Besides high returns, the safety of investments is what makes a scheme attractive to investors. In both aspects, PPF remains an effective long-term investment scheme. As it is a government-backed scheme, PPF offers safety along with appealing returns. Being a savings scheme exempt from taxes, PPF is especially suitable for self-employed professionals and small businesses which are not covered by the Employees’ Provident Fund (EPF). However, investors need to examine the particulars of the scheme before investing.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

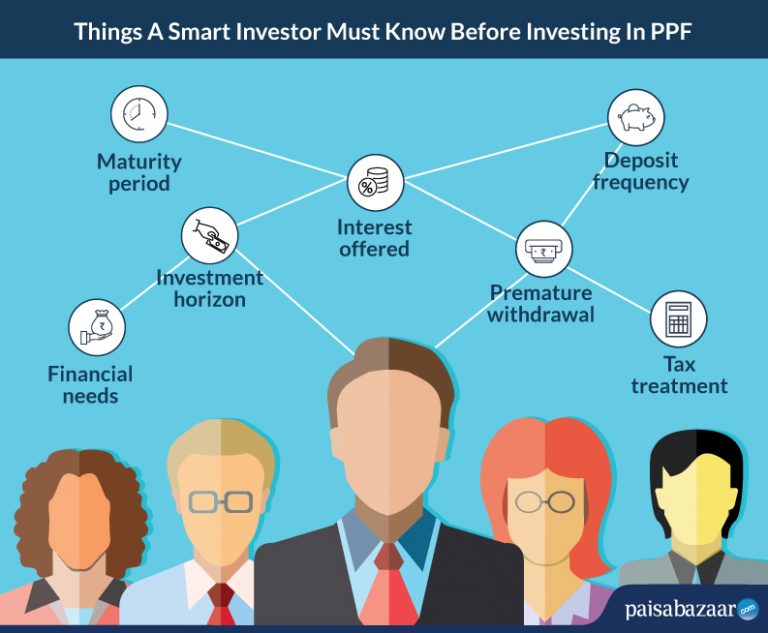

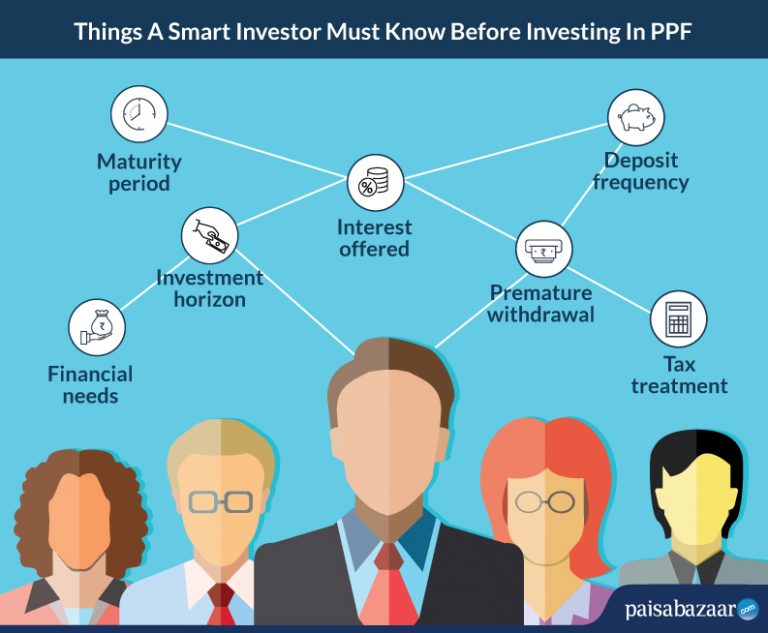

Interesting Things You Must Know Before Investing in PPF

Here are 10 things a smart investor should keep in mind before investing in PPF:

1. Safe Investments Due to Government Backing

By investing in PPF, you will save yourself from the anxiety of investment risks. PPF is a government-backed scheme in which the interest is set and paid by the government of India. Thus, the government’s guarantee makes it a safe investment option for every Indian citizen.

2. Guaranteed Returns but the Rate of Returns Fluctuate

Since PPF is a government-backed scheme, the returns on investment are guaranteed but not fixed. The rate of interest for PPF is fixed by the government for every quarter. According to historical returns, the interest rates on PPF have dropped from 12% to the present 7.1%. Currently, the PPF interest rate is fixed at 7.1% for Q2 of FY 2022-23 (July-September).

3. PPF Lock-in Period

PPF is primarily suitable for investors who are willing to invest their corpus for a long-term. It has a maturity period of 15 years before which, only partial withdrawals are allowed after completion of 5 years of continuous contributions. However, after completion of the lock-in period (15 years), investors can extend the tenure indefinitely in blocks of 5 years.

Also read: PPF Withdrawals

4. PPF Comes under the EEE Category of Tax Exemption

PPF falls under the EEE (Exempt-Exempt-Exempt) category of Income Tax implications. This implies that contributions of up to Rs. 1.5 lakh in PPF are eligible for deductions under Section 80C of the Income Tax Act. Secondly, the interest earned on the principal amount as well as the maturity amount is exempt from taxes. So, this can be a good enough reason for individuals to choose PPF.

5. Strategic Deposit Time for Higher Interests

The interest on PPF account balance is compounded annually and credited at the end of the financial year. But, the interest is calculated every month on the lowest balance in the account between 5th and the last day of the month. Hence, it is recommended that you should invest in PPF before the fifth of every month.

View: PPF Calculator- PPF Interest Rate, Loan, Maturity & Withdrawal Calculator

6. Maximise PPF Returns

Investors can maximize their returns from PPF. This can be done by investing Rs. 1.5 lakh in one go at the start of the financial year. Calculations of PPF interest are carried out from April-to-March year. So, if you want to maximize your returns, you should deposit the amount on/before 5th April every year. In this way, a one-time investment will earn interest for the entire year.

7. Ideal Fund for Child’s Future

PPF accounts can be opened by a parent/guardian in the name of a minor. It can help build a tax-free corpus that can later be used for the child’s future needs, educational expenses, etc. once the PPF account matures after 15 years and after the minor turns 18 years old.

8. You can Take a Loan against PPF Balance

This is another great benefit of PPF. In times of emergencies, you can take a loan against PPF balance. However, the loan facility is available from the 3rd financial year up to 6th financial year from the date of opening the account. And, a second loan can be obtained only after the closure of the first loan.

9. No Contributions = Inactive PPF

An investor is required to make a minimum investment of Rs. 500 annually. A maximum investment of Rs. 1.5 lakh can be made in one year in PPF account. In case the investor fails to make the minimum contribution per year, the account becomes inactive. To revive the account, a written request should be made along with a fine of Rs.50 for each year the account has been inactive.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

10. Benefitting from the Spouse’s Income

If you open a PPF account in the name of your spouse, you will be able to benefit more. According to the tax laws in India, if any amount gifted to a spouse is invested, the income from the invested amount will be clubbed with the benefactor’s income. Since PPF is a tax-free investment, your tax liability won’t be pushed. So, you will be able to invest Rs. 1.5 lakh a year in PPF scheme and avail the benefits.

Bottom Line

Individuals who are willing to invest for a long-term period in a government-backed scheme should invest in PPF. It is especially a benefiting scheme for self-employed people and small businessmen who are not benefited by the EPF. Also, individuals who want to start saving and also enjoy tax-free investments can invest in the Public Provident Fund.