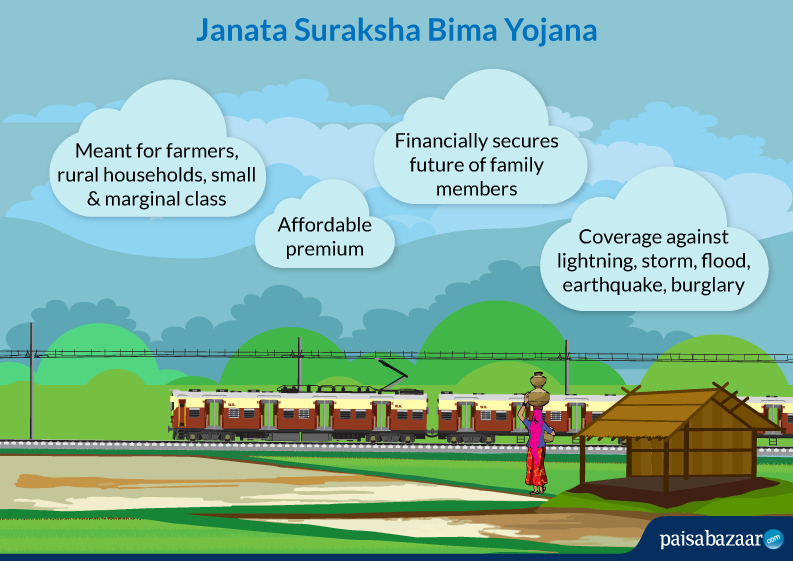

One of the leading government insurance solutions doing rounds for the benefit of rural public, Janata Suraksha Bima Yojana is a sure-shot gift you should pamper yourself with. As the name suggests, this is for general public and is highly affordable, which is the whole point of it anyway.

What is Janata Suraksha Bima Yojana?

Janata Suraksha Bima Yojana is an insurance plan for farmers, rural dwellers and marginalized labour class who can’t afford high premium insurance cover. The insurance offers coverage against natural calamities, thefts and personal accidents.

What all Janata Suraksha Bima Yojana includes:

Janata Suraksha Bima Yojana covers most of the eventualities which a farmer, rural household or agricultural labourer might face. The scope of the policy includes:

Section 1

The claim is on First Loss Basis. Maximum 50% of the total property value can be claimed under this insurance.

- Section 1A offers insurance to buildings against perils like fire and earthquakes

- Section 1B offers insurance for household assets against perils like fire and earthquakes

- Section 1C offers insurance for household goods against vandalism

Section 2

Section 2 offers coverage against

- Personal accidents to the policyholder and the family members (spouse and children)

- Permanent and total disability of the insured due to the accident

- Death of the insured caused by the accidental injury

Also Check:-Jan Sewa Bima Yojana

How Janata Suraksha Bima Yojana Functions

Farmers and workers can opt for Janata Suraksha Bima Yojana by following the below steps:

- Fill up an application form and provide the details of the property or people for whom the insurance is required

- The insurance company verifies the details and approves/rejects the application based on authenticity of the application

- If the application is approved, the sum insured and the premium amount is agreed between the insured and the insurer and policy comes into existence post premium payment

- If there is an eventuality, the claimant intimates the insurance company about the same

- If proper claim documents are submitted, an investigator from the insurance company validates the claim

- If the claim is valid as per the policy, the compensation is paid to the insured

Eligibility Criteria

- People between 10 to 70 years of age can opt for the personal accident cover under Janata Suraksha Bima Yojana

- People of any sex, race, etc. engaged in agricultural activities, constituting rural the disorganised sector of the economy, are eligible to insure their dwellings, household goods in case of fire, burglary and calamities including earthquake.

Also Check:- Kotak Platinum Insurance Plan

How is Janata Suraksha Bima Yojana claim processed?

The claim settlement for Janata Suraksha Bima Yojana is quick and easy. Following steps are followed to get the compensation.

