Under the Atal Pension Yojana or APY scheme, a minimum monthly pension between Rs.1000 to Rs. 5000 is guaranteed for the beneficiaries. Subscribers can opt for a monthly pension which could be Rs. 1000, Rs. 2000, Rs. 3000, Rs. 4000 or Rs. 5000, which will start after the age of 60 years. The amount of pension one receives is directly related to the age at which the individual has joined Atal Pension Yojana and the monthly amount which is contributed.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Table of Contents :

Objective of the Scheme

Atal Pension Yojana is focused upon:

- Unorganized sector such as house help, gardeners, delivery boys etc.

- Ensure a sense of security and protect the citizens from accidents, illness, diseases

Eligibility Criteria

All Indian citizens between the age of 18 to 40 years can enroll for the pension scheme. However, pension will start after the subscriber attains the age of 60 years.

- The individual applying for the benefit of the scheme must contribute for at least 20 years

- The individual enrolled under Swavalamban Yojana will be migrated under Atal Pension Scheme automatically

Atal Pension Yojana Details

The following are some of the key features of the Atal Pension Yojana:

- Available for subscription to all Indians in the age group of 18 years to 40 years.

- Pension will start after the subscriber attains the age of 60 years.

- Pension amount can be selected as Rs. 1000, Rs. 2000, Rs. 3000, Rs. 4000 or Rs. 5000 monthly. Contribution amounts will be calculated accordingly.

- Bank account is mandatory for the scheme and deposit amount is auto-debited from the account periodically.

- Contributions made into the Atal Pension Yojana are eligible for tax deduction under Section 80CCD.

How to Open Atal Pension Yojana Account

- Fill up and submit the APY registration form at your local bank branch

- Provide your bank account number, Aadhar no. and mobile number

- Your first contribution amount will be deducted from your linked bank account at the time of account opening.

- Your bank will issue acknowledgment No./PRAN No. to you.

- Subsequent contributions will be automatically deducted from your bank account.

How to Download APY Form

- The account opening form for Atal Pension Yojana can easily be obtained offline from you nearby bank branch that participates in the scheme.

- However, the APY application form can also be downloaded for free from various websites such as the Pension Fund Regulatory and Development Authority (PFRDA) official website.

- Alternatively, the Atal Pension Yojana subscription form is also available online on various banking websites that includes most major banks (private as well as public-sector ones) operating in India.

Download the Application Form from the PFRDA website

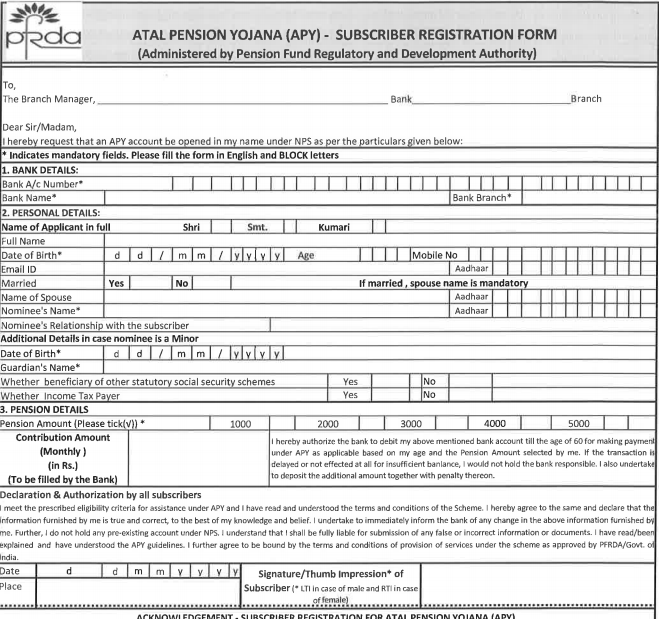

APY Form Sample

The following is a sample of the Atal Pension Yojana Form which is available as a free download from the PFRDA website:

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to Fill Application Form

The Atal Pension Yojana application form comprises the following key fields that need to be filled out correctly prior to submission of the application form:

- Section 1 – Bank details like bank account number, bank name, and bank branch information.

- Section 2 – Personal details such as name of the applicant, date of birth, email id, marital status, name of the spouse, name of the nominee, nominee’s relationship with the subscriber, age and mobile number of the subscriber. Aadhar card details of spouse and nominee are also needed.

