop proposed for insurance. However, Sum Insured for areas that are irrigated and non-irrigated would be separate.