- The eventuality needs to be informed to the insurance company within 7 days of the mishap

- The claim must be informed in written format

- He should provide all necessary assistance to the insurer to verify the claim

- If there is damage to property, the insurance company may choose to repair or replace the same.

- If the claim is not as per the policy, the insurance company may reject the same

Also Check:- Chola MS Swasth Parivar Insurance

Documents required for filing the claim

Janata Suraksha Bima Yojana claim settlement requires different set of documents as per the eventuality. These are:

For Fire Claims

- Duly filled claim form

- Photocopy of the insurance policy

- List of damaged goods

- Newspaper cuttings where the fire breakout report was published/ Panchnama/Fire Brigade Report

- Images of the damaged property/ products

- An estimate of the insurance claim

For Burglary Claims

- Duly filled claim form

- FIR of the theft

- Images showcasing burglary

- Photocopy of the insurance policy

For Personal Accident Claims

- Duly filled claim form

- Photocopy of the insurance policy.

- FIR of the accident

- Post-mortem Report and Death Certificate in case of death

- Doctor’s certificate in case of disability

How long does it take to pay out the claim?

In the event of a claim under Janata Suraksha Bima Yojana, the insurance company settles the same within 30 days, subject to validity and authenticity of the claim and documents submitted.

Cases where you can’t claim Janata Suraksha Bima Yojna

- Wear and tear or gradual deterioration of the machinery or goods

- Any damage or confiscation of the property by the government

- Damage or defect which existed before the commencement of the policy

- Accidental injury, temporary/permanent disability or death cause to the insured members due to

- War, invasions or civil commotion

- Ionising radiation or contamination caused by nuclear fuel or waste

- Committing any illegal/criminal activity

Renewal Process

This policy comes with the option of renewal but also has a pre-requisite attached to it. You need to intimate the renewal process along with remittance of the renewal premium amount before the expiry of the policy.

Indian companies offering Janata Suraksha Bima Yojna

There are certain companies offering this particular insurance like IFFCO-Tokio General Insurance Co. Ltd., etc. from where one can get insured under this low-budgeted cover.

Important Aspects

Some critical points to be kept in mind regarding Janata Suraksha Bima Yojana are:

- Coverage against fire and burglary is offered on First Loss Basis

- Coverage for damage to household property is based on the present market value of the goods

- There can be only one Janata Suraksha Bima Yojana for one household

- If you need to cancel the policy, the request will be entertained only in written format

- If there is any false claim, misrepresentation of the incident or non-disclosure of material information, the insurance company may cancel the policy and forfeit all paid premium

Advantages of Buying a Janata Suraksha Bima Yojana

Janata Suraksha Bima Yojana is beneficial to the workers engaged in the agricultural or unorganised sector in the following ways:

- Secures the future of the family members of the farmers or labourers of the unorganised sector in case of death or disability of the insured

- Compensates the loss of income caused due to loss or damage of property

- Premium amount starts from Rs.15; so this policy can cover people falling under the poverty line

FAQs

Q1. Is Janata Suraksha Bima Yojana an individual scheme?

This policy can be available by individuals and b groups, both.

Q2. Can the policyholder add new members to the Janata Suraksha Bima Yojana?

During the course of the Janata Suraksha Bima Yojana, new members cannot be added to the policy. In a similar way, existing members cannot be deleted from the plan. Only marriage is the exception in this condition.

Q3. Can the insured cancel Janata Suraksha Bima Yojana?

Both the insured and the insurer cancel the insurance policy. Both parties need to give 15-day notice to termite the plan.

Q4. What is the meaning of First Loss?

This refers to the percentage of the total value of the property at risk covered under the insurance. This is the maximum amount which can be claimed in case of any loss/damage.

Q5. Within how many days the insured needs to inform about change of contact details or address?

The insured needs to inform about change of contact details or address within 30 days

Q6. Is there any Free Lookup Period under Janata Suraksha Bima Yojana?

Yes, 15 days from the date of the receipt of the policy.