- Section 3 – Pension details to be provided like pension amount selected – Rs. 1000/Rs. 2000/ Rs. 3000/Rs. 4000/Rs. 5000

- The Monthly contribution amount will be calculated and filled out by the bank.

- Additional details required if nominee is a minor include –, Date of birth, guardian’s name and answers to key information like ‘Is the minor a beneficiary of other statutory social security schemes?’ And ‘Is the minor an income tax payer?’

If the APY applicant does not have an account with bank they are applying through, they have to open a bank account with a scheduled bank with core banking platform. Once the bank account is up and running, the remaining steps are same as existing Bank Account holders.

Once filled out completely, the application form must be signed by the subscriber and submitted to the bank.

The APY form also contains an Acknowledgement Section which reads – “Acknowledgement – Subscriber Registration for Atal Pension Yojana (APY)”. This will be filled out and signed/stamped by a bank official once the application is processed.

Contribution

- You have to provide savings bank account details, your mobile number and authorization letter allowing the bank to automatically deduct your contribution every month. This is called auto-debit system.

- Contribution can be done monthly, quarterly or half-yearly and the instruction for auto debit should be made accordingly

- Due date for monthly contribution is determined by the first date of contribution. All subsequent contributions will be based on this date. For example if you make your first contribution on the 14th of January, your next due date will be 14th February and so on.

- Account should be sufficiently funded to execute the standing instruction for scheduled transfer of money to APY scheme

- Also Aadhaar card must be submitted as it is used as the primary document for KYC to identify subscriber, spouse and nominee. Identification document is mandatory to avoid future disputes of rights and entitlements of pension and corpus.

Can you Change your APY Pension Payout

- The subscriber can change the pension amount during the period the contribution is made. This can be done once in a year, in the month of April

- In case of downgrade of pension, the differential amount will be refunded to the contributor through direct credit to bank account that is registered under APY.

- Upgrading or downgrading of the APY account is chargeable. An upfront fee of Rs. 25 will be charged by the bank.

- Long term commitment of the subscriber is imperative since the subscription will be made over at least a period of 20 years (in case subscriber enters scheme at age of 40 years).

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to Contribute to Atal Pension Yojana

Contributions to Atal Pension Yojana are made by setting up an auto-debit instruction with your bank. This is the only way to contribute.

If you do not keep sufficient account balance for the auto debit, a penalty will be charged as follows:

- If contribution per month is up to Rs. 100, then penalty of Re. 1 will be charged

- If contribution per month is between Rs. 101 to 500, then penalty will be Rs. 2

- If contribution per month is between Rs. 501 to 1000, then penal charges will be Rs. 5

- If the contribution per month is over Rs. 1,001, the penal charges will be Rs. 10

What Happens if you Fail to Contribute to APY

If you subscribe to APY and yet fail to make regular contributions to the pension scheme due to failure of auto-debit instruction, the following occurs:

- Atal Pension Yojana account is frozen after 6 months of non-payment

- Deactivation of the APY account after 12 months of non-payment

- Automatic closure of the APY account after 24 months of non-payment

- The Bank can recover the due amount any time until the last day of that month. Funds can be recovered as and when there are funds in the APY-linked bank account and at any point of time during the month.

Note: To prevent late payment, periodical mobile alerts are sent to APY subscribers by banks.

Fees, Charges Pertaining to Maintenance of APY Account

| Intermediary | Activity | Relevant Charges |

| Point of Presence | Registration of APY Subscriber | Rs.120 to 150, which depends on the number of subscribers |

| Recurring Charges Per Annum | Rs. 100 per subscriber | |

| Central Recordkeeping Agencies | APY Account opening charges | Rs. 15 per account |

| Account maintenance charges | Rs. 40 per account per annum | |

| Custodian | Investment maintenance Fee (per annum) | 0.0075% for electronic & 0.05% for physical segment of AUM* |

| Pension Fund Managers | Investment maintenance Fee (per annum) | 0.0102% of AUM |

*AUM – Assets under Management

How is APY Money Invested

The investment details matter less in the APY than NPS because you get a guaranteed pension. The investment return only matters if the returns generated exceed the guaranteed pension amount. In such cases a higher pension amount or higher return of corpus for nominees will be available on death of the subscriber.

