The global Novel Covid-19 or Coronavirus pandemic has hit the world’s economy drastically and could have created a hole in the pockets of many. In times like these people may need to liquidate their ‘emergency funds’. One of these can be the Employee Provident Fund.

What is Employee Provident Fund- A Glance

Employee Provident Fund (EPF) is a fund wherein the employees, during their course of employment, contribute 12% of their monthly salary for the purpose of their retirement. A similar amount is also contributed by the employer to the employee’s account. The amount gets automatically deducted from the employee’s monthly salary and is transferred to the EPF account. The major purpose of investing in EPF accounts is to gather a corpus for the employee’s retirement. However, the EPFO allows the investors of the fund to withdraw a part of this corpus under special circumstances such as child’s education, daughter’s wedding, or any medical emergency.

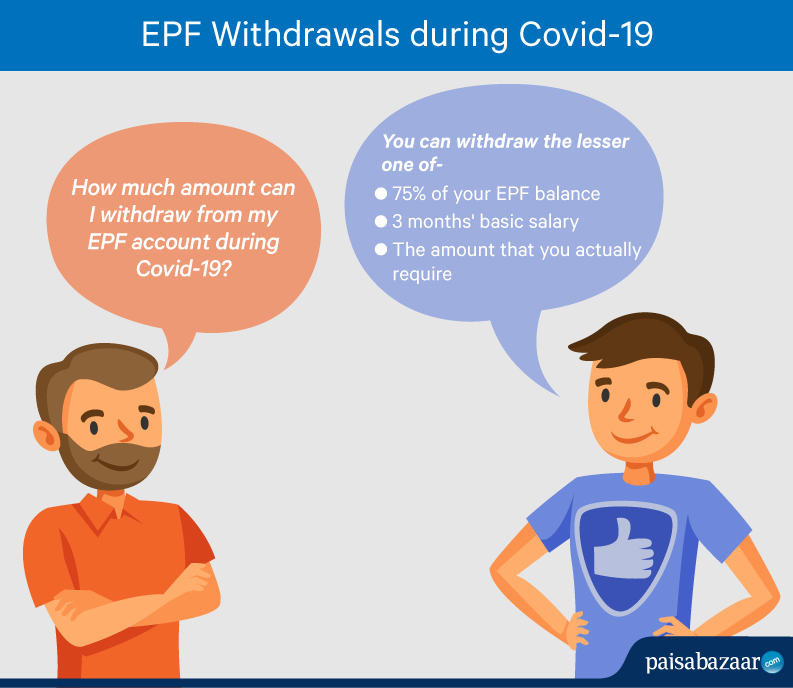

Withdrawals from EPF during Covid-19

Owing to the difficult times that the country is going through, the government has allowed individuals to partially withdraw their EPF corpus in order to survive the crisis. The EPFO has operationalised this withdrawal and named it ‘non-refundable advance’. The withdrawal process has also been expedited and you can expect the amount in a minimum of 3 working days.

The accumulated EPF corpus can be defined as the balance that has been gathered by the employee’s contributions, which is 12% of his basic salary, the employer’s contribution, which is 3.67% (out of a contribution of 12%, the employer contributes 8.33% to the Employee’s Pension Scheme and the remaining 3.67% to the Employees Provident Fund).

Employee’s basic wages constitute his/her basic salary and dearness allowance, if any. This amount can be found on the employee’s salary slip under the tag ‘basic pay’.

How to Withdrawal EPF Balance

Before you begin to withdraw your EPF balance, make sure that your EPF account is linked with your Aadhaar and that your UAN is activated. It is also mandatory that your bank account is seeded with your UAN. After getting this done, you must follow the given steps-

- Log in to the UAN member portal here

- Go to the ‘Online Services’ section

- Click on ‘Claim’ (Form 31, 19, 10C and 10D)

- Enter the last four digits of your bank account

- Click on ‘Proceed Online Claim’

- From the dropdown list, Select ‘PF Advance’ Form 31

- Select ‘Outbreak of Pandemic (Covid-19)’ as the purpose of withdrawal

- Enter the required amount

- Upload a scanned copy of a cheque and enter your address

- Click on ‘Get Aadhaar OTP’

- Enter the OTP sent to your registered mobile number that is linked to your Aadhaar

- Click on ‘Submit’

Unlike others, the withdrawal for the outbreak of this pandemic will most likely be honoured within a time period of 3 days.

Taxation on Withdrawals from EPF during Covid-19

It must be noted that taking a non-refundable advance from your EPF account will not impact your account in any way. It will continue to operate and earn interest on the accumulated corpus in the same way as it was.

- Since the withdrawal is considered as income of the investor, the funds withdrawn from the EPF account before 5 years of continuous service are fully taxable as per the investor’s applicable tax slab

- TDS will be deducted if the amount withdrawn is more than Rs.50,000

- If the employee furnishes his PAN card at the time of withdrawal, the TDS will be deducted at 10%, which otherwise will be 30%

5 Comments

How much tax will be calculated for PF amount.

10% TDS will be deducted if service is less than 5 years. To avoid you need to submit form 15G

Thanks for the article. It has been informative. But I have strong feeling the 3-day settlement is very optimistic. I have applied on 30th. But there is no response yet. So just a heads up to everyone to not have their hopes very high

I apply for 4 days complete but status under process .

You should get it soon.