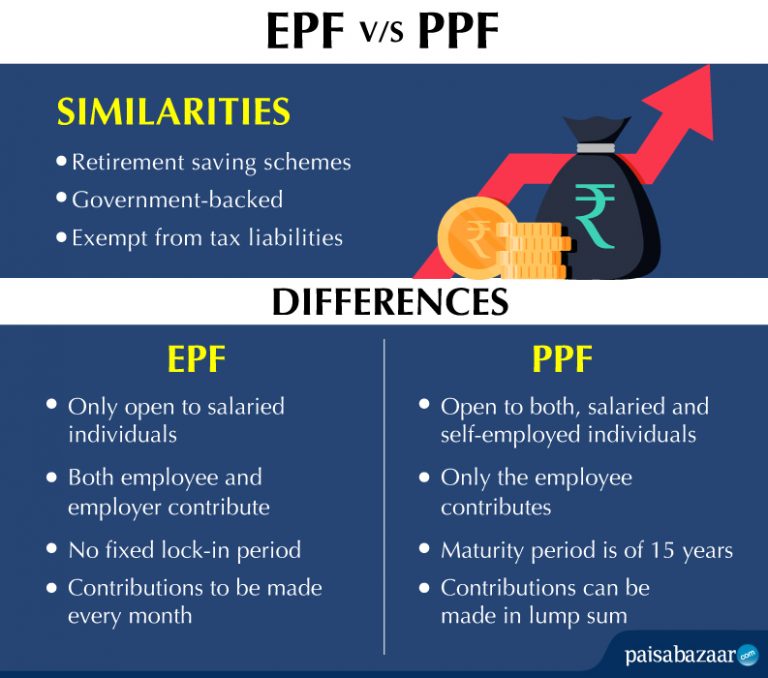

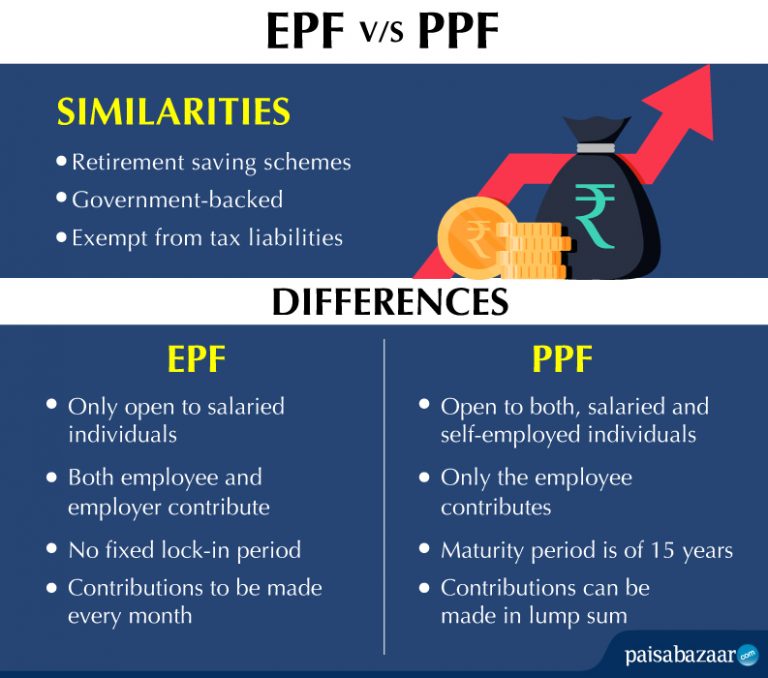

Employees’ Provident Fund (EPF) and Public Provident Fund (PPF) are the two most popular retirement saving schemes in India. Since both are government backed and long-term retirement products, there is a lot of confusion among the investors regarding these investment products.

Therefore, if you are planning for building a large retirement corpus, it becomes important to properly understand the differences between EPF and PPF.

Who can subscribe?

First and foremost, one must know that the EPF is only open to salaried individuals working in the establishments covered under the Employees’ Provident Fund and Misc. Act, 1952 while the PPF under the Public Provident Fund Act, 1968 is open to salaries and self employed individuals.

Contributions

- In case of the EPF, both the employee, as well as the employer, make contributions to the employee’s EPF account. In case of PPF, only the investor contributes to his PPF account.

- Both the employee and the employer contribute 12% of the employee’s salary (basic+DA) with a salary upper cap of Rs.15,000 towards the EPF account of the employee. In case of the PPF, one can start with a minimum contribution of Rs.500 and go upto annual investment of Rs.1.5 lakh.

- EPF contributions are made on a monthly basis while one can make contributions to PPF as a lump-sum or in a maximum of 12 installments per year.

- It is compulsory for any organization employing 20 or more people to get registered under the Employees’ Provident Fund Organization (EPFO) and make EPF contributions. However, enrolling under the PPF scheme is completely an optional decision

Lock-in Period

- There is no such lock-in period for the EPF deposits. One can withdraw the funds (fully/partially) under various but pre-defined circumstances. For example, if a member remains unemployed for a month or more, he can withdraw 75% of his EPF corpus.

- The maturity period for the PPF deposits is 15 years. However, one can withdraw partial PPF deposits (upto 50%) before maturity under various circumstances. The subscriber can extend the PPF deposits for another 5 years over and above of the lock-in period.

Returns

The current interest rate on EPF is 8.50%. The rate is declared by the EPFO every year. The interest is calculated the on your monthly average EPF balance but gets credited at the end of the financial year.

The current interest rate on PPF is 7.9% (Q2, FY 2019-20) and it is reset every quarter. The PPF rate is calculated on the lowest balance between the 1st and 5th of every month, for that month.

Tax Benefits

The proceeds from the EPF are tax exempt only when the employee has a minimum service tenure of 5 years cumulatively. PPF investments, on the other hand, are tax-exempt subject to the investment cap limit under section 80C.

Loan Option

An EPF subscriber can apply for a loan on his EPF deposits for the specific reasons as specified by the EPFO itself.

In case of the PPF, one can apply for a loan after completing 7 years. However, the upper limit of a loan against PPF is 50% of the total PPF balance at the end of the 4th year.