- Government Securities – Min. 45% and max. 50%

- Debt Securities and term deposits of banks – Min.35% and max. 45%

- Equity and related instrument – Min. 5% and max. 15%

- Asset Backed Securities etc. – Max. 5 %

- Money Market Instruments – Max. 5%

NPS Swavalamban Scheme

Swavalamban Yojana was a pension scheme that was supported by Government. The scheme was targeted at the unorganised work sector in India. This scheme has been replaced by Atal Pension Yojana.

The existing subscribers of Swavalamban scheme were transferred to APY automatically with the choice to opt out. In case there was no transfer, subscribers were also allowed to approach the nearest authorised bank and convert their Swavalamban account into APY with PRAN details.

Those opting out got Government’s contribution only up to 2016/2017, in case they are identified as eligible. They were allowed to continue with the Swavalamban scheme, until they reach the exit age of 60. Those subscribers of Swavalamban scheme who were over the age of 40 and unwilling to continue could opt out the Swavalamban scheme by completely withdrawing the entire contribution in lump sum.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Atal Pension Yojana Benefits

The Atal Pension Yojana offers a wide range of benefits to its subscribers. The following is a shortlist of the key benefits of this government backed pension scheme:

- Low risk retirement option as benefits guaranteed by Government of India.

- Guaranteed pension of Rs. 1,000, Rs. 2000, Rs. 3000, Rs. 4000 or Rs. 5,000 depending on contributions made by the subscriber.

- Contributions to APY qualify for tax benefits under Section 80CCD (1) of the Income Tax Act, 1961.

- Easy to subscribe for Indian residents whether self-employed or salaried.

- APY accepts subscription even from those contributing to other private/government-backed pension schemes.

- Guaranteed benefits for spouse/nominee/next of kin as per applicable rules in case of demise of the APY subscriber.

- Flexible subscription as pension amount can be upgraded or downgraded based on subscriber’s choice.

- High flexibility for subscriber with option to subscribe on a monthly, quarterly or half-yearly basis.

- APY subscription is open to both organized and unorganized sector workers.

Tax Benefits for APY Subscribers

Atal Pension Yojana is a government notified pension scheme hence it offers tax exemption benefits up to the Rs. 1.5 lakh cumulative annual limit under Section 80C of the Income Tax Act, 1961.

Additionally, APY also qualifies for additional benefit of up to Rs. 50,000 annually under the relatively newer Section 80CCD (1) of the Income Tax Act, 1961. This additional benefit of up to Rs. 50,000 annually is the same that applies to National Pension System contributions which is over and above the Rs. 1.5 lakh annual tax exemption benefit offered u/s 80C.

APY Account Closure and Exit

Closure of APY account and exit from the scheme is only allowed in case of terminal illness or death. Upon death of the subscriber, the APY corpus in its entirety is paid to the nominee as per details provided in the APY account opening form.

Co-contribution by the Government is available in this scheme to make APY more popular among workers in the unorganized sector. The co-contribution by the government would be 50% of the amount contributed by the beneficiary per year or Rs. 1000 per year, whichever is lower will be added by the Government.

The Government will participate in this co-contribution for five years i.e., from Financial Year 2015-16 to 2019-20. Subscribers enjoying the co-contribution cannot be members of any statutory social security scheme and should not be paying income tax (meaning their income should be below the income tax threshold).

Atal Pension Yojana Calculation

The Atal Pension Yojana calculation is based on:

- The amount of pension which the applicant wants to receive

- The age at which the applicant is getting enrolled into the scheme

The above mentioned factors are directly effected by one another-

- The monthly contributions are lesser in case of early enrollment in the scheme. Example: if you enter the scheme at the age of 18, you will have 42 years to reach the pension goal.

- Likewise, if you enter the scheme at the age of 40, you will have 20 years to complete the final goal but the monthly contribution amount will be higher in the latter case.

The minimum contribution to get Rs.1000 as pension amount, at the age of 18, is Rs.42. The maximum contribution of Rs.1454 will be paid at the age of 40 years for a pension amount of Rs.5000.

Currently, the Atal Pension Yojana calculation provides different required contribution amounts based on whether your contribution is made into the scheme every month, every quarter or every half-year as well as your target monthly pension amount.

Given below are the tabular representations of monthly, quarterly and half-yearly contributions required to be made to reach a certain goal set by the candidate:

Indicative APY Monthly Contribution Chart

If you were to invest in APY scheme every month, the following Atal Pension Yojana chart shows the monthly contribution amount based on age of entry into the scheme and the target monthly pension amount desired after retirement.

This Atal Pension Yojana calculation is indicative and the actual amount that you need to contribute may change at a later date. The following chart sums up your monthly contribution requirement for this pension scheme:

| Entry Age (years) | Total Years of Contribution | Monthly Contribution Amount Required | ||||

| Monthly Pension of Rs. 1000 | Monthly Pension of Rs. 2000 | Monthly Pension of Rs. 3000 | Monthly Pension of Rs. 4000 | Monthly Pension of Rs. 5000 | ||

| 18 | 42 | 42 | 84 | 126 | 168 | 210 |

| 19 | 41 | 46 | 92 | 138 | 183 | 228 |

| 29 | 40 | 50 | 100 | 150 | 198 | 248 |

| 21 | 39 | 54 | 108 | 162 | 215 | 269 |

| 22 | 38 | 59 | 117 | 177 | 234 | 292 |

| 23 | 37 | 64 | 127 | 192 | 254 | 318 |

| 24 | 36 | 70 | 139 | 208 | 277 | 346 |

| 25 | 35 | 76 | 151 | 226 | 301 | 376 |

| 26 | 34 | 82 | 164 | 246 | 327 | 409 |

| 27 | 33 | 90 | 178 | 268 | 356 | 446 |

| 28 | 32 | 97 | 194 | 292 | 388 | 485 |

| 29 | 31 | 106 | 212 | 318 | 423 | 529 |

| 30 | 30 | 116 | 231 | 347 | 462 | 577 |

| 31 | 29 | 126 | 252 | 379 | 504 | 630 |

| 32 | 28 | 138 | 276 | 414 | 551 | 689 |

| 33 | 27 | 151 | 302 | 453 | 602 | 752 |

| 34 | 26 | 165 | 330 | 495 | 659 | 824 |

| 35 | 26 | 181 | 362 | 543 | 722 | 902 |

| 36 | 24 | 198 | 396 | 594 | 792 | 990 |

| 37 | 23 | 218 | 436 | 654 | 870 | 1087 |

| 38 | 22 | 240 | 480 | 720 | 957 | 1196 |

| 39 | 21 | 264 | 528 | 792 | 1054 | 1318 |

| 40 | 20 | 291 | 582 | 873 | 1164 | 1454 |

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Indicative APY Quarterly Contribution Chart

Using the available Atal Pension Yojana calculation methodology, it is possible to arrive at the quarterly contribution that you are required to make to the pension scheme depending on your age of entry as well as your desired monthly pension amount.

The following Atal Pension Yojana chart of quarterly contribution provides indicative values that may change at a later date:

| Entry Age (years) | Total Years of Contribution | Quarterly Contribution Amount Required | ||||

| Monthly Pension of Rs. 1000 | Monthly Pension of Rs. 2000 | Monthly Pension of Rs. 3000 | Monthly Pension of Rs. 4000 | Monthly Pension of Rs. 5000 | ||

| 18 | 42 | 125 | 250 | 376 | 501 | 626 |

| 19 | 41 | 137 | 274 | 411 | 545 | 679 |

| 29 | 40 | 149 | 298 | 447 | 590 | 739 |

| 21 | 39 | 161 | 322 | 483 | 641 | 802 |

| 22 | 38 | 176 | 349 | 527 | 697 | 870 |

| 23 | 37 | 191 | 378 | 572 | 757 | 948 |

| 24 | 36 | 209 | 414 | 620 | 826 | 1031 |

| 25 | 35 | 226 | 450 | 674 | 897 | 1121 |

| 26 | 34 | 244 | 489 | 733 | 975 | 1219 |

| 27 | 33 | 268 | 530 | 799 | 1061 | 1329 |

| 28 | 32 | 289 | 578 | 870 | 1156 | 1445 |

| 29 | 31 | 316 | 632 | 948 | 1261 | 1577 |

| 30 | 30 | 346 | 688 | 1034 | 1377 | 1720 |

| 31 | 29 | 376 | 751 | 1129 | 1502 | 1878 |

| 32 | 28 | 411 | 823 | 1234 | 1642 | 2053 |

| 33 | 27 | 450 | 900 | 1350 | 1794 | 2241 |

| 34 | 26 | 492 | 983 | 1475 | 1964 | 2456 |

| 35 | 26 | 539 | 1079 | 1618 | 2152 | 2688 |

| 36 | 24 | 590 | 1180 | 1770 | 2360 | 2950 |

| 37 | 23 | 650 | 1299 | 1949 | 2593 | 3239 |

| 38 | 22 | 715 | 1430 | 2146 | 2852 | 3564 |

| 39 | 21 | 787 | 1574 | 2360 | 3141 | 3928 |

| 40 | 20 | 867 | 1734 | 2602 | 3469 | 4333 |

Indicative APY Half-Yearly Contribution Chart

The following chart has been calculated based on current APY calculation rules in case half yearly contributions were made over a specific period of time to receive a desired pension amount after attaining the age of 60 years.

The values provided as half yearly contribution amounts in the following table are indicative and may change at a later date.

| Entry Age (years) | Total Years of Contribution | Half-Yearly Contribution Amount Required | ||||

| Monthly Pension of Rs. 1000 | Monthly Pension of Rs. 2000 | Monthly Pension of Rs. 3000 | Monthly Pension of Rs. 4000 | Monthly Pension of Rs. 5000 | ||

| 18 | 42 | 248 | 496 | 744 | 991 | 1239 |

| 19 | 41 | 271 | 543 | 814 | 1080 | 1346 |

| 29 | 40 | 295 | 590 | 885 | 1169 | 1464 |

| 21 | 39 | 319 | 637 | 956 | 1269 | 1588 |

| 22 | 38 | 348 | 690 | 1045 | 1381 | 1723 |

| 23 | 37 | 378 | 749 | 1133 | 1499 | 1877 |

| 24 | 36 | 413 | 820 | 1228 | 1635 | 2042 |

| 25 | 35 | 449 | 891 | 1334 | 1776 | 2219 |

| 26 | 34 | 484 | 968 | 1452 | 1930 | 2414 |

| 27 | 33 | 531 | 1050 | 1582 | 2101 | 2632 |

| 28 | 32 | 572 | 1145 | 1723 | 2290 | 2862 |

| 29 | 31 | 626 | 1251 | 1877 | 2496 | 3122 |

| 30 | 30 | 685 | 1363 | 2048 | 2727 | 3405 |

| 31 | 29 | 744 | 1487 | 2237 | 2974 | 3718 |

| 32 | 28 | 814 | 1629 | 2443 | 3252 | 4066 |

| 33 | 27 | 891 | 1782 | 2673 | 3553 | 4438 |

| 34 | 26 | 974 | 1948 | 2921 | 3889 | 4863 |

| 35 | 26 | 1068 | 2136 | 3205 | 4261 | 5323 |

| 36 | 24 | 1169 | 2337 | 3506 | 4674 | 5843 |

| 37 | 23 | 1287 | 2573 | 3860 | 5134 | 6415 |

| 38 | 22 | 1416 | 2833 | 4249 | 5648 | 7058 |

| 39 | 21 | 1558 | 3116 | 4674 | 6220 | 7778 |

| 40 | 20 | 1717 | 3435 | 5152 | 6869 | 8581 |

Return of Corpus to the Nominees and Beneficiaries of APY

In case of death of the Atal Pension Yojana subscriber, the nominee or beneficiary of the subscriber would receive the following payout based on the monthly pension amount opted for by the subscriber:

| Monthly Pension Amount (in Rupees) | Return of Corpus to the nominee of the subscriber (in Rupees) |

| 1000 | 170,000 |

| 2000 | 340,000 |

| 3000 | 510,000 |

| 4000 | 680,000 |

| 5000 | 850,000 |

Check Account Statement Online

- In case you have already subscribed for APY and have a valid PRAN, you can check your account statement online easily.

- If your APY Account is registered with NSDL CRA, you can check your Atal Pension Yojana Account Statement online on the NSDL website as shown below.

- In case you are using your PRAN (Permanent Retirement Account Number) to check your APY online statement, you only need your account number registered with APY to check the online APY statement.

- Otherwise, you will have to provide the subscriber name, bank account number and date of birth as per APY records to check your Atal Pension Yojana account statement online.

- Alternately, you can also receive APY statements on your registered email account periodically so that you can track your APY account balance conveniently.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Atal Pension Yojana App

Atal Pension Yojana App has been introduced by PFRDA to enable easy access to APY account for subscribers.

By installing the app, you can check your APY account balance, details of when the next contribution is due, APY account details, APY transactions list and more. The Atal Pension Yojana App from PFRDA is available for free from the Android App Store.

Customer Support Toll Free Number

At present there is no centralised Atal Pension Yojana Support toll free number as an APY account can be opened at various leading banks across India.

Hence, the primary point of contact with respect to APY account-related issues would be the specific bank where you have opened your pension account. Alternatively, in case of Atal Pension Yojana Support you can call the following toll free numbers:

CRA (Central Recordkeeping Agency) – 1800-222-080

NPS Helpdesk – 1800-110-708

APY Login Portal: Registration and Login

You can register for you Atal Pension Yojana account through your bank. At present most leading banks in India can help you register for an Atal Pension Yojana Account with either NSDL or Karvy.

Once you have registered for your APY account through you bank, you will be provided a PRAN (Permanent Retirement Account Number) and you can use this to log in to your Atal Pension Yojana account with Karvy as shown below:

As shown above, all you need is your PRAN and applicable APY account password to login.

Alternately, the APY online account with NSDL login screen is as follows:

If your APY account is with NSDL, you can use your PRAN and bank a/c number to log into your Atal Pension Yojana online account.

How to Withdraw Money from APY Account

Voluntary exit of a subscriber from Atal Pension Yojana may be permitted only in exceptional circumstances such as terminal illness.

The only way to process the closure request is by submitting the completely filled out APY Account Closure Form (Voluntary Exit) with the bank you have opened your APY account with.

After receiving the form from you, the bank will process the request and calculate the total contribution plus interest accrued to your account and then deduct any APY account closure/maintenance charges that may be applicable.

The balance amount will be credited to your registered bank account as a lump sum. Under existing APY rules, the pay-outs from this pension account in case of voluntary exit are not made in cash.

FAQs

Q. Are there any tax benefits of investing in the Atal Pension Yojana?

Ans. Yes, Atal Pension Yojana investments offer tax deduction benefits under section 80CCD of the IT Act, 1961.

Q. I am a self-employed individual. Do I qualify for pension under Atal Pension Yojana?

Ans. Yes. Any Indian resident within the age group of 18 years to 40 years, irrespective of whether they are salaried or self-employed, can opt for pension under the Atal Pension Yojana.

Q. I do not have a bank account. Do I need one for APY?

Ans. Yes. A bank account is mandatory if you wish to subscribe for pension under the Atal Pension Yojana.

Q. Can I choose which funds to invest in under APY?

Ans. No. Funds in the Atal Pension Yojana are managed by the PFRDA (Pension Fund Regulatory and Development Authority) and you cannot pick or choose what to investment in under the APY pension scheme.

This benefit of choosing your investments is available in case you opt for the National Pension System (NPS).

Q. When does normal exit occur in case of the Atal Pension Yojana?

Ans. Normal exit under the APY scheme occurs when the subscriber attains the age of 60 years i.e. age of retirement. After this, the benefit of fixed pension starts for the APY subscriber.

Q. How to Open Atal Pension Yojana Account with SBI?

Ans. State Bank of India is one of India’s top banks offering its customers the option of opening an APY account with ease.

While a major portion of the process of opening an Atal Pension Yojana account with SBI can be completed online, in the final step, the online form needs to be printed out, signed and physically submitted along with applicable documents at a nearby SBI branch to complete the process.

The following are the key steps of the SBI APY account opening process:

- Log into your online SBI Netbanking account and navigate to the Social Security Schemes link located under the e-services menu.

- On clicking the “Social Security Scheme” link, you will be directed to the page where you can choose to subscribe in any of the three leading social security schemes among Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) or Atal Pension Yojana account with SBI.

- On selecting the APY option, a subsequent page with the SBI APY account e-form will appear where you have to fill out additional details such as Aadhaar number, updated contact details, etc. The form is auto filled with the SBI account details that will be used to subscribe to the SBI APY account online.

After you have filled out the required fields in the online SBI Atal Pension Yojana form, you have to print it out sign it and submit it at the SBI branch (as mentioned on the form) to complete the process of opening a Atal Pension Yojana account with the State Bank of India.

Once your APY account is up and running, you will receive a PRAN i.e. Permanent Retirement Account Number for your APY account. The APY PRAN is different from the NPS PRAN at present and you will have two unique PRAN if you are subscribing to both pension schemes.

Q. How many APY accounts can I open?

Ans. You can open only a single APY account.

Q. If I move my residence/city, how can I make contributions to APY account?

Ans. The contributions are remitted through auto debit uninterruptedly even when you relocate to a new place.

Q. Is there a way to apply for APY online?

Ans. No, at present you cannot apply for APY online. You need to visit your respective bank branch and fill out the APY